IN DoR Form ES-40 2021 free printable template

Show details

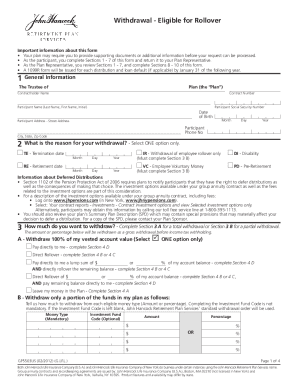

Form ES40State Form 46005 (R20 / 920)Indiana Department of Revenue2021Estimated Tax Payment Former Social Security NumberSpouses Social Security Numerous first nameInitialLast name filing a joint

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN DoR Form ES-40

Edit your IN DoR Form ES-40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN DoR Form ES-40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN DoR Form ES-40 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IN DoR Form ES-40. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR Form ES-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN DoR Form ES-40

How to fill out IN DoR Form ES-40

01

Obtain the IN DoR Form ES-40 from the official website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal details such as name, address, and contact information.

04

Provide any necessary identification numbers or codes as required.

05

Complete the section regarding the purpose of the form.

06

Include any additional information requested in the form, such as financial or employment details.

07

Review your entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form by mail or in person to the appropriate office as per guidelines.

Who needs IN DoR Form ES-40?

01

Individuals or businesses seeking to comply with specific regulatory requirements in Indiana.

02

Those involved in activities that require formal reporting or documentation as mandated by Indiana state regulations.

03

Applicants for permits, licenses, or certain types of financial transactions that require the completion of this form.

Fill

form

: Try Risk Free

People Also Ask about

Did they get rid of the 1040 EZ?

In the past, if you had a simple tax return to prepare, you likely filed your return with IRS Form 1040EZ. This form covered a broad range of taxpayers. However, filing with Form 1040EZ is no longer an option. This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation.

What tax form has replaced the 1040EZ?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040. Form 1040EZ could only be used by people below age 65 with no dependents earning less than $100,000 per year.

Who gives you a 1040 form?

How to get Form 1040. The IRS offers a PDF version of Form 1040 that you can download and fill out manually, but your best bet is probably using one of the popular tax software programs. The software will walk you through filling out the form, any necessary schedules that go with it, and help with the math.

What is the easiest 1040 form?

IRS Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out.You could use Form 1040-EZ if all of the following apply: You are filing as single or married filing jointly. Your taxable income is less than $100,000. You don't claim any dependents. You don't itemize deductions.

Is there a 1040 EZ Form for 2022?

Is there still a 1040 EZ form? No, in the past, if you needed to submit a basic tax return, you most likely used IRS Form 1040EZ. This form applied to a wide variety of taxpayers. However, Form 1040EZ is no longer an option for filing taxes.

Where can I pick up a 1040 tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the 2022 Form 1040-ES payment voucher?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IN DoR Form ES-40 online?

Completing and signing IN DoR Form ES-40 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my IN DoR Form ES-40 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your IN DoR Form ES-40 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out IN DoR Form ES-40 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IN DoR Form ES-40 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IN DoR Form ES-40?

IN DoR Form ES-40 is a tax form used in Indiana for electronic submission of estimated tax payments for individuals and businesses.

Who is required to file IN DoR Form ES-40?

Individuals and businesses in Indiana that are required to make estimated tax payments based on their expected tax liability are required to file IN DoR Form ES-40.

How to fill out IN DoR Form ES-40?

To fill out IN DoR Form ES-40, taxpayers need to provide their personal information, income details, and any tax deductions or credits they expect to claim, along with the estimated tax payment amount.

What is the purpose of IN DoR Form ES-40?

The purpose of IN DoR Form ES-40 is to allow taxpayers to report and pay their estimated tax liabilities to the state of Indiana in a timely manner.

What information must be reported on IN DoR Form ES-40?

The information that must be reported on IN DoR Form ES-40 includes the taxpayer's name, address, Social Security number or Employer Identification Number, estimated income, and the amount of estimated tax due.

Fill out your IN DoR Form ES-40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN DoR Form ES-40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.