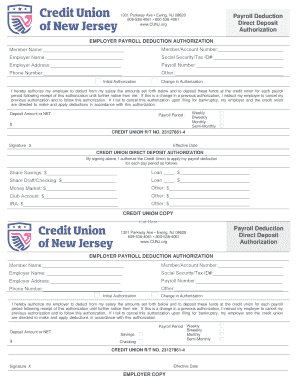

NJ CUNJ Employer Payroll Deduction Direct Deposit Authorization 2021-2025 free printable template

Show details

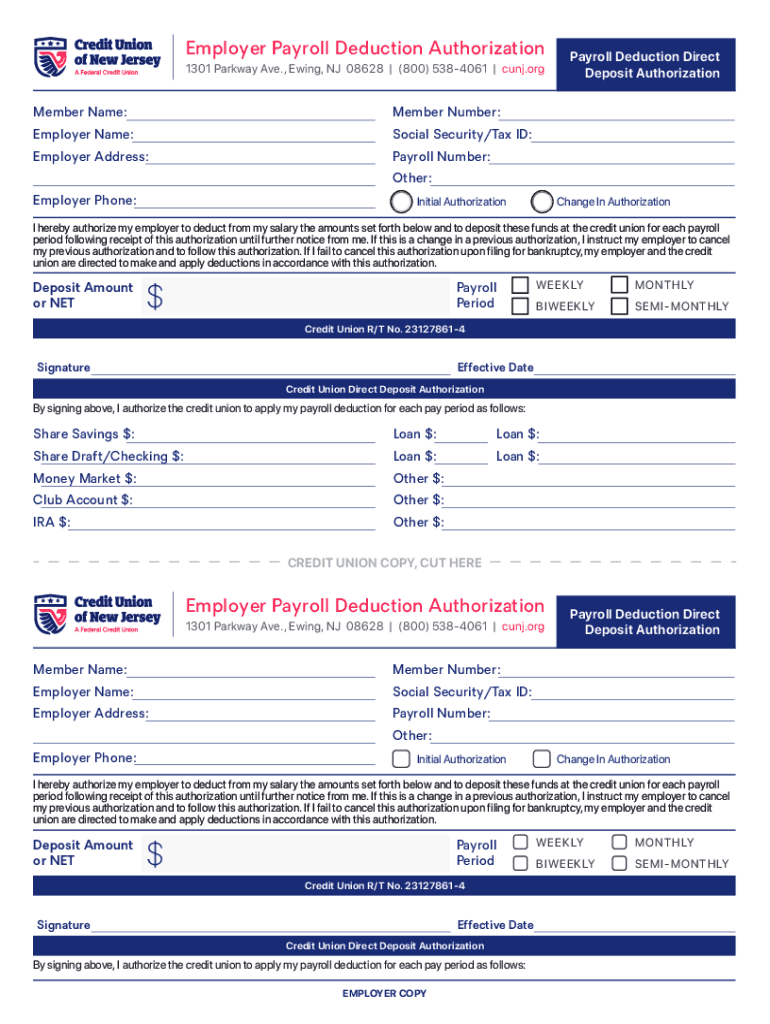

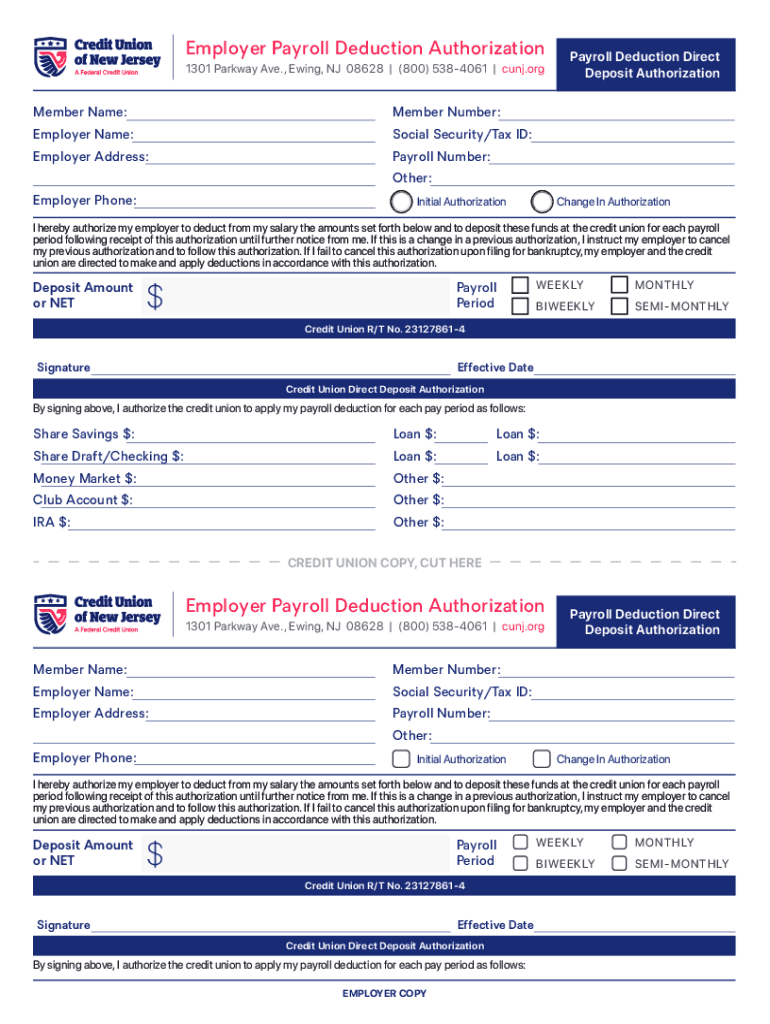

Employer Payroll Deduction Authorization

1301 Parkway Ave., Ewing, NJ 08628 | (800) 5384061 | conj.remember Name:Member Number:Employer Name:Social Security/Tax ID:Employer Address:Payroll Number:Payroll

