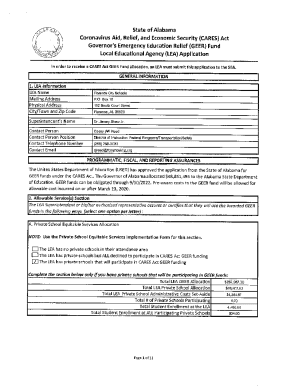

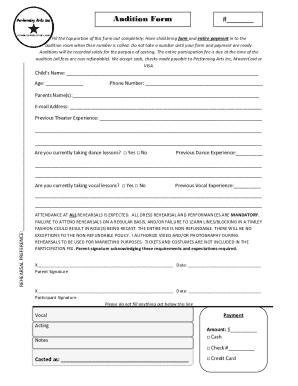

IN DoR Form ES-40 2025 free printable template

Show details

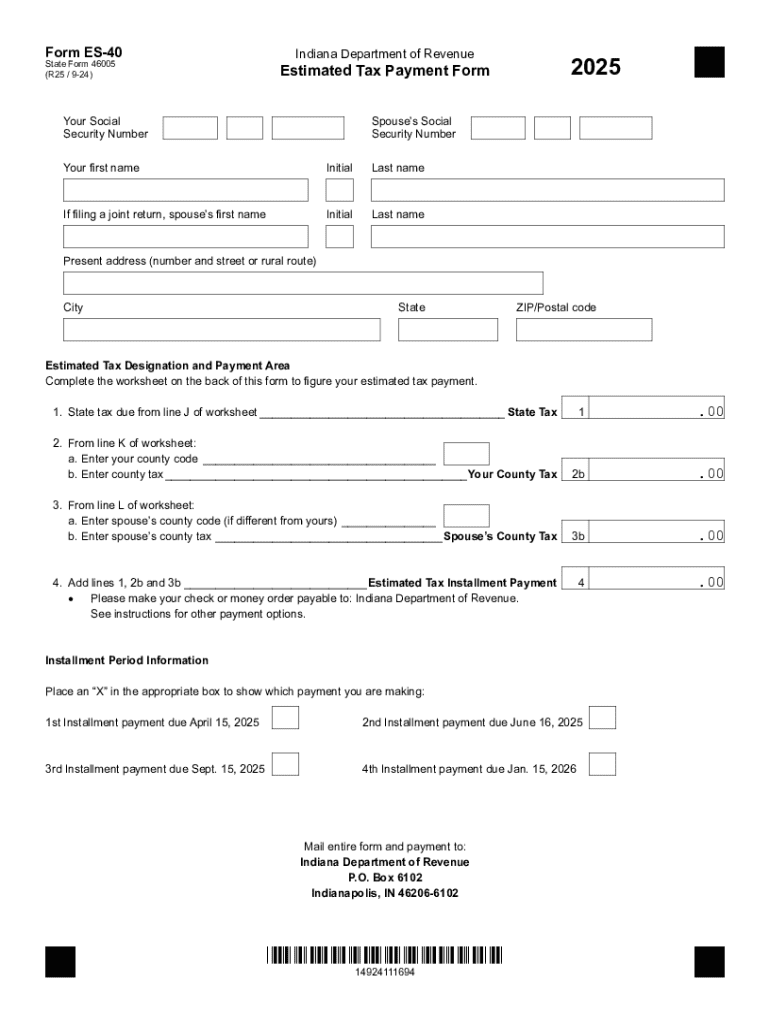

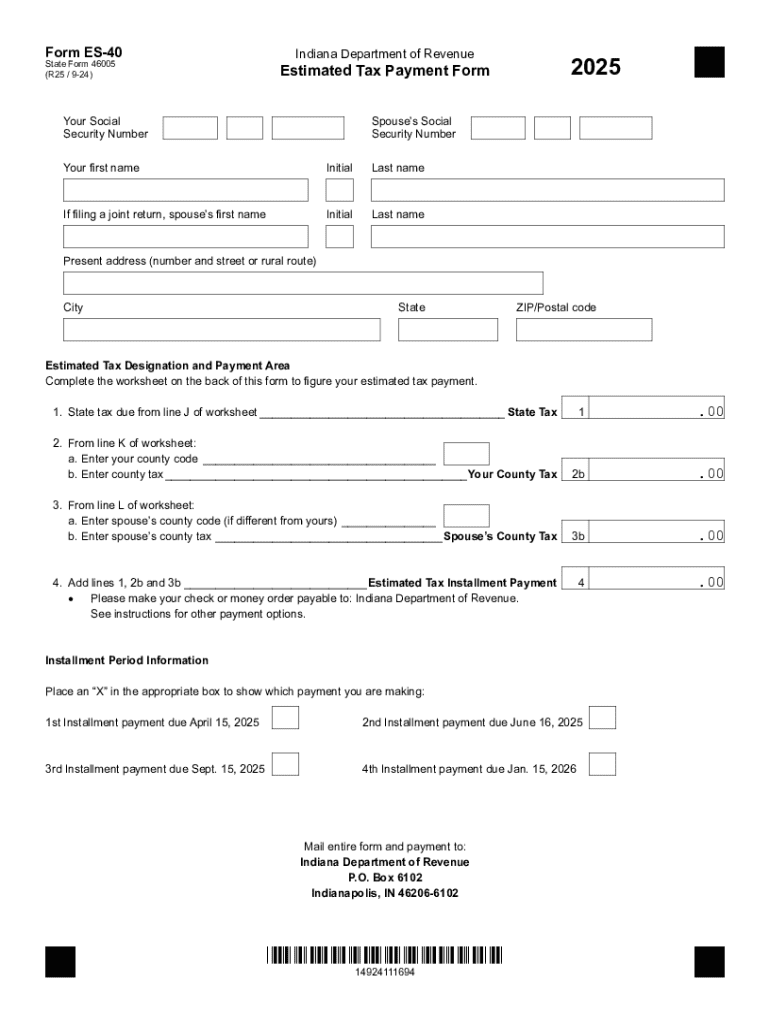

Form ES-40 State Form 46005 (R25 / 9-24) Indiana Department of Revenue 2025 Estimated Tax Payment Form Your Social Security Number Spouse’s Social Security Number Your first name Initial Last name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign es-40 - forms in

Edit your es-40 - forms in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your es-40 - forms in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit es-40 - forms in online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit es-40 - forms in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN DoR Form ES-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out es-40 - forms in

How to fill out IN DoR Form ES-40

01

Download the IN DoR Form ES-40 from the official website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information in the designated fields, such as name, address, and contact details.

04

Provide the necessary identification information, such as your Social Security Number or other ID numbers as required.

05

If applicable, detail any relevant information related to the purpose of the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form as per the guidelines provided, either online or by mail.

Who needs IN DoR Form ES-40?

01

Individuals seeking to report or document specific events or changes related to legal or administrative matters.

02

Entities that are required to maintain compliance with state regulations or laws.

03

Anyone who needs to provide formal notification to the Indiana Department of Revenue regarding changes in status.

Fill

form

: Try Risk Free

People Also Ask about

Did they get rid of the 1040 EZ?

In the past, if you had a simple tax return to prepare, you likely filed your return with IRS Form 1040EZ. This form covered a broad range of taxpayers. However, filing with Form 1040EZ is no longer an option. This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation.

What tax form has replaced the 1040EZ?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040. Form 1040EZ could only be used by people below age 65 with no dependents earning less than $100,000 per year.

Who gives you a 1040 form?

