MO Form E-6 2024-2025 free printable template

Show details

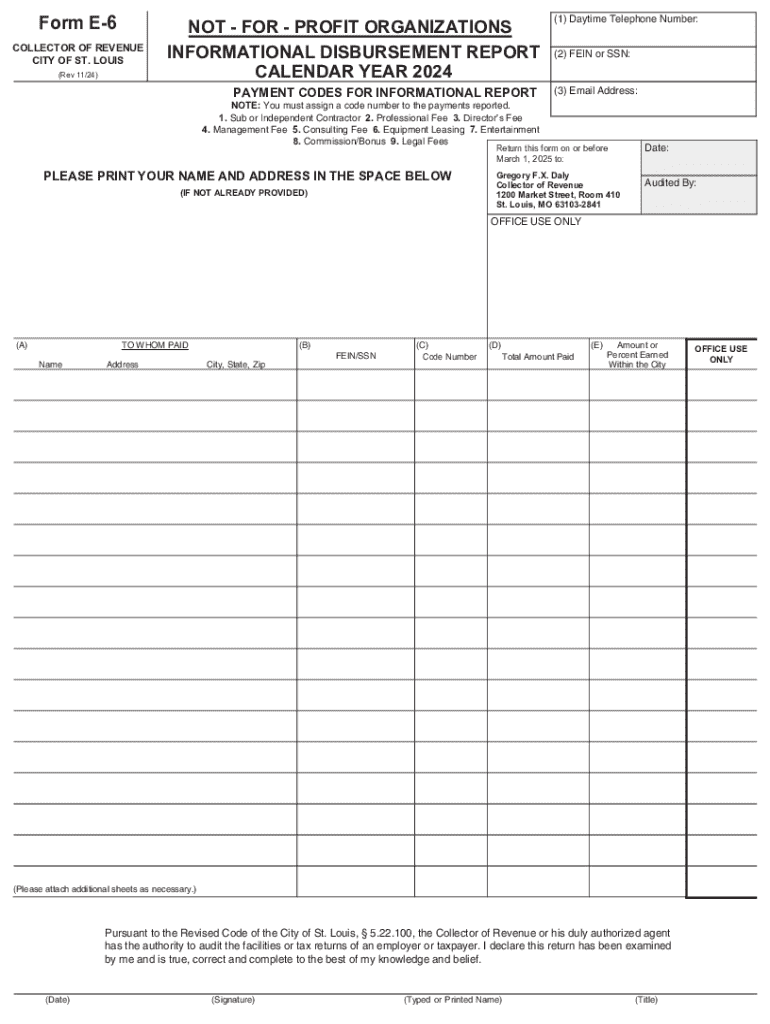

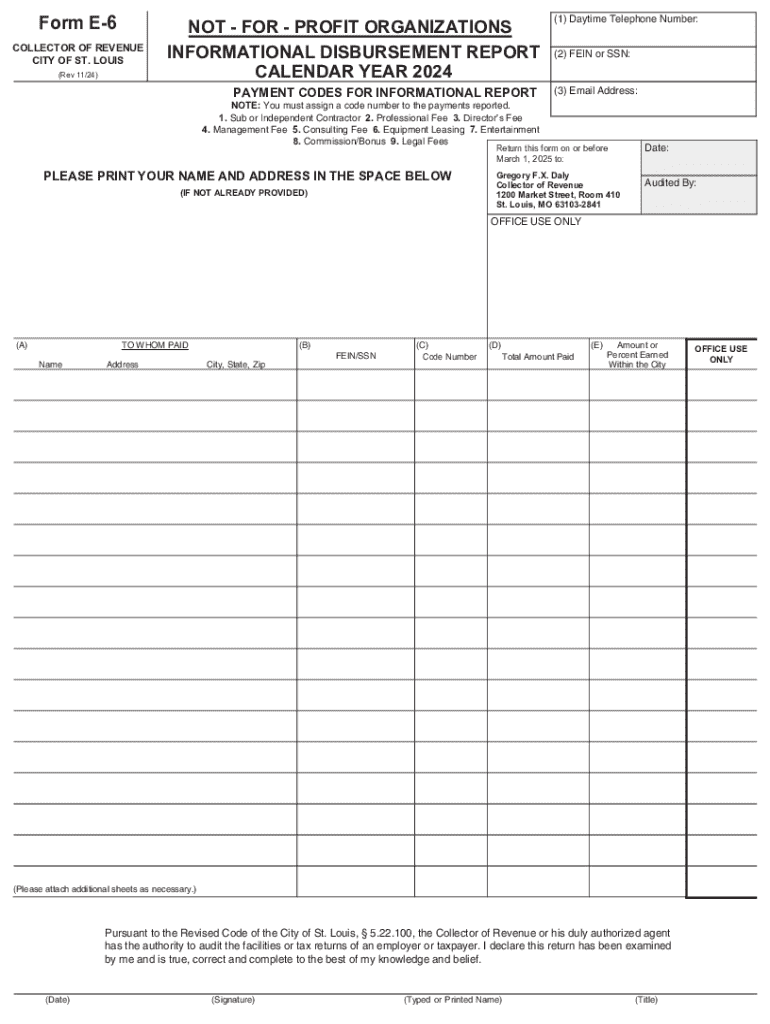

Form E6

COLLECTOR OF REVENUE

CITY OF ST. LOUIS

(Rev 11/24)NOT FOR PROFIT ORGANIZATIONS

INFORMATIONAL DISBURSEMENT REPORT

CALENDAR YEAR 2024

PAYMENT CODES FOR INFORMATIONAL REPORT(1) Daytime Telephone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign missouri form e

Edit your missouri e6 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri form e 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit missouri e 6 report online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit missouri e6 blank form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form E-6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form e6 informational

How to fill out MO Form E-6

01

Gather all necessary personal and financial information required for the form.

02

Start by filling out your name, address, and contact information in the designated fields.

03

Provide your Social Security Number or Tax Identification Number as required.

04

Enter the details of your income sources and any deductions you wish to claim.

05

Review the form for accuracy and completeness before submission.

06

Sign and date the form at the appropriate section.

Who needs MO Form E-6?

01

Individuals or businesses that need to report specific tax-related information to the state of Missouri.

02

Those who are claiming certain deductions or credits.

03

Taxpayers who have income that needs to be reported on the form.

Video instructions and help with filling out and completing form e 6

Instructions and Help about form e 6 blank

Fill

form e 6 pdf

: Try Risk Free

People Also Ask about form e6 download

Does Missouri have an e-file form?

General Information About Individual Income Tax Electronic Filing. Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021.

Can I still file my 2014 taxes electronically?

You can no longer e-file a 2014 federal or state tax return anywhere; instructions on how to file a 2014 IRS or state tax return are below. Complete and sign the 2014 IRS Tax Return forms and then download, print, and mail them to the IRS; the address is on the Form 1040.

Where can I get CRA tax forms?

order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Does the IRS accept returns printed on both sides?

