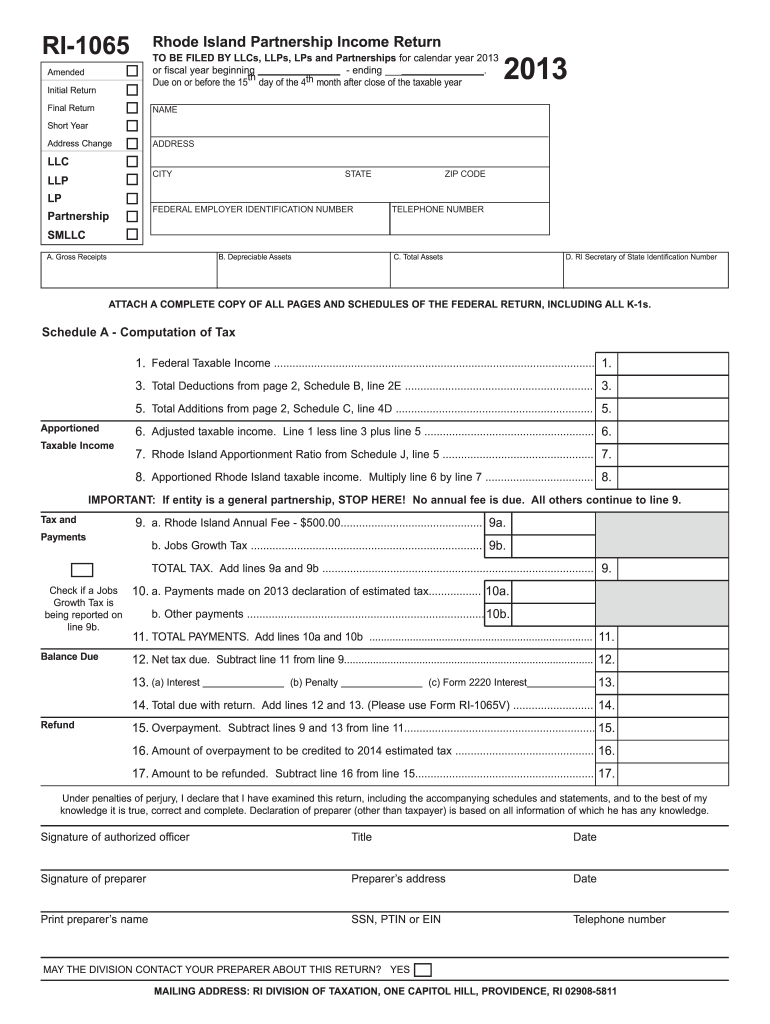

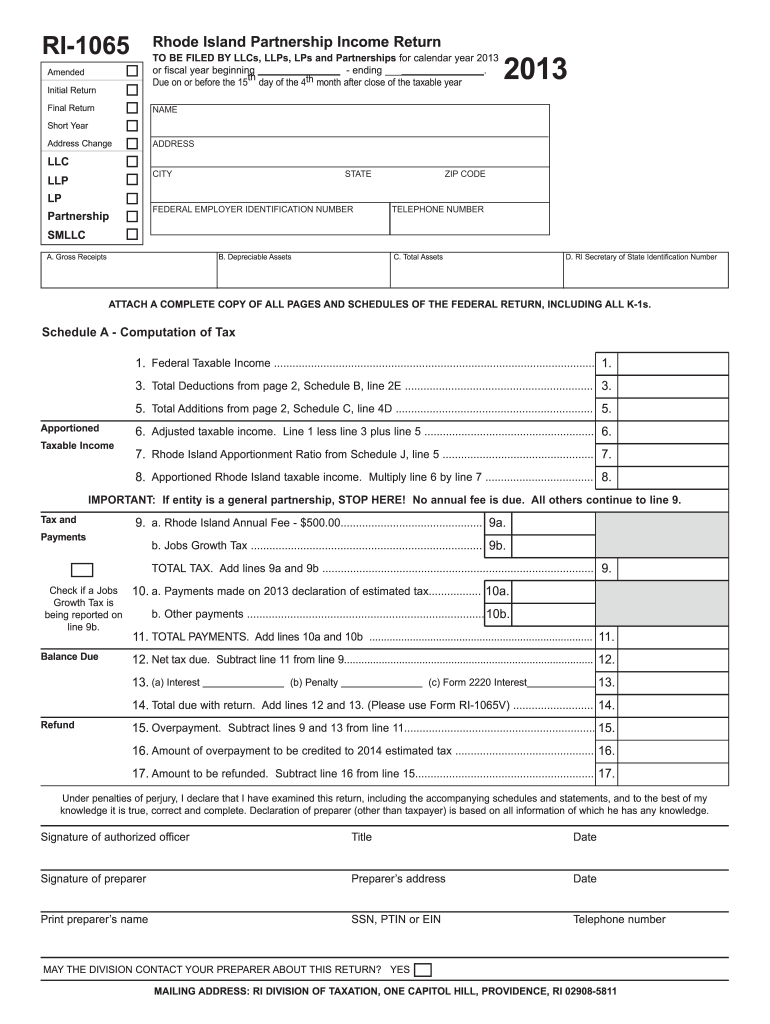

RI RI-1065 2013 free printable template

Show details

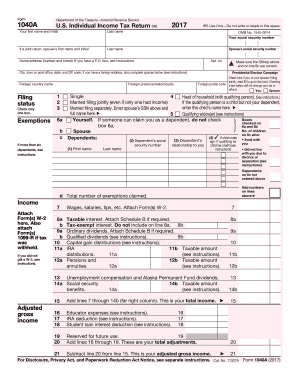

Search RI.gov: ... UPDATED 11/07/2016; MEF updates — 1040, 1065 and 1120 — UPDATED 09/22/2016 ... All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format; To have ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI-1065

Edit your RI RI-1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI-1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI RI-1065 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI RI-1065. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI-1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI-1065

How to fill out RI RI-1065

01

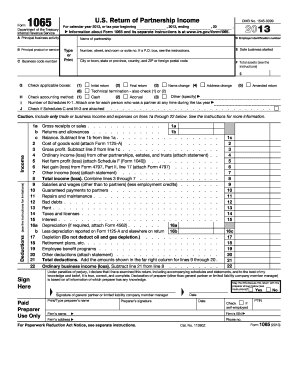

Obtain the RI RI-1065 form from the Rhode Island Division of Taxation website or your local tax office.

02

Fill in the basic information about the partnership, including its name, address, and federal employer identification number (EIN).

03

Indicate the type of partnership on the form (e.g., general partnership, limited partnership, limited liability company).

04

Report the income, deductions, and credits for the partnership for the tax year.

05

Provide the partner information, including names, addresses, and the share of income and deductions for each partner.

06

Ensure all calculations are correct, and double-check the figures reported on the form.

07

Sign and date the form, authorizing the submission.

08

Submit the completed form to the Rhode Island Division of Taxation by the deadline.

Who needs RI RI-1065?

01

Partnerships operating in Rhode Island that need to report their income, deductions, and credits.

02

Limited liability companies (LLCs) taxed as partnerships.

03

Partners in a partnership who need to report their share of income on their individual tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is Rhode Island Form RI 1040C NE?

Purpose: Form RI-1040C-NE, Rhode Island Nonresident Income Tax Agreement/Election to be Included in a Composite Return, is used to substan- tiate the qualified electing nonresident partner, shareholder, member or ben- eficiary's election to be included on Form RI-1040C, Rhode Island Composite Income Tax Return.