How to get Form 1040. The IRS offers a PDF version of Form 1040 that you can download and fill out manually, but your best bet is probably using one of the popular tax software programs. The software will walk you through filling out the form, any necessary schedules that go with it, and help with the math.

What is the easiest 1040 form?

IRS Form 1040-EZ was the shortest of the 1040 forms and the easiest to fill out.You could use Form 1040-EZ if all of the following apply: You are filing as single or married filing jointly. Your taxable income is less than $100,000. You don't claim any dependents. You don't itemize deductions.

Is there a 1040 EZ Form for 2022?

Is there still a 1040 EZ form? No, in the past, if you needed to submit a basic tax return, you most likely used IRS Form 1040EZ. This form applied to a wide variety of taxpayers. However, Form 1040EZ is no longer an option for filing taxes.

Where can I pick up a 1040 tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

What is the 2022 Form 1040-ES payment voucher?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete es-40 - forms in online?

pdfFiller makes it easy to finish and sign es-40 - forms in online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in es-40 - forms in?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your es-40 - forms in to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out es-40 - forms in on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your es-40 - forms in. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IN DoR Form ES-40?

IN DoR Form ES-40 is a state-specific form used for reporting estimated tax payments for individuals and businesses in Indiana.

Who is required to file IN DoR Form ES-40?

Individuals and corporations that expect to owe at least $1,000 in state income tax after subtracting withholding and refundable credits must file IN DoR Form ES-40.

How to fill out IN DoR Form ES-40?

To fill out IN DoR Form ES-40, taxpayers should enter their personal information, estimate their annual income, calculate the expected tax due, and indicate payment amounts for each quarter.

What is the purpose of IN DoR Form ES-40?

The purpose of IN DoR Form ES-40 is to allow taxpayers to report and pay their estimated state income taxes on a quarterly basis.

What information must be reported on IN DoR Form ES-40?

Taxpayers must report their name, address, Social Security number, estimated annual income, estimated tax liability, and quarterly payment amounts on IN DoR Form ES-40.

Fill out your es-40 - forms in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Es-40 - Forms In is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.