MO Form E-6 2023 free printable template

Show details

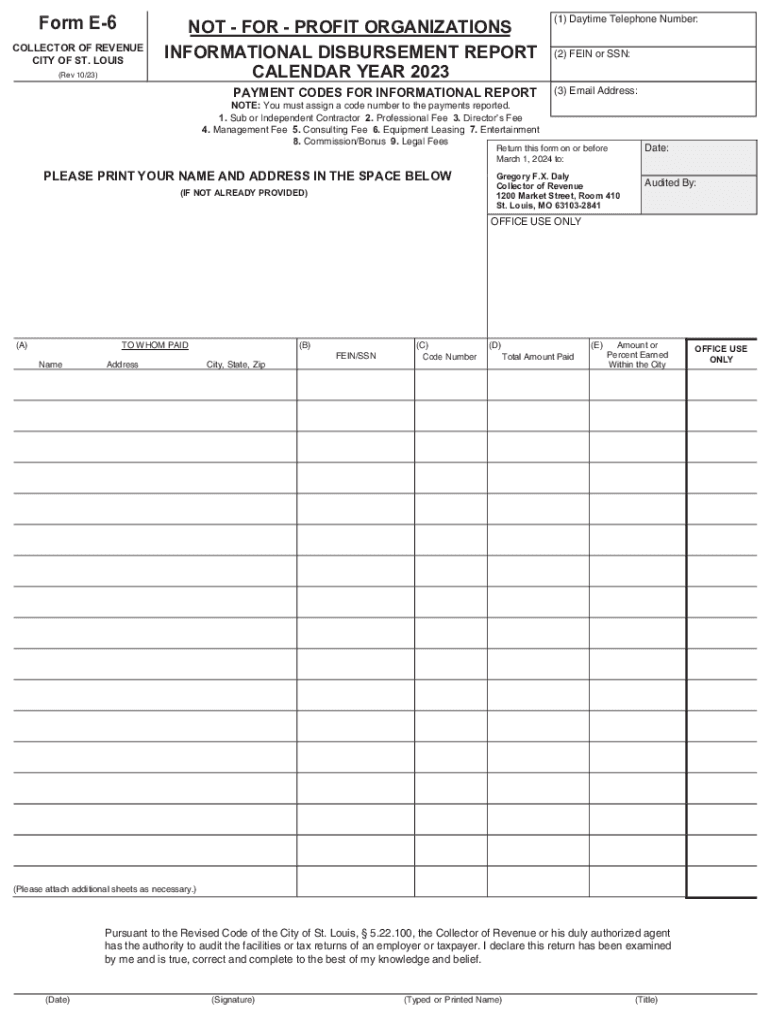

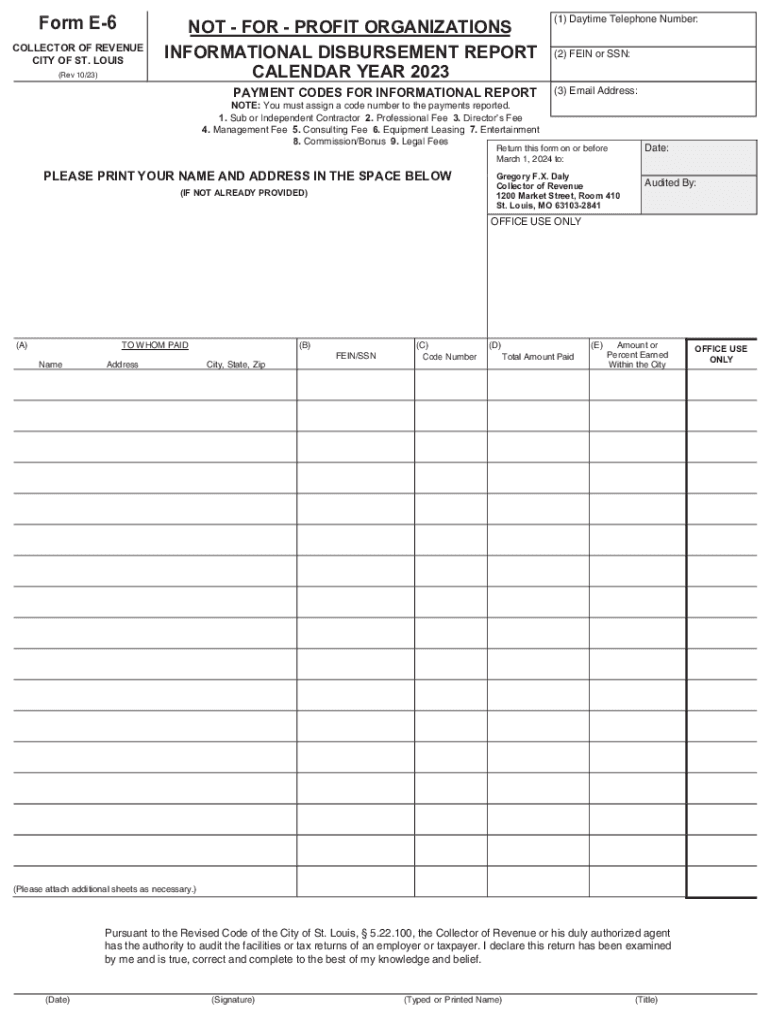

Form E6

COLLECTOR OF REVENUE

CITY OF ST. LOUIS

(Rev 10/23)NOT FOR PROFIT ORGANIZATIONS

INFORMATIONAL DISBURSEMENT REPORT

CALENDAR YEAR 2023

PAYMENT CODES FOR INFORMATIONAL REPORT(1) Daytime Telephone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form e6 download

Edit your form e 6 year form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form e 6 report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form e6 informational online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit missouri e 6 printable form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form E-6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out missouri form e 6

How to fill out MO Form E-6

01

Obtain MO Form E-6 from the official website or local government office.

02

Begin filling out the form with your personal information, including your name, address, and contact details.

03

Provide the necessary information regarding your financial situation as required by the form.

04

Attach any required supporting documents, such as identification or proof of income.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form before submission.

07

Submit the form to the appropriate agency or office as instructed.

Who needs MO Form E-6?

01

Individuals who are applying for certain benefits or assistance programs in Missouri.

02

Residents of Missouri who need to report their financial status for tax-related purposes.

03

Those who require a verification of income or circumstances for legal or governmental requests.

Video instructions and help with filling out and completing missouri form e

Instructions and Help about missouri e 6 report

Fill

mo form e 6

: Try Risk Free

People Also Ask about missouri e 6

Does Missouri have an e-file form?

General Information About Individual Income Tax Electronic Filing. Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.8 million electronically filed returns in 2021.

Can I still file my 2014 taxes electronically?

You can no longer e-file a 2014 federal or state tax return anywhere; instructions on how to file a 2014 IRS or state tax return are below. Complete and sign the 2014 IRS Tax Return forms and then download, print, and mail them to the IRS; the address is on the Form 1040.

Where can I get CRA tax forms?

order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Does the IRS accept returns printed on both sides?

