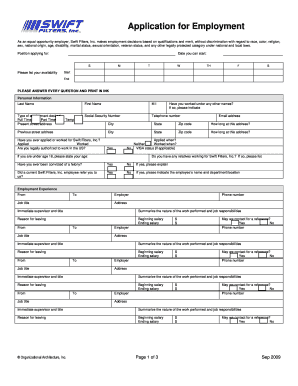

RI RI-1065 2020 free printable template

Show details

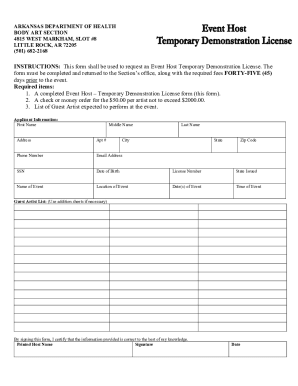

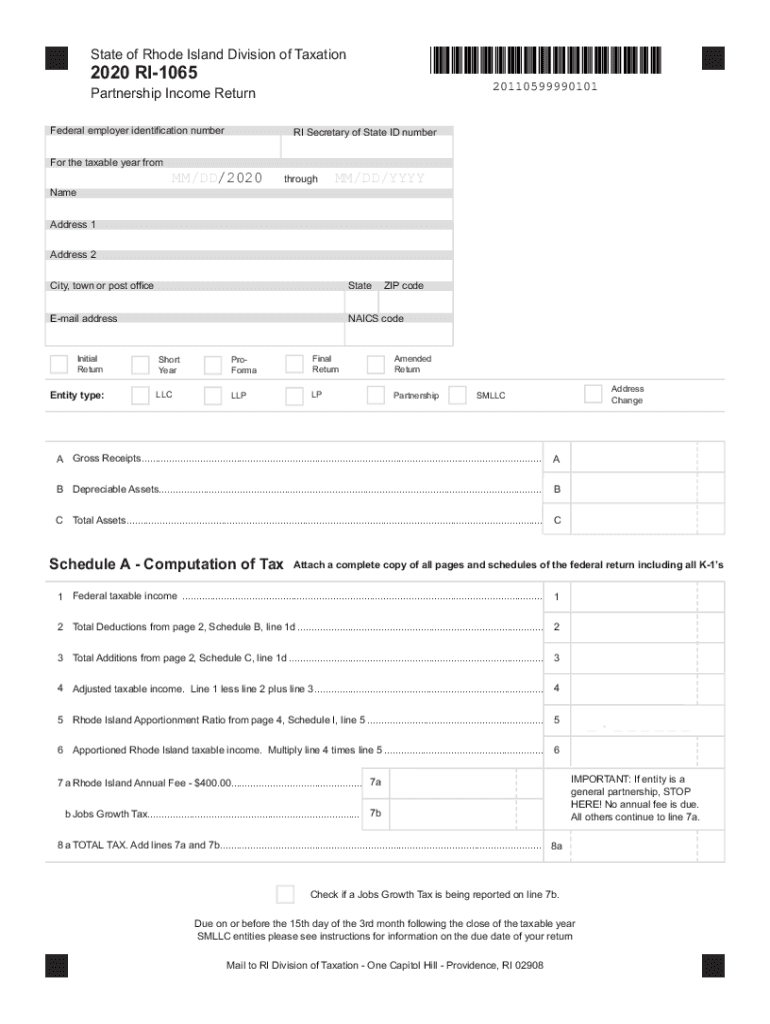

State of Rhode Island Division of Taxation2020 RI1065

20110599990101Partnership Income Return

Federal employer identification numberRISecretary of State ID number the taxable year Fromm/DD/2020throughMM/DD/YYYYName

Address

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI-1065

Edit your RI RI-1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI-1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI RI-1065 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI RI-1065. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI-1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI-1065

How to fill out RI RI-1065

01

Gather the necessary information about the entity and its income.

02

Download the RI RI-1065 form from the Rhode Island Department of Revenue website.

03

Fill out the identification section with the entity name, address, and federal employer identification number (EIN).

04

Report total income, deductions, and credits accurately on the form.

05

Include all relevant schedules and attachments required for the form.

06

Complete the signature section, ensuring authorized representatives sign the form.

07

Double-check all entries for accuracy and completeness.

08

Submit the completed form by the due date, either electronically or by mail.

Who needs RI RI-1065?

01

Entities operating in Rhode Island that are required to report income and pay tax as partnerships or limited liability companies (LLCs).

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a form 1065?

