RI RI-1065 2021 free printable template

Show details

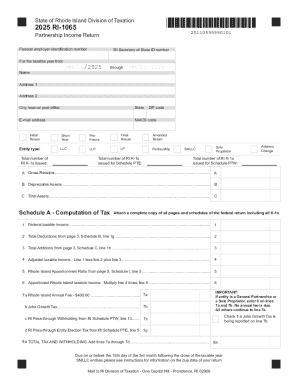

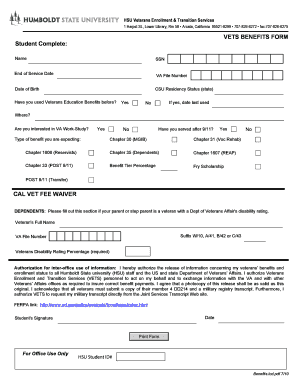

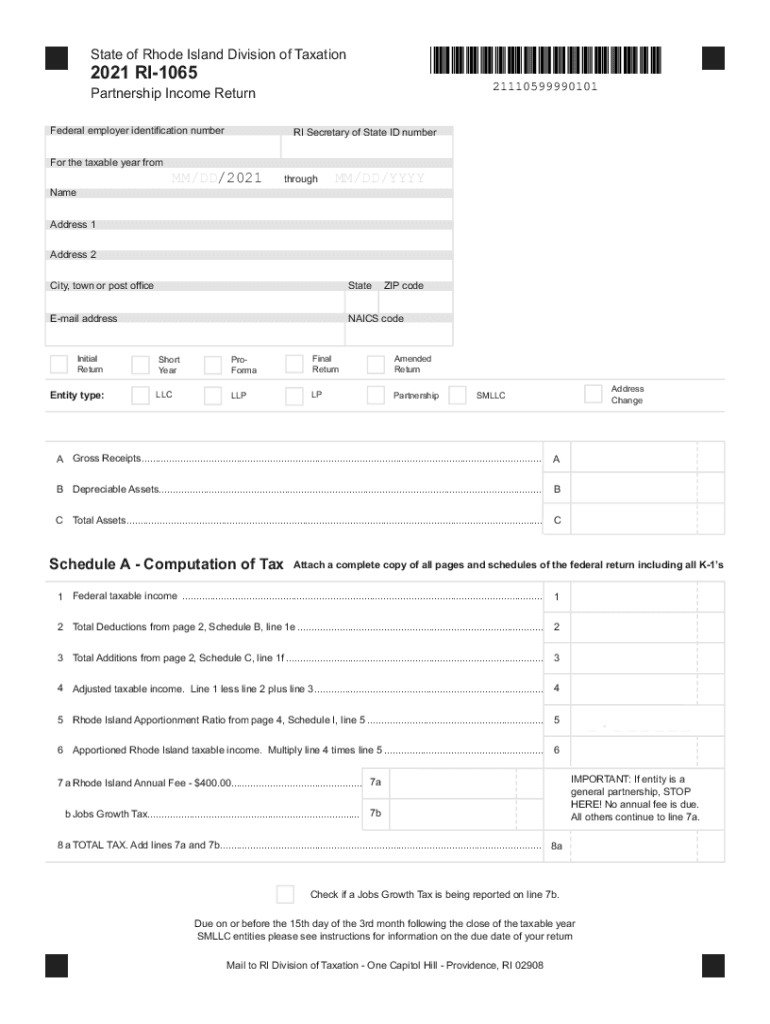

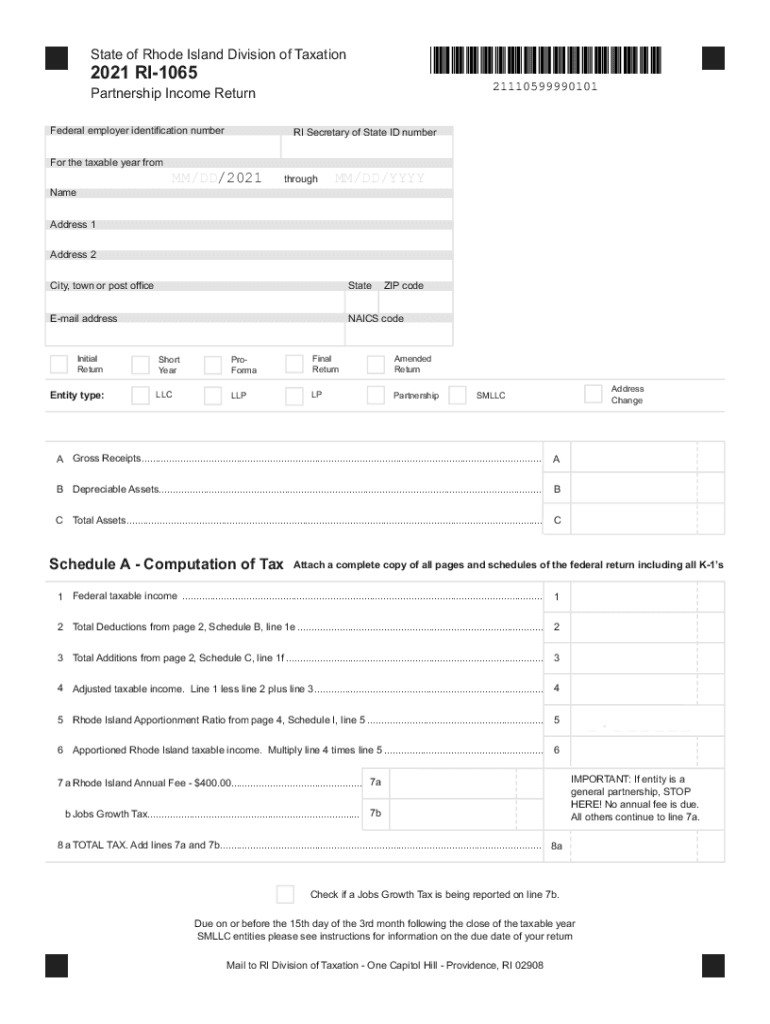

State of Rhode Island Division of Taxation2021 RI1065

21110599990101Partnership Income Return

Federal employer identification numberRISecretary of State ID number the taxable year Fromm/DD/2021throughMM/DD/YYYYName

Address

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI-1065

Edit your RI RI-1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI-1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI RI-1065 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit RI RI-1065. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI-1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI-1065

How to fill out RI RI-1065

01

Gather all necessary financial documents and information relevant to your business.