Note: The IRS and state taxing authorities do not accept mailed paper returns that are printed on both sides of the paper. This option should only be used to give a client a copy of their tax return that WILL NOT be mailed to the IRS or state.

Can tax documents be printed front and back?

Just note that each form within the return can be double sided but you can't print different forms sharing the same page. So for instance you have a 1040 and a schedule D, the 1040 can be double sided and the D can be double sided but they can not share a page.

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

What is the latest tax form 2022?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

What is the earliest you can file taxes for 2022?

2022 tax filing season begins Jan. 24; IRS outlines refund timing and what to expect in advance of April 18 tax deadline. Internal Revenue Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mo e 6 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form e6 city, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit MO Form E-6 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign MO Form E-6. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How can I fill out MO Form E-6 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MO Form E-6. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MO Form E-6?

MO Form E-6 is a tax form used in Missouri to report and reconcile income tax withheld from employees' wages.

Who is required to file MO Form E-6?

Employers who have withheld Missouri income tax from their employees' wages are required to file MO Form E-6.

How to fill out MO Form E-6?

To fill out MO Form E-6, employers need to enter their business information, total wages paid, total Missouri income tax withheld, and any adjustments or corrections. The form typically requires following specific instructions provided by the Missouri Department of Revenue.

What is the purpose of MO Form E-6?

The purpose of MO Form E-6 is to provide the Missouri Department of Revenue with a summary of the total state income tax withheld by employers, ensuring compliance with state tax laws.

What information must be reported on MO Form E-6?

Information that must be reported on MO Form E-6 includes the employer's name and identification number, total wages paid to employees, total Missouri income tax withheld, and any other relevant adjustments or notes.

Fill out your MO Form E-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO Form E-6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.