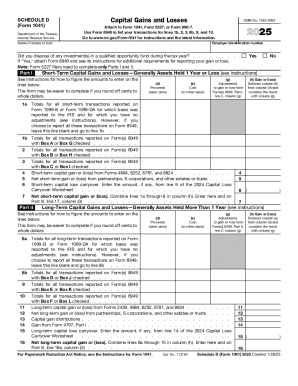

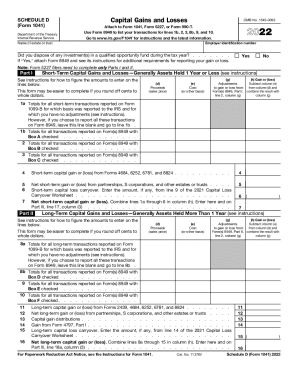

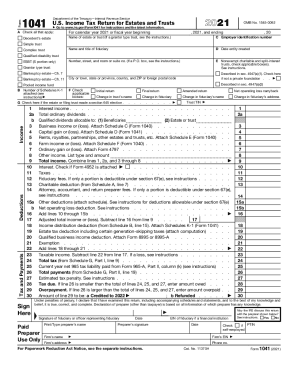

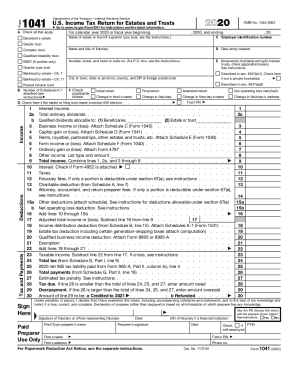

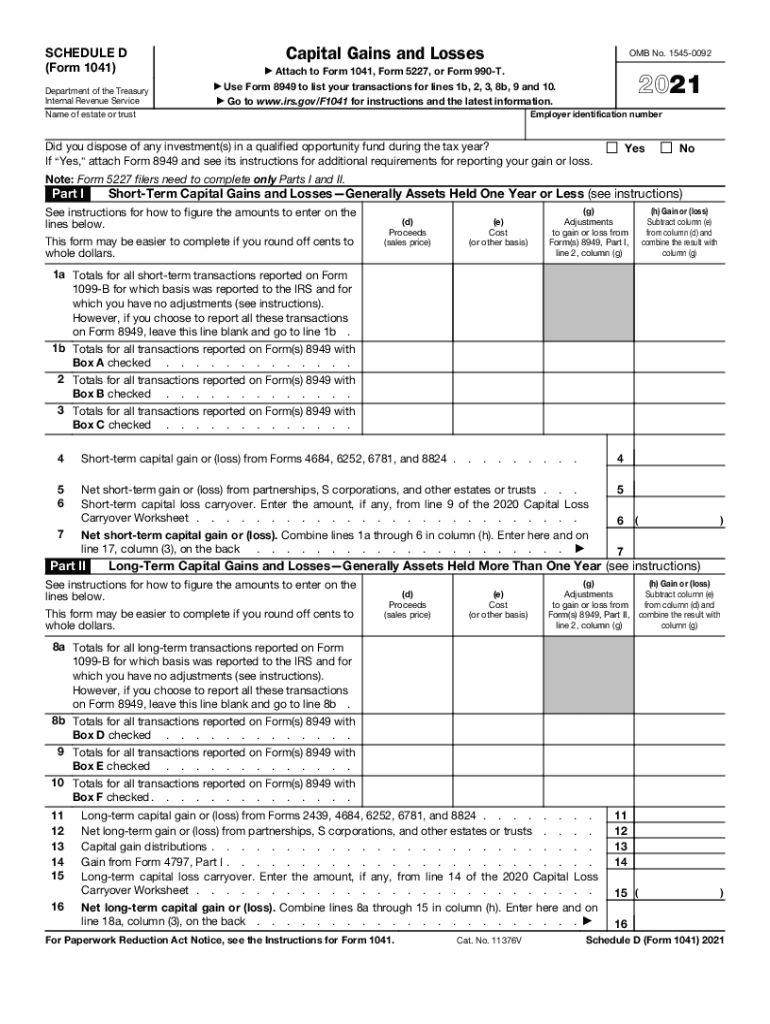

IRS 1041 - Schedule D 2021 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2021 previous version

What is IRS 1041 - Schedule D?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041 - Schedule D

What should I do if I made an error on my IRS 1041 - Schedule D?

If you realize you made a mistake on your IRS 1041 - Schedule D after submission, you can file an amended return using Form 1041-X. It's important to explain the corrections clearly and provide any additional supporting documentation needed. Ensure that you double-check the completed form to avoid repeating the error.

How can I track the status of my IRS 1041 - Schedule D submission?

To verify the status of your IRS 1041 - Schedule D, you can use the IRS 'Where's My Refund?' tool online, which provides updates on your filing. If you filed electronically, be aware of common rejection codes and resolve any issues outlined in the IRS correspondence. Keeping a record of your submission confirmation is crucial for tracking.

What if I receive an IRS notice about my filing of IRS 1041 - Schedule D?

If you receive an IRS notice or letter regarding your IRS 1041 - Schedule D, carefully read the communication to understand the issue. Prepare any required documentation and consult tax professionals if needed. Respond promptly to avoid further complications and keep records of all correspondence for your files.

Are there special rules for filing IRS 1041 - Schedule D for nonresidents?

Yes, nonresidents must adhere to specific guidelines when filing the IRS 1041 - Schedule D. This includes understanding applicable tax treaties and ensuring compliance with regulations for foreign payees. It’s advisable to consult a tax professional familiar with cross-border tax issues to navigate the complexities.

See what our users say