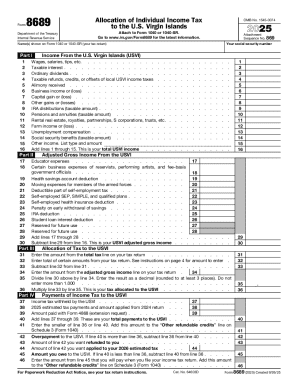

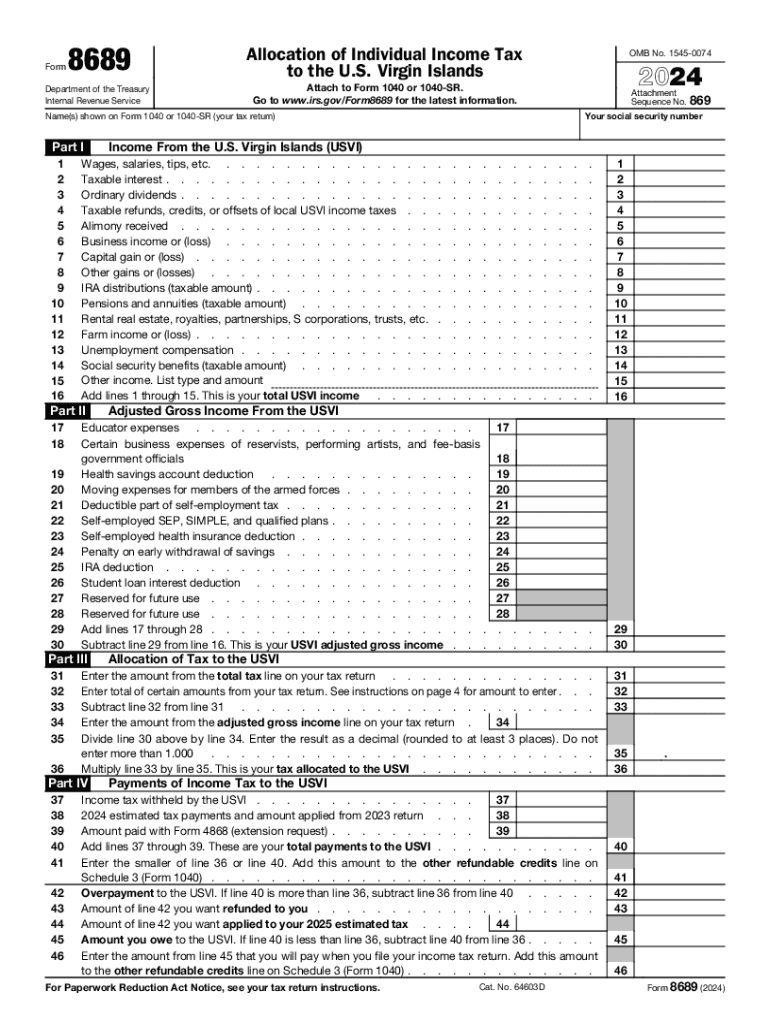

IRS 8689 2024 free printable template

Instructions and Help about IRS 8689

How to edit IRS 8689

How to fill out IRS 8689

Latest updates to IRS 8689

About IRS 8 previous version

What is IRS 8689?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8689

What should I do if I notice an error after submitting the IRS 8689?

If you discover an error after submitting the IRS 8689, you will need to file an amended version of the form. Be sure to clearly indicate the corrections made and include any necessary supporting documentation. This ensures proper processing and helps prevent potential complications with your submission.

How can I verify the status of my IRS 8689 submission?

To check the status of your IRS 8689 submission, you can utilize the IRS 'Where's My Refund?' tool on their website. Be sure to have your pertinent information ready, as this will help you navigate the system efficiently. It’s important to note that processing times may vary, so patience is sometimes necessary.

What should I keep in mind regarding data security when submitting the IRS 8689 electronically?

When e-filing the IRS 8689, it's crucial to ensure that your internet connection is secure and that you are using a reputable software program. Additionally, keep your sensitive personal information, like Social Security numbers, confidential. Regularly updating your passwords can also help safeguard your data.

What steps must nonresidents take when filing the IRS 8689?

Nonresidents filing the IRS 8689 should ensure they provide accurate details concerning their foreign status and any applicable treaties that might affect their obligations. It’s essential to understand the specific regulations that pertain to foreign payees, including how income sourced in the U.S. is treated.

How can I address a notice I received about my IRS 8689 submission?

If you receive a notice regarding your IRS 8689 submission, carefully read the correspondence for instructions on how to respond. Gather the documentation requested and make sure to submit any responses within the deadlines specified. Properly addressing notices can help clarify any issues and ensure your submission is processed correctly.