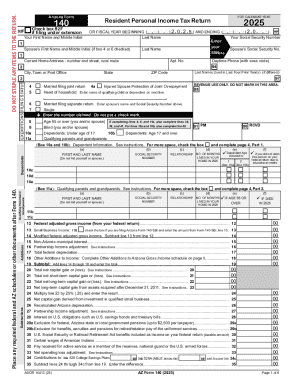

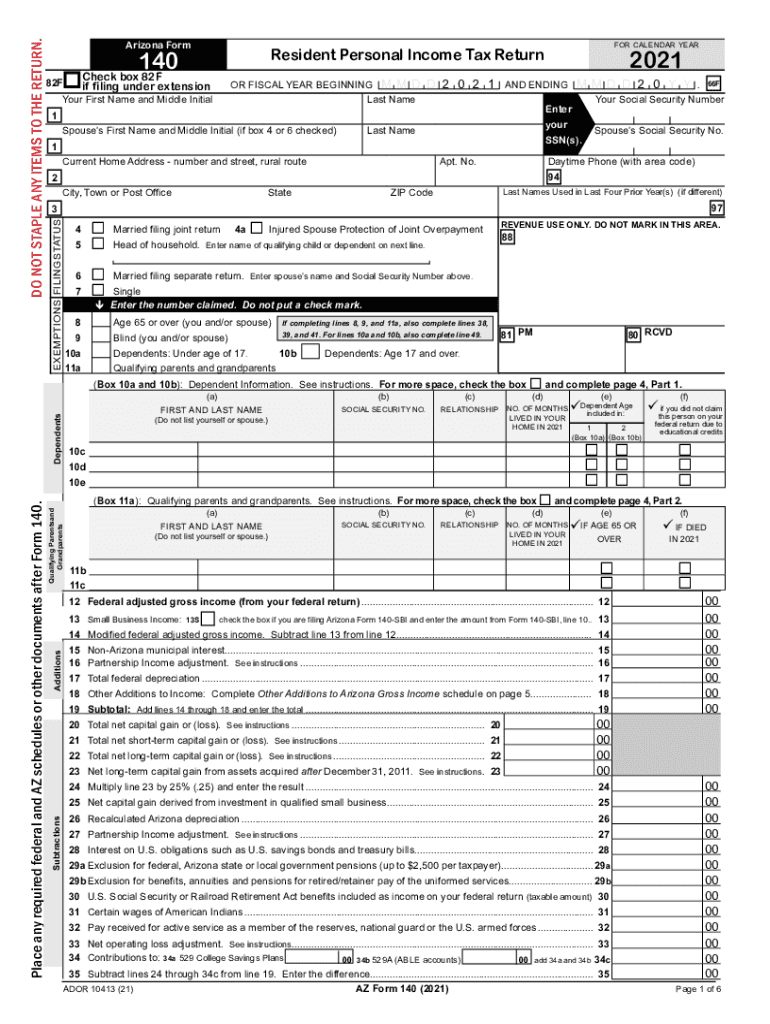

AZ Form 140 2021 free printable template

Instructions and Help about AZ Form 140

How to edit AZ Form 140

How to fill out AZ Form 140

About AZ Form previous version

What is AZ Form 140?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

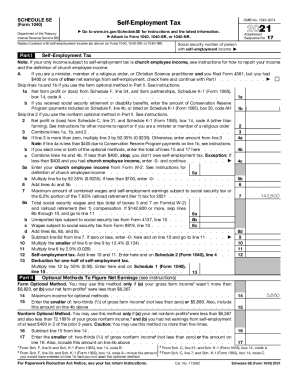

Is the form accompanied by other forms?

FAQ about AZ Form 140

What should I do if I made a mistake on my arizona 140 tax?

If you find an error after submitting your arizona 140 tax, you should file an amended return using Form 140-X. This process allows you to correct mistakes made on the original submission. Be sure to provide a clear explanation of the changes and any necessary supporting documentation.

How can I check the status of my arizona 140 tax submission?

To verify the status of your arizona 140 tax, you can use the Arizona Department of Revenue's online tracking system. This system provides updates on the receipt and processing of your return. If your return has been rejected, the system may also provide common rejection codes to help you identify any issues.

What should I do if I receive an audit notice after filing my arizona 140 tax?

If you receive an audit notice regarding your arizona 140 tax, review the corresponding documentation thoroughly. Prepare any requested materials and respond to the notice promptly, providing clear evidence and explanations for your filings. It's advisable to consult a tax professional for assistance with the audit process.

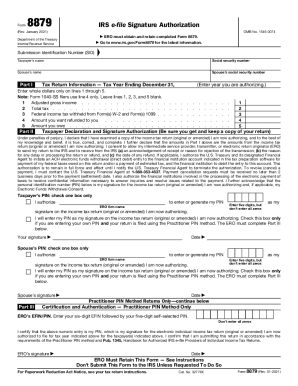

Are electronic signatures acceptable for filing my arizona 140 tax?

Yes, electronic signatures are acceptable for filing your arizona 140 tax. Ensure your e-filing software is compatible with Arizona's acceptance criteria for e-signatures. Retaining copies of your signed documents in a secure location is also crucial for future reference.

See what our users say