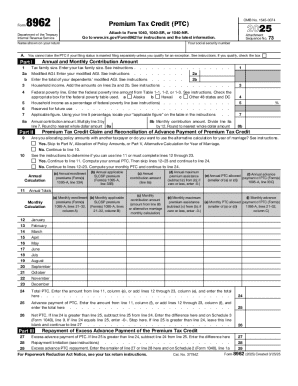

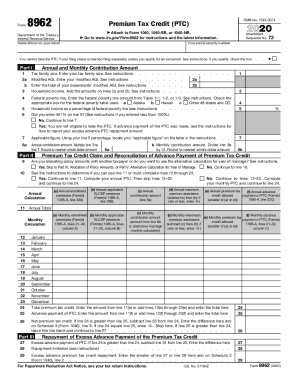

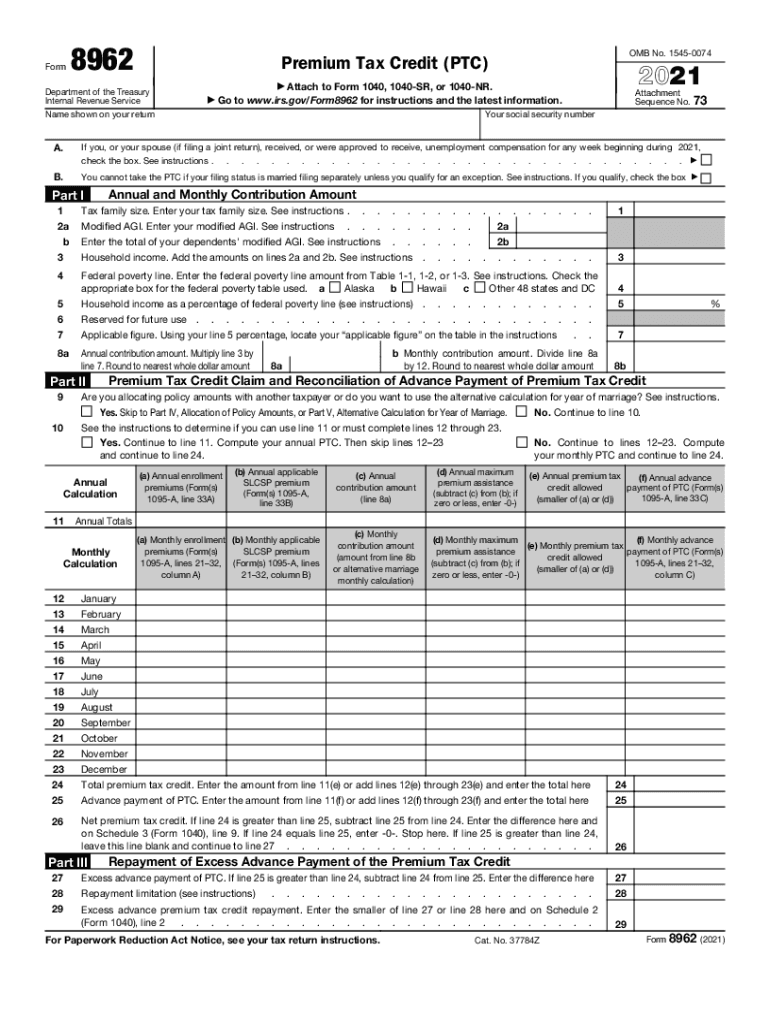

IRS 8962 2021 free printable template

Instructions and Help about IRS 8962

How to edit IRS 8962

How to fill out IRS 8962

About IRS 8 previous version

What is IRS 8962?

Who needs the form?

Components of the form

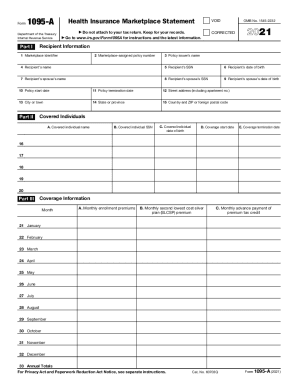

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

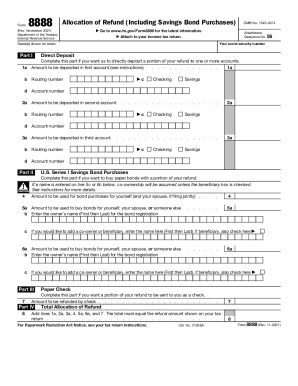

Is the form accompanied by other forms?

FAQ about IRS 8962

What should I do if I realize I've made a mistake after submitting my IRS 8962?

If you discover an error after filing your IRS 8962, you must submit a corrected form. This process typically involves filing Form 1040-X, Amended U.S. Individual Income Tax Return, along with a revised IRS 8962. Ensure that any adjustments are clearly documented to prevent confusion during processing.

How can I verify that the IRS received my IRS 8962 submission?

To confirm receipt of your submitted IRS 8962, you can use the IRS 'Where's My Refund?' tool or the IRS2Go mobile app. These platforms provide updates regarding the status of your return and any associated forms, allowing you to track processing without unnecessary delays.

What should I do if my IRS 8962 submission gets rejected?

If your IRS 8962 is rejected, carefully review the rejection notice for error codes related to your submission. You will need to correct the identified issues and resubmit your form electronically or via mail. It's important to address rejection reasons promptly to avoid delays in processing your tax return.

Are there legal considerations for submitting IRS 8962 for nonresident aliens?

Nonresident aliens must consider their eligibility for Premium Tax Credits before filing IRS 8962. Certain residency and income requirements must be met. It's advisable to consult a tax professional familiar with IRS regulations for nonresidents to ensure compliance with tax obligations.

What common errors should I be aware of when filing the IRS 8962?

Common errors when filing the IRS 8962 include inaccuracies in reporting annual income, failing to reconcile advance payments accurately, and miscalculating the Premium Tax Credit. Double-checking your figures and adhering to guidelines can help mitigate these issues and ensure a smoother filing process.

See what our users say