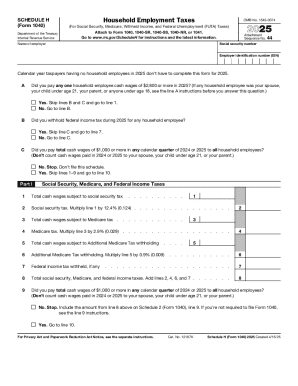

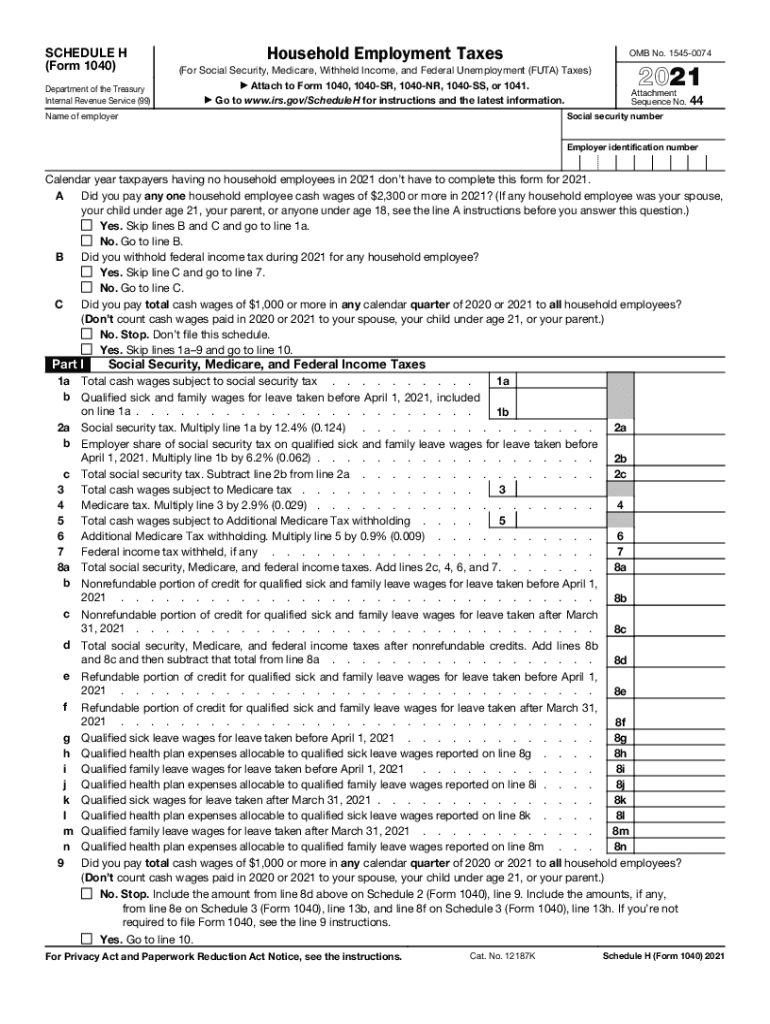

IRS 1040 - Schedule H 2021 free printable template

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

How to fill out IRS 1040 - Schedule H

About IRS 1040 - Schedule H 2021 previous version

What is IRS 1040 - Schedule H?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule H

What should I do if I realize I made an error after filing IRS 1040 - Schedule H?

If you discover an error on your IRS 1040 - Schedule H after submission, you need to file an amended return using Form 1040-X. Ensure you clearly state the corrections made and attach any necessary documentation to support your changes. It's best to correct mistakes as soon as possible to avoid potential penalties.

How can I track the status of my IRS 1040 - Schedule H after submission?

To track the status of your IRS 1040 - Schedule H, you can use the IRS 'Where's My Refund?' tool online, which provides updates on your return's processing. Additionally, if you e-filed, you may receive electronic confirmation, but if you mailed it, tracking may not be available until it is processed fully by the IRS.

Are there any common mistakes to avoid when filing IRS 1040 - Schedule H?

Common mistakes when filing IRS 1040 - Schedule H include mismatched information such as names and Social Security numbers, incorrect calculations of wages owed, or failing to include necessary documentation. Carefully reviewing your entries and cross-referencing with IRS guidelines can help mitigate these issues.

What should I do if I receive a notice from the IRS regarding my IRS 1040 - Schedule H?

If you receive a notice from the IRS about your IRS 1040 - Schedule H, read the notice carefully to understand the issue. Respond promptly, providing any required documentation or correction as instructed. Keeping thorough records of your correspondence with the IRS is advisable.