UT USTC TC-194A 2021 free printable template

Show details

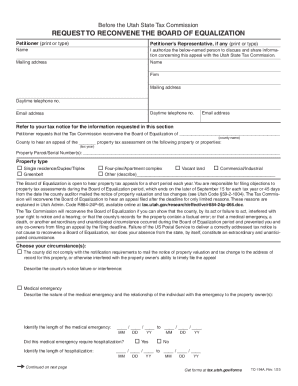

Get forms online - tax. utah. gov Before The Utah State Tax Commission REQUEST TO RECONVENE THE BOARD Of EQUALIZATION Petitioner print or type Name Petitioner s Representative if any print or type I authorize the below-named person to discuss and share information concerning this appeal with the Utah State Tax Commission. Mailing address Firm Daytime telephone no. Failure of the US Postal Service to deliver a correctly addressed tax notice is not cause to reconvene a Board of Equalization nor...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-194A

Edit your UT USTC TC-194A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-194A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT USTC TC-194A online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT USTC TC-194A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-194A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-194A

How to fill out UT USTC TC-194A

01

Begin by gathering all necessary personal and financial information.

02

Write your name at the top of the form.

03

Provide your contact information, including address and phone number.

04

Fill out the sections regarding your income sources.

05

Include any deductions or exemptions you qualify for.

06

Ensure that you review all the details for accuracy.

07

Sign and date the form at the bottom.

Who needs UT USTC TC-194A?

01

Individuals who are applying for a specific tax or financial relief program.

02

People who need to report their financial status for government assistance.

Instructions and Help about UT USTC TC-194A

Fill

form

: Try Risk Free

People Also Ask about

What is the role of the Board of Equalization?

The BOE has a major role in California's property tax system. The BOE is responsible for assessing property owned or used by railroads and privately- held public utilities, and for ensuring statewide uniformity in the assessment of properties by the 58 county assessors.

What is the Forsyth County NC Board of Equalization and Review?

The Forsyth County Board of Equalization (BOE) consists of citizens of the county appointed by the Grand Jury for the purpose of providing independent and unbiased hearings of appeals regarding property taxes. Members and Alternate Members of the Board of Equalization serve a three-year term of office.

What is the purpose of the Board of Equalization?

The BOE is responsible for assessing property owned or used by railroads and privately- held public utilities, and for ensuring statewide uniformity in the assessment of properties by the 58 county assessors.

What is the Board of Equalization Utah?

The County Council is the Board of Equalization (Board or BOE). The Board sets policy and makes all final decisions based on its findings or findings made by hearing officers appointed by the Board.

What is a Board of Equalization and review?

In 1879, the California State Board of Equalization (BOE) was established under the California Constitution to regulate county assessment practices, equalize county assessment ratios, and assess properties of intercounty railroads.

Is Utah a tax friendly state?

Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-194A without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your UT USTC TC-194A into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute UT USTC TC-194A online?

pdfFiller has made it easy to fill out and sign UT USTC TC-194A. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit UT USTC TC-194A online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your UT USTC TC-194A and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is UT USTC TC-194A?

UT USTC TC-194A is a tax form used in Utah for individuals and businesses to report specific tax information to the state.

Who is required to file UT USTC TC-194A?

Individuals and businesses that meet certain criteria specified by the Utah State Tax Commission are required to file UT USTC TC-194A.

How to fill out UT USTC TC-194A?

To fill out UT USTC TC-194A, gather the necessary financial information, follow the instructions provided on the form, and ensure all required fields are completed accurately.

What is the purpose of UT USTC TC-194A?

The purpose of UT USTC TC-194A is to collect tax information for state revenue purposes and ensure compliance with tax laws.

What information must be reported on UT USTC TC-194A?

The UT USTC TC-194A requires reporting information such as income, deductions, tax credits, and any other financial details relevant to tax obligations.

Fill out your UT USTC TC-194A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-194a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.