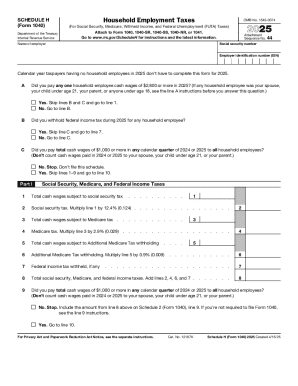

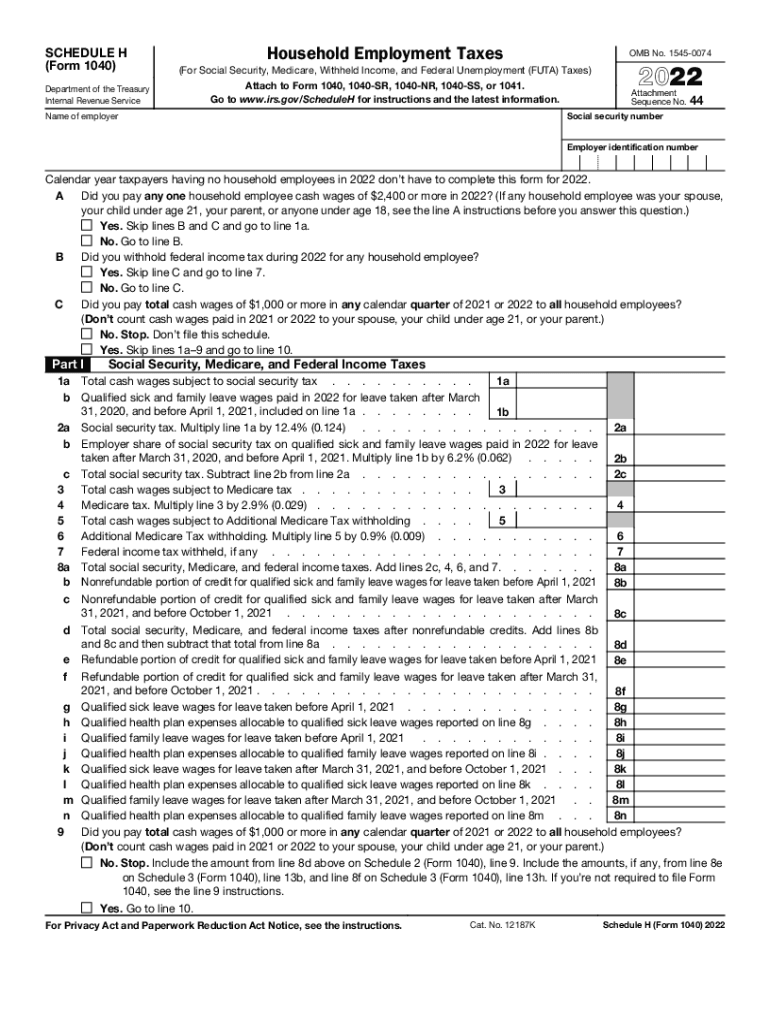

IRS 1040 - Schedule H 2022 free printable template

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

How to fill out IRS 1040 - Schedule H

About IRS 1040 - Schedule H 2022 previous version

What is IRS 1040 - Schedule H?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule H

What should I do if I notice an error after filing my IRS 1040 - Schedule H?

If you discover an error on your IRS 1040 - Schedule H after filing, you should submit an amended return using Form 1040-X. This will allow you to correct the mistake and ensure that your tax information is accurate. It's important to include any necessary supporting documentation with your amended return.

How can I check the status of my IRS 1040 - Schedule H submission?

To verify the status of your IRS 1040 - Schedule H submission, you can use the IRS 'Where's My Refund?' tool if you are expecting a refund. Additionally, e-filing software often provides a way to track submission and processing status. Be sure to have your personal information handy for verification.

What are common mistakes to avoid when filing IRS 1040 - Schedule H?

Common mistakes when filing the IRS 1040 - Schedule H include miscalculating the amounts owed for household employment taxes or failing to report all employees. Double-check all calculations and ensure that every employee is accounted for to avoid IRS notices or penalties.

What should I do if I receive a notice or letter from the IRS regarding my 1040 - Schedule H?

If you receive a notice from the IRS regarding your IRS 1040 - Schedule H, carefully read the notice to understand the issue. Respond promptly, providing the requested documentation or clarification. Keeping thorough records is essential in case further information is needed in your response.

Are there any specific technical requirements for e-filing my IRS 1040 - Schedule H?

When e-filing your IRS 1040 - Schedule H, ensure that you are using compatible software that supports the form. Additionally, you should have a secure internet connection and confirm that your browser is updated. These steps can help minimize technical issues during the filing process.