Note: The IRS and state taxing authorities do not accept mailed paper returns that are printed on both sides of the paper. This option should only be used to give a client a copy of their tax return that WILL NOT be mailed to the IRS or state.

Can tax documents be printed front and back?

Just note that each form within the return can be double sided but you can't print different forms sharing the same page. So for instance you have a 1040 and a schedule D, the 1040 can be double sided and the D can be double sided but they can not share a page.

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

What is the latest tax form 2022?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is the earliest you can file taxes for 2022?

2022 tax filing season begins Jan. 24; IRS outlines refund timing and what to expect in advance of April 18 tax deadline. Internal Revenue Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get e6 louis collector?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form e 6 disbursement in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the missouri e 6 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit form e 6 download on an iOS device?

Create, edit, and share form e calendar from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is MO Form E-6?

MO Form E-6 is a tax form used in Missouri for reporting certain income and withholding information for employees.

Who is required to file MO Form E-6?

Employers who withhold Missouri state income tax from their employees' wages are required to file MO Form E-6.

How to fill out MO Form E-6?

To fill out MO Form E-6, you need to provide the employer's information, the total wages paid, total Missouri income tax withheld, and any other required details specific to your employment.

What is the purpose of MO Form E-6?

The purpose of MO Form E-6 is to report and reconcile the amounts of Missouri income tax withheld from employee wages to ensure accurate tax reporting and compliance.

What information must be reported on MO Form E-6?

The information that must be reported on MO Form E-6 includes the employer's name and address, federal employer identification number (EIN), total wages, total tax withheld, and employee details such as names and Social Security numbers.

Fill out your form e 6 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form E 6 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.