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ CUNJ Employer Payroll Deduction Direct

Edit your NJ CUNJ Employer Payroll Deduction Direct form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ CUNJ Employer Payroll Deduction Direct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ CUNJ Employer Payroll Deduction Direct online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ CUNJ Employer Payroll Deduction Direct. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ CUNJ Employer Payroll Deduction Direct Deposit Authorization Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ CUNJ Employer Payroll Deduction Direct

How to fill out NJ CUNJ Employer Payroll Deduction Direct Deposit

01

Obtain the NJ CUNJ Employer Payroll Deduction Direct Deposit form from your employer or their HR department.

02

Fill out your personal information, including your name, address, and employee identification number.

03

Provide your bank account details, including the bank's name, account number, and routing number.

04

Indicate the amount you wish to have deducted from your paycheck for direct deposit.

05

Sign and date the form to verify that the information provided is accurate.

06

Submit the completed form to your employer's payroll department for processing.

Who needs NJ CUNJ Employer Payroll Deduction Direct Deposit?

01

Employees of organizations participating in the NJ CUNJ direct deposit program.

02

Individuals looking to have a portion of their paycheck directly deposited into their bank account.

03

Employees who prefer secure and convenient payment options instead of receiving a physical paycheck.

Fill

form

: Try Risk Free

People Also Ask about

Does New Jersey have credit unions?

New Jersey (NJ) is home to many credit unions that offer exceptional services to their members. In this comprehensive guide, we will introduce you to the top 10 best credit unions in NJ, based on their reputation, membership benefits, services, and overall customer satisfaction.

Who is the best credit union?

Here are the highest credit union savings account rates for May 2023 Blue Fed, APY: 5.00%, Min. Balance to Earn APY: $0. Alliant Credit Union, APY: 3.10%, Min. Balance to Earn APY: $100. Consumers Credit Union, APY: 2.00%, Min. First Tech Federal Credit Union, APY: 0.90%, Min. Navy Federal Credit Union, APY: 0.25%, Min.

Is a credit union an alternative to a bank?

Credit unions are bank alternatives that allow you to bank locally with like-minded people. A credit union is a nonprofit bank cooperative owned by its members, who pool their money to offer each other loans and other financial services at reasonable interest rates.

How many credit unions are in New Jersey?

There are 162 credit unions that have a branch in New Jersey. They serve 99 different cities, towns, or villages, 21 different counties, and 0 different zip codes.

Who regulates credit unions in NJ?

The NJ Department of Banking and Insurance - Division of Banking regulates state-chartered banks, savings banks, savings and loan institutions and credit unions, and may take enforcement action against these institutions in the event any violations of banking law or regulations are found.

What is the routing number for Credit of New Jersey?

To sign up for Direct Deposit or Payroll Deduction, you'll need our Routing and Transit number: 2312-7861-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NJ CUNJ Employer Payroll Deduction Direct online?

pdfFiller has made it simple to fill out and eSign NJ CUNJ Employer Payroll Deduction Direct. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the NJ CUNJ Employer Payroll Deduction Direct in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit NJ CUNJ Employer Payroll Deduction Direct on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NJ CUNJ Employer Payroll Deduction Direct.

What is NJ CUNJ Employer Payroll Deduction Direct Deposit?

NJ CUNJ Employer Payroll Deduction Direct Deposit is a system that allows employers in New Jersey to directly deposit payroll deductions into designated accounts for employees, ensuring efficient and timely processing of employee contributions.

Who is required to file NJ CUNJ Employer Payroll Deduction Direct Deposit?

Employers in New Jersey who withhold payroll deductions for state taxes, unemployment insurance, or other mandated contributions are required to file NJ CUNJ Employer Payroll Deduction Direct Deposit.

How to fill out NJ CUNJ Employer Payroll Deduction Direct Deposit?

To fill out NJ CUNJ Employer Payroll Deduction Direct Deposit, employers need to complete the designated form with employee information, including Social Security number, account details for direct deposit, and the amount to be deducted.

What is the purpose of NJ CUNJ Employer Payroll Deduction Direct Deposit?

The purpose of NJ CUNJ Employer Payroll Deduction Direct Deposit is to streamline the process of collecting employee deductions, reduce administrative burden, and enhance the accuracy and security of transactions.

What information must be reported on NJ CUNJ Employer Payroll Deduction Direct Deposit?

Employers must report information including employee names, Social Security numbers, the amounts deducted, and the account details for the direct deposit of these deductions.

Fill out your NJ CUNJ Employer Payroll Deduction Direct online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ CUNJ Employer Payroll Deduction Direct is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.