02

Begin by entering your business name, address, and federal employer identification number (EIN) at the top of the form.

03

Fill out the income section by reporting all sources of revenue generated by the business.

04

Deduct allowable business expenses in the designated section to determine your net income.

05

Report the share of income/loss for each partner in the appropriate sections.

06

Complete the tax credits and payments section if applicable, ensuring all credits are accurately calculated.

07

Review all information for accuracy before submitting.

08

Sign and date the form by an authorized partner or representative.

Who needs RI RI-1065?

01

Businesses operating as partnerships in Rhode Island.

02

Partners in a partnership who need to report income and losses to the state.

03

Tax professionals preparing partnership tax returns for clients in Rhode Island.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a form 1065?

Who Needs to File Form 1065? All business partnerships must file Form 1065. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners.

What is a RI 1065V?

Form RI-1065V is a statement you send with your payment of any balance due on line 13 from Form RI-1065. Using Form RI-1065V allows us to more accurately and efficiently process your payment. We strongly encourage you to use Form RI- 1065V, but there is no penalty for not doing so.

What is a ri extension?

Extended Deadline with Rhode Island Tax Extension: Rhode Island offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Rhode Island Tax Extension Form: To request a Rhode Island extension, file Form RI-4868 by the original due date of your return.

Are LLCs taxed differently?

Your LLC profits are taxed at your individual income tax rates—just like when your LLC is taxed like a sole proprietorship. No double taxation and you can qualify for the pass-through deduction.

What is the IRS tax rate for LLC?

LLC self-employment taxes The total self-employment tax is 15.3%, and it's broken down into several parts: 12.4% social security tax on earnings up to $137,700. 2.9% Medicare tax on all earnings. 0.9% Medicare surtax on earnings over $200,000.

What is the business tax for Rhode Island?

Rhode Island Corporate Income tax is assessed at the rate of 7% of Rhode Island taxable income.

How are LLCs taxed in Rhode Island?

By default, single-member Rhode Island LLCs are taxed as Sole Proprietorships by the IRS, and by default, multi-member Rhode Island LLCs are taxed as Partnerships by the IRS.

Who must file RI 1065?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

Does a single member LLC need to file a 1065 in Rhode Island?

For a LLC with a single member taxed as a Subchapter C corporation or as a Subchapter S corporation, a profit or loss statement shall be an acceptable attachment to Form RI-1065. D. Any LLC disregarded for federal income tax purposes is still required to file the Form RI- 1065 with payment of the annual charge.

Does Rhode Island recognize single member LLC?

This includes a single-member LLC (SMLLC) and any LLC treated as a disregarded entity for federal tax purposes. Form RI-1065 shall be filed for any tax year beginning on or after January 1, 2012. For tax years prior to 2012, Form RI-1120S shall be filed to pay the annual charge.

What is Ri 1040V?

It is a statement you send with your payment of any balance due on line 15c of your Form RI-1040 or line 18c of your Form RI-1040NR. Using Form RI-1040V allows us to process your payment more accurately and efficiently. We strongly encourage you to use Form RI-1040V, but there is no penalty if you do not do so.

Does every LLC have to file a 1065?

Filing Requirements for an LLC Partnership The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

What is Ri employment registration number?

Contact Phone Numbers: RI Employer Tax Section 401-574-8700 (Option 1) - unemployment and TDI. RI Division of Taxation - 401-574-8829 - sales tax questions (Do you need a permit to make sales at retail?

Who must file RI-1065?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

Who must file Rhode Island tax return?

ing to Rhode Island Instructions for Form RI-1040: If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return.

Does a single member LLC need to file a 1065?

Note: Single-member LLCs may NOT file a partnership return. Most LLCs with more than one member file a partnership return, Form 1065. If you would rather file as a corporation, Form 8832 must be submitted.

How do LLCs avoid taxes?

As an LLC owner you're able to reduce taxes by: Claiming business tax deductions. Using self directed retirement accounts. Deducting health insurance premiums. Reducing taxable income with your LLC's losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit RI RI-1065 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including RI RI-1065, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send RI RI-1065 to be eSigned by others?

Once your RI RI-1065 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the RI RI-1065 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your RI RI-1065 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is RI RI-1065?

RI RI-1065 is the Rhode Island Partnership Return of Income form, used by partnerships to report income, deductions, and credits.

Who is required to file RI RI-1065?

Partnerships that operate in Rhode Island or derive income from Rhode Island sources are required to file RI RI-1065.

How to fill out RI RI-1065?

To fill out RI RI-1065, taxpayers must provide information on the partnership's income, deductions, partner allocations, and other relevant financial details as specified in the instructions.

What is the purpose of RI RI-1065?

The purpose of RI RI-1065 is to report the income and expenses of the partnership to the state of Rhode Island for tax purposes.

What information must be reported on RI RI-1065?

RI RI-1065 must report the partnership's total income, deductions, credits, partner information, and any other financial data required by the form.

Fill out your RI RI-1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI-1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.