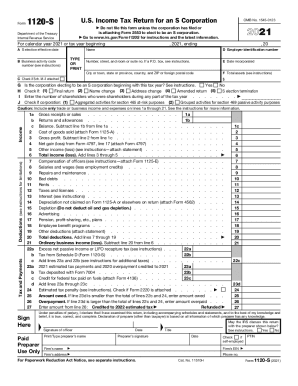

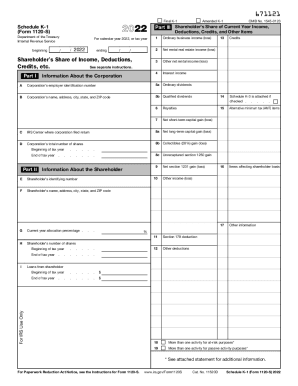

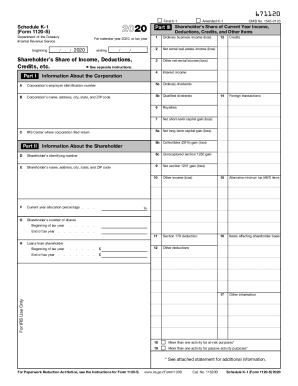

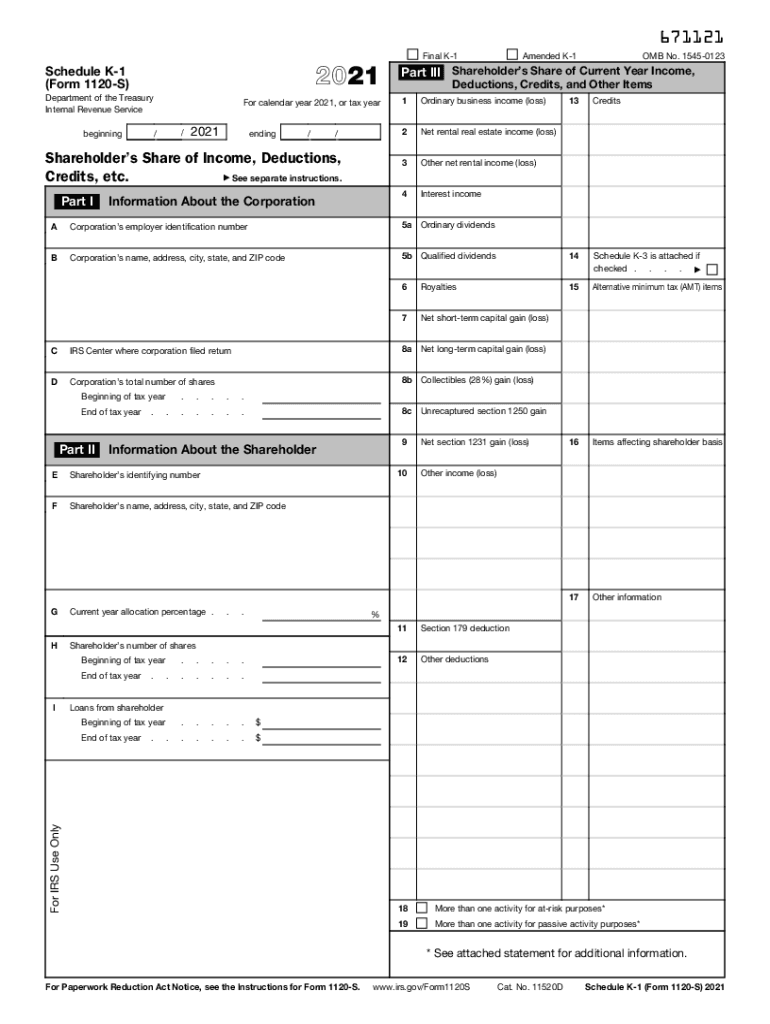

IRS 1120S - Schedule K-1 2021 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

About IRS 1120S - Schedule K-1 2021 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I realize I've made a mistake after filing my IRS 1120S - Schedule K-1?

If you notice an error on your filed IRS 1120S - Schedule K-1, you can submit an amended return. This involves filling out a corrected version of the schedule and clearly marking it as 'amended.' Keep in mind that you should attach an explanation of the changes made and submit the amended form accordingly.

How can I verify that my IRS 1120S - Schedule K-1 has been received by the IRS?

To check the status of your IRS 1120S - Schedule K-1, you can contact the IRS directly or use the IRS online tools for tracking filings. If you e-filed, it may take a few days to appear in the system, and you can also monitor any communications from the IRS for confirmation.

What are some common errors to watch out for when filing the IRS 1120S - Schedule K-1?

Common filing errors for the IRS 1120S - Schedule K-1 include incorrect taxpayer information, mismatched Social Security numbers, and failing to report all sources of income. Double-checking your entries and ensuring that all supporting documents are accurate can help prevent these mistakes.

What should I do if I receive a notice from the IRS regarding my IRS 1120S - Schedule K-1?

Upon receiving an IRS notice about your IRS 1120S - Schedule K-1, carefully read the contents to understand the issue. Gather any requested documentation and respond within the specified timeframe. It’s advisable to consult with a tax professional if the notice relates to complex matters.

Are there specific technical requirements for e-filing the IRS 1120S - Schedule K-1?

Yes, when e-filing your IRS 1120S - Schedule K-1, ensure that you use compatible software that meets IRS specifications. This includes using the latest version of your e-filing software, having a stable internet connection, and making sure your submissions are formatted according to IRS guidelines.

See what our users say