Who Needs to File Form 1065? All business partnerships must file Form 1065. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners.

What is a RI 1065V?

Form RI-1065V is a statement you send with your payment of any balance due on line 13 from Form RI-1065. Using Form RI-1065V allows us to more accurately and efficiently process your payment. We strongly encourage you to use Form RI- 1065V, but there is no penalty for not doing so.

What is a ri extension?

Extended Deadline with Rhode Island Tax Extension: Rhode Island offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Rhode Island Tax Extension Form: To request a Rhode Island extension, file Form RI-4868 by the original due date of your return.

Are LLCs taxed differently?

Your LLC profits are taxed at your individual income tax rates—just like when your LLC is taxed like a sole proprietorship. No double taxation and you can qualify for the pass-through deduction.

What is the IRS tax rate for LLC?

LLC self-employment taxes The total self-employment tax is 15.3%, and it's broken down into several parts: 12.4% social security tax on earnings up to $137,700. 2.9% Medicare tax on all earnings. 0.9% Medicare surtax on earnings over $200,000.

What is the business tax for Rhode Island?

Rhode Island Corporate Income tax is assessed at the rate of 7% of Rhode Island taxable income.

How are LLCs taxed in Rhode Island?

By default, single-member Rhode Island LLCs are taxed as Sole Proprietorships by the IRS, and by default, multi-member Rhode Island LLCs are taxed as Partnerships by the IRS.

Who must file RI 1065?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

Does a single member LLC need to file a 1065 in Rhode Island?

For a LLC with a single member taxed as a Subchapter C corporation or as a Subchapter S corporation, a profit or loss statement shall be an acceptable attachment to Form RI-1065. D. Any LLC disregarded for federal income tax purposes is still required to file the Form RI- 1065 with payment of the annual charge.

Does Rhode Island recognize single member LLC?

This includes a single-member LLC (SMLLC) and any LLC treated as a disregarded entity for federal tax purposes. Form RI-1065 shall be filed for any tax year beginning on or after January 1, 2012. For tax years prior to 2012, Form RI-1120S shall be filed to pay the annual charge.

What is Ri 1040V?

It is a statement you send with your payment of any balance due on line 15c of your Form RI-1040 or line 18c of your Form RI-1040NR. Using Form RI-1040V allows us to process your payment more accurately and efficiently. We strongly encourage you to use Form RI-1040V, but there is no penalty if you do not do so.

Does every LLC have to file a 1065?

Filing Requirements for an LLC Partnership The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

What is Ri employment registration number?

Contact Phone Numbers: RI Employer Tax Section 401-574-8700 (Option 1) - unemployment and TDI. RI Division of Taxation - 401-574-8829 - sales tax questions (Do you need a permit to make sales at retail?

Who must file RI-1065?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

Who must file Rhode Island tax return?

ing to Rhode Island Instructions for Form RI-1040: If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return.

Does a single member LLC need to file a 1065?

Note: Single-member LLCs may NOT file a partnership return. Most LLCs with more than one member file a partnership return, Form 1065. If you would rather file as a corporation, Form 8832 must be submitted.

How do LLCs avoid taxes?

As an LLC owner you're able to reduce taxes by: Claiming business tax deductions. Using self directed retirement accounts. Deducting health insurance premiums. Reducing taxable income with your LLC's losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send RI RI-1065 to be eSigned by others?

RI RI-1065 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the RI RI-1065 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your RI RI-1065 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out RI RI-1065 on an Android device?

Use the pdfFiller mobile app to complete your RI RI-1065 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is RI RI-1065?

RI RI-1065 is a tax form used by partnerships and limited liability companies (LLCs) in Rhode Island to report income, deductions, and taxes owed.

Who is required to file RI RI-1065?

Any partnership or LLC conducting business in Rhode Island, or earning income from Rhode Island sources, is required to file RI RI-1065.

How to fill out RI RI-1065?

To fill out RI RI-1065, include basic information about the business, report income and deductions, and allocate income or loss among partners or members. Ensure to follow the instructions provided by the Rhode Island Division of Taxation.

What is the purpose of RI RI-1065?

The purpose of RI RI-1065 is to provide the state of Rhode Island with a detailed account of the partnership's or LLC's financial activities for tax purposes.

What information must be reported on RI RI-1065?

Information that must be reported on RI RI-1065 includes the partnership's or LLC's gross income, deductions, credits, partners’ profits and losses, and any other pertinent financial information.

Fill out your RI RI-1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI-1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.