IN DoR Form ES-40 2024 free printable template

Show details

Form

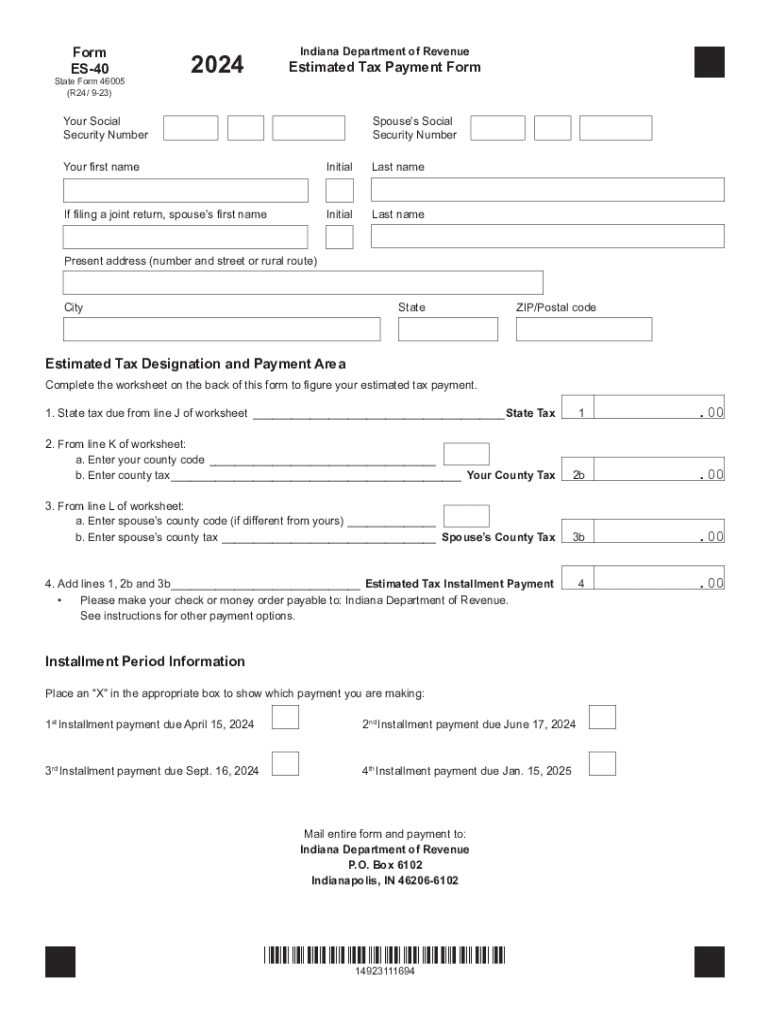

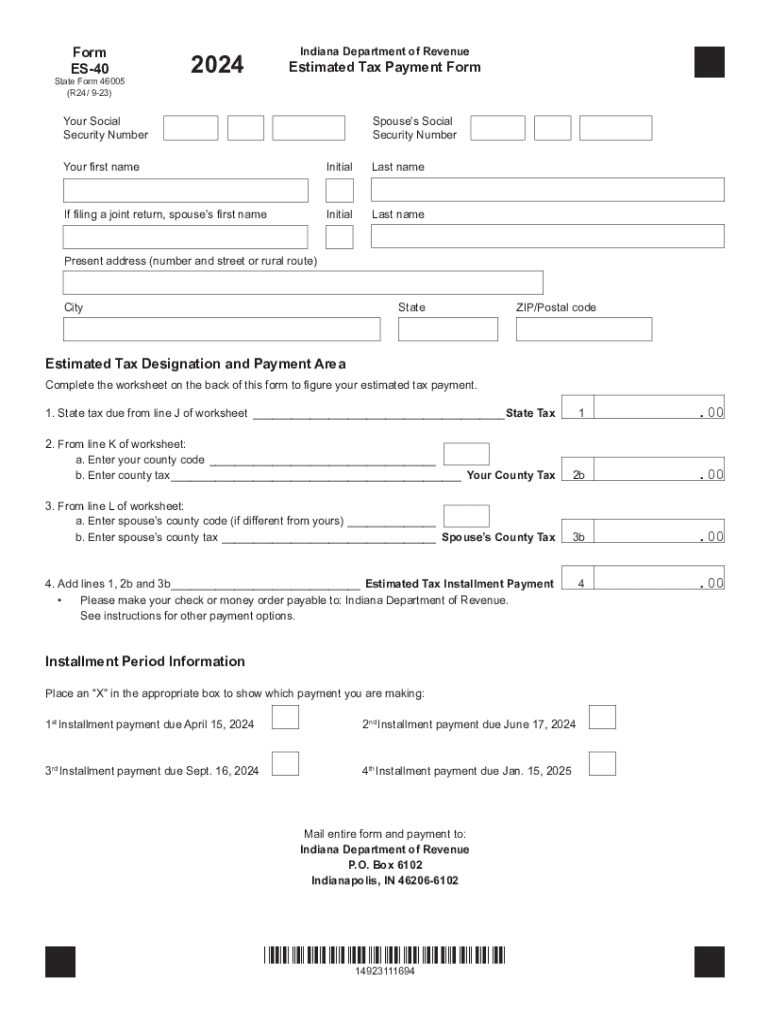

ES40State Form 46005

(R23 / 922)Indiana Department of Revenue2023Estimated Tax Payment FormYour Social

Security NumberSpouses Social

Security NumberYour first nameInitialLast nameIf filing a

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana es40 46005 estimated tax pdf form

Edit your indiana dor 46005 estimated payment fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana revenue 40 46005 estimated tax payment form printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana es 40 46005 form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indiana es 40 46005 estimated form print. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR Form ES-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out indiana es 46005 estimated form blank

How to fill out IN DoR Form ES-40

01

Obtain the IN DoR Form ES-40 from the official website or designated office.

02

Fill in your personal information in the designated sections, including name, address, and contact details.

03

Provide relevant details regarding the purpose of the form in the appropriate fields.

04

Attach any necessary supporting documents that are required for the submission.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed form to the appropriate authority as instructed.

Who needs IN DoR Form ES-40?

01

Individuals or organizations applying for a specific permit or license governed by Indiana regulations.

02

Those who need to report changes or updates related to their registration or compliance status.

03

Applicants seeking to fulfill regulatory requirements set by the Indiana Department of Revenue.

Fill

indiana dor es 40 46005 estimated printable

: Try Risk Free

People Also Ask about indiana dor 46005 estimated tax printable

Did they get rid of the 1040 EZ?

In the past, if you had a simple tax return to prepare, you likely filed your return with IRS Form 1040EZ. This form covered a broad range of taxpayers. However, filing with Form 1040EZ is no longer an option. This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation.

What tax form has replaced the 1040EZ?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040. Form 1040EZ could only be used by people below age 65 with no dependents earning less than $100,000 per year.

Who gives you a 1040 form?

How to get Form 1040. The IRS offers a PDF version of Form 1040 that you can download and fill out manually, but your best bet is probably using one of the popular tax software programs. The software will walk you through filling out the form, any necessary schedules that go with it, and help with the math.

