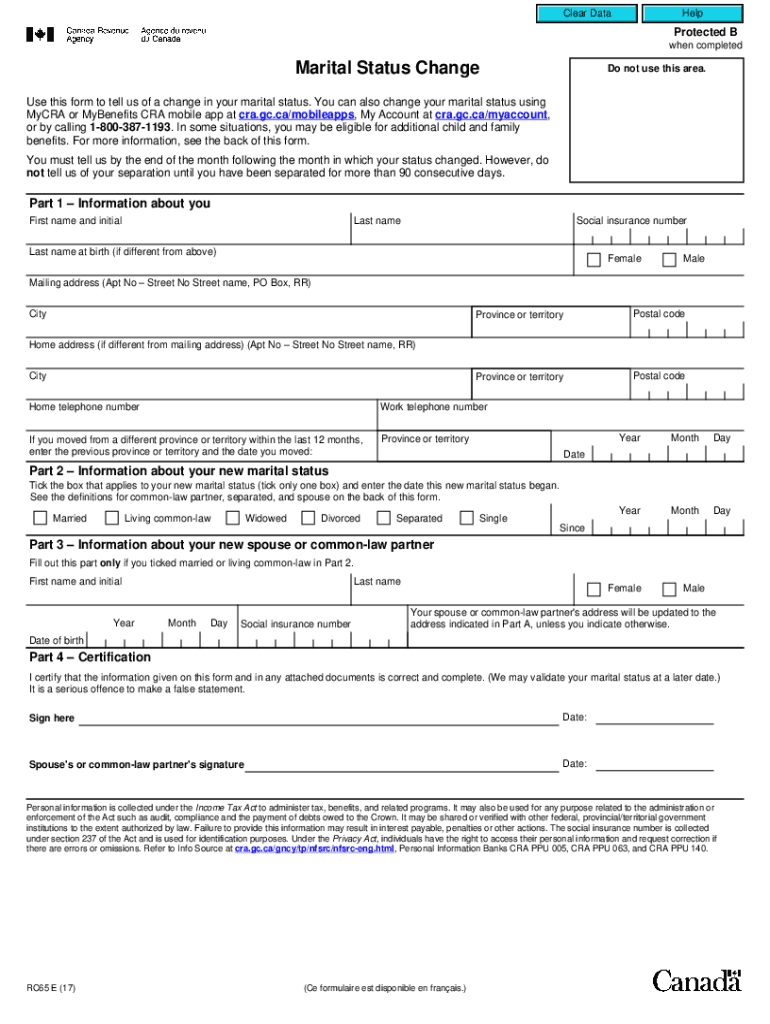

