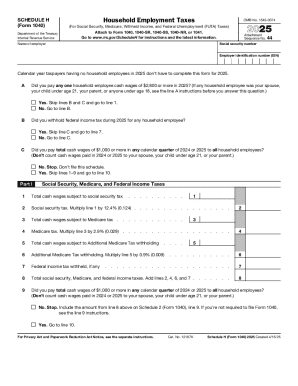

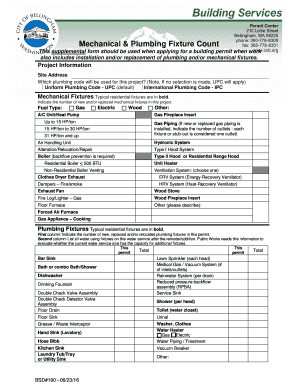

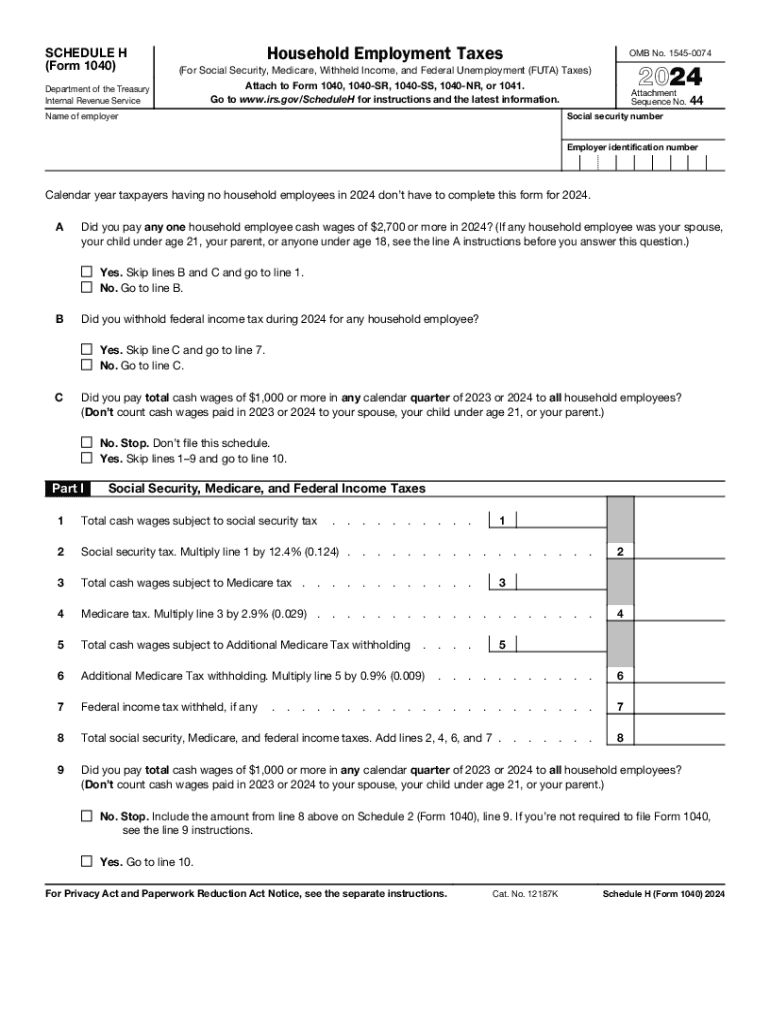

IRS 1040 - Schedule H 2024 free printable template

Instructions and Help about schedule h for

How to edit schedule h for

How to fill out schedule h for

Latest updates to schedule h for

All You Need to Know About schedule h for

What is schedule h for?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule H

What should I do if I notice an error after filing schedule h for?

If you find a mistake after filing schedule h for, you should submit an amended form as soon as possible. It's important to indicate that you're filing a corrected version by marking it appropriately. Make sure to keep copies of both the original and amended forms for your records.

How can I verify the status of my schedule h for submission?

To check the status of your submitted schedule h for, you can use the tracking feature provided by the e-filing service you used. You may also look out for confirmation emails or notifications, which typically indicate that your form has been received and is being processed.

What should I do if my schedule h for is rejected during e-filing?

If your schedule h for is rejected, review the error codes provided by the e-filing system to understand the reasons for rejection. Common issues may include missing information or incorrect formats. Correct the identified issues and resubmit your form promptly.

Are there any specific privacy concerns I should be aware of when filing schedule h for electronically?

When filing schedule h for electronically, ensure that you're using secure and reputable filing platforms to protect your personal information. Be mindful of data encryption standards and opt for e-signature options that comply with legal requirements for privacy and security.

What are common mistakes filers make with schedule h for, and how can I avoid them?

Common mistakes with schedule h for include entering incorrect amounts and failing to provide required information. To avoid these pitfalls, cross-check your entries before submission and refer to the specific guidelines provided by the filing authority to ensure you're complying with all requirements.