What is the easiest 1040 form?

IRS Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out.You could use Form 1040-EZ if all of the following apply: You are filing as single or married filing jointly. Your taxable income is less than $100,000. You don't claim any dependents. You don't itemize deductions.

Is there a 1040 EZ Form for 2022?

Is there still a 1040 EZ form? No, in the past, if you needed to submit a basic tax return, you most likely used IRS Form 1040EZ. This form applied to a wide variety of taxpayers. However, Form 1040EZ is no longer an option for filing taxes.

Where can I pick up a 1040 tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the 2022 Form 1040-ES payment voucher?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indiana revenue es40 46005 blank in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your indiana dor es 40 46005 estimated and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for the indiana dor 46005 estimated tax payment form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your indiana revenue es 40 46005 estimated payment print.

How do I edit indiana es40 46005 tax form printable on an Android device?

You can make any changes to PDF files, such as indiana es 40 46005 estimated tax fill, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is IN DoR Form ES-40?

IN DoR Form ES-40 is a document used for filing estimated tax payments in the state of Indiana.

Who is required to file IN DoR Form ES-40?

Individuals, businesses, or entities that expect to owe a certain amount in state taxes during the year are required to file IN DoR Form ES-40.

How to fill out IN DoR Form ES-40?

To fill out IN DoR Form ES-40, you must provide your personal or business information, calculate your expected tax liability, and report the payment amount for each installment.

What is the purpose of IN DoR Form ES-40?

The purpose of IN DoR Form ES-40 is to facilitate automatic or scheduled payment of estimated state taxes, helping taxpayers avoid underpayment penalties.

What information must be reported on IN DoR Form ES-40?

Information that must be reported on IN DoR Form ES-40 includes taxpayer identification details, expected income, estimated tax liability, and payment amounts for each of the four quarterly installments.

Fill out your indiana dor 46005 estimated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Es 40 is not the form you're looking for?Search for another form here.

Keywords relevant to indiana 46005 estimated payment form

Related to indiana dor es 40 46005 estimated form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.