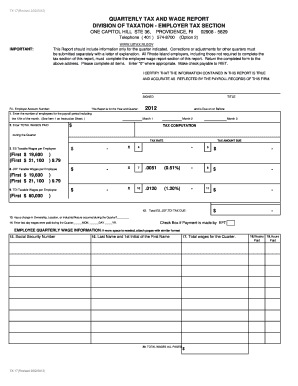

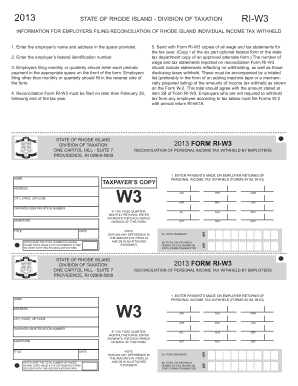

Where do I mail my RI COI form?

RI Division of Taxation Change of Address The form should be mailed to: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806. You can also submit your Rhode Island change of address through the Tax Portal by selecting “service request.”

How do I contact the RI Division of Taxation?

If you have any questions, please call our customer service team at (401) 574-8484.

Where do I mail my RI 1065?

For all June 30 fiscal year end filers, Forms RI-1065 and RI-1120S are due on or before the fifteenth day of the third month following the close of the taxable year (September 15). Returns must be filed with: Rhode Island Division of Taxation One Capitol Hill, Suite 9 Providence, RI 02908-5811.

Does Rhode Island have a state tax form?

Starting with the return for the period ending January 2023 [filed in February 2023], monthly and quarterly Sales and Use Tax filers will begin using the RI Division of Taxation's new sales form - Form RI-STR. Click for Form RI-STR, the form instructions and the Advisory issued regarding the new form.

Does Rhode Island have corporate tax?

Rhode Island Corporate Income tax is assessed at the rate of 7% of Rhode Island taxable income. To calculate the Rhode Island taxable income, the statute starts with Federal taxable income.

What is the sales tax for the state of RI division of Taxation?

The sales tax is imposed upon the retailer at the rate of 7% of the gross receipts from taxable sales. In addition to the sales tax, there is also a 6% hotel tax on the rental of rooms in hotels, motels or lodging houses.

What is the tax rate for an LLC in Rhode Island?

In Rhode Island, the corporate tax generally is a flat 7% of net income with a $400 minimum tax. Use the state's corporation income tax return (Form RI-1120C) to pay this tax. For more details, check Nolo's article, 50-State Guide to Business Income Tax, or the DOT website.

Where do I file my RI-1065?

For all June 30 fiscal year end filers, Forms RI-1065 and RI-1120S are due on or before the fifteenth day of the third month following the close of the taxable year (September 15). Returns must be filed with: Rhode Island Division of Taxation One Capitol Hill, Suite 9 Providence, RI 02908-5811.

What is Rhode Island corporate state income tax?

Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes. Rhode Island's tax system ranks 42nd overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my RI RI-1065 directly from Gmail?

RI RI-1065 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify RI RI-1065 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including RI RI-1065. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find RI RI-1065?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the RI RI-1065 in seconds. Open it immediately and begin modifying it with powerful editing options.

What is RI RI-1065?

RI RI-1065 is a tax form used by partnerships and limited liability companies in Rhode Island to report income, deductions, and credits.

Who is required to file RI RI-1065?

Partnerships and limited liability companies doing business in Rhode Island, as well as those that derive income from Rhode Island sources, are required to file RI RI-1065.

How to fill out RI RI-1065?

To fill out RI RI-1065, the entity must gather necessary financial information, complete the form by providing income, deductions, and credits, and ensure all partner information is included before submitting it to the Rhode Island Division of Taxation.

What is the purpose of RI RI-1065?

The purpose of RI RI-1065 is to report the financial activity of partnerships and LLCs for tax purposes to the state of Rhode Island.

What information must be reported on RI RI-1065?

RI RI-1065 must report information such as total income, deductions, credits, the names and addresses of partners, and their respective share of income and losses.

Fill out your RI RI-1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI-1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.