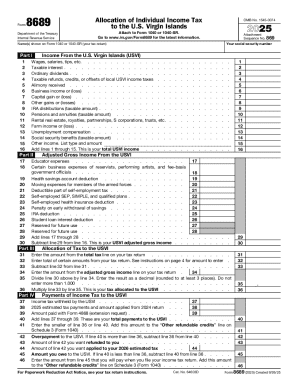

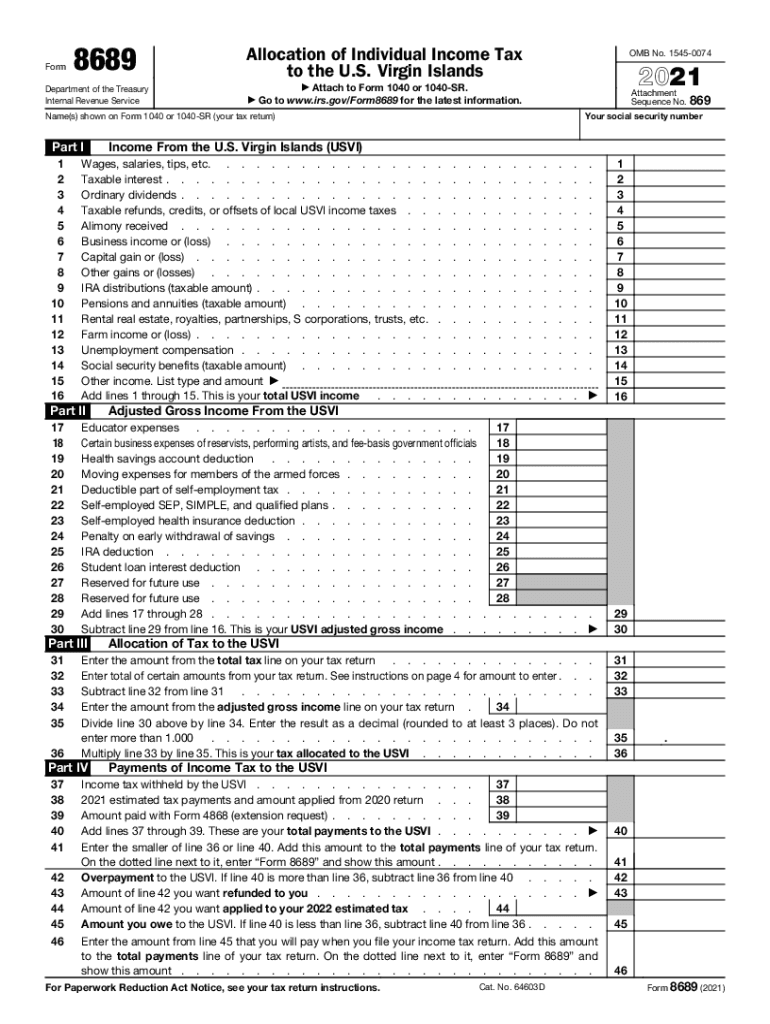

IRS 8689 2021 free printable template

FAQ about IRS 8689

How can I correct mistakes on my submitted 8689 form?

To correct mistakes on a submitted 8689 form, you must submit an amended version of the form. Ensure that you clearly indicate it as an amendment, providing the necessary corrections. It’s best to review the specifics on the IRS website for any guidelines on the submission process.

How can I track the status of my 8689 submission?

To verify the receipt and processing of your 8689 form, you can use the IRS online tracking service. If you submitted electronically, watch for confirmation emails. Be mindful of common e-file rejection codes that could affect processing.

What should I do if I receive a notice regarding my 8689 form?

If you receive a notice about your 8689 form, carefully read the communication for specific instructions. Prepare any necessary documentation to support your case, and respond promptly to avoid further complications or penalties.

Is e-signature acceptable for the 8689 form?

Yes, e-signatures are generally acceptable for the 8689 form when filed electronically. Ensure that you follow all relevant protocols for secure submission, as these measures enhance privacy and data security during the filing process.

What special considerations should nonresidents keep in mind while filing the 8689?

Nonresidents must be aware of specific rules governing the filing of the 8689. They should understand how to report income accurately and be mindful of any additional documentation that may be required for foreign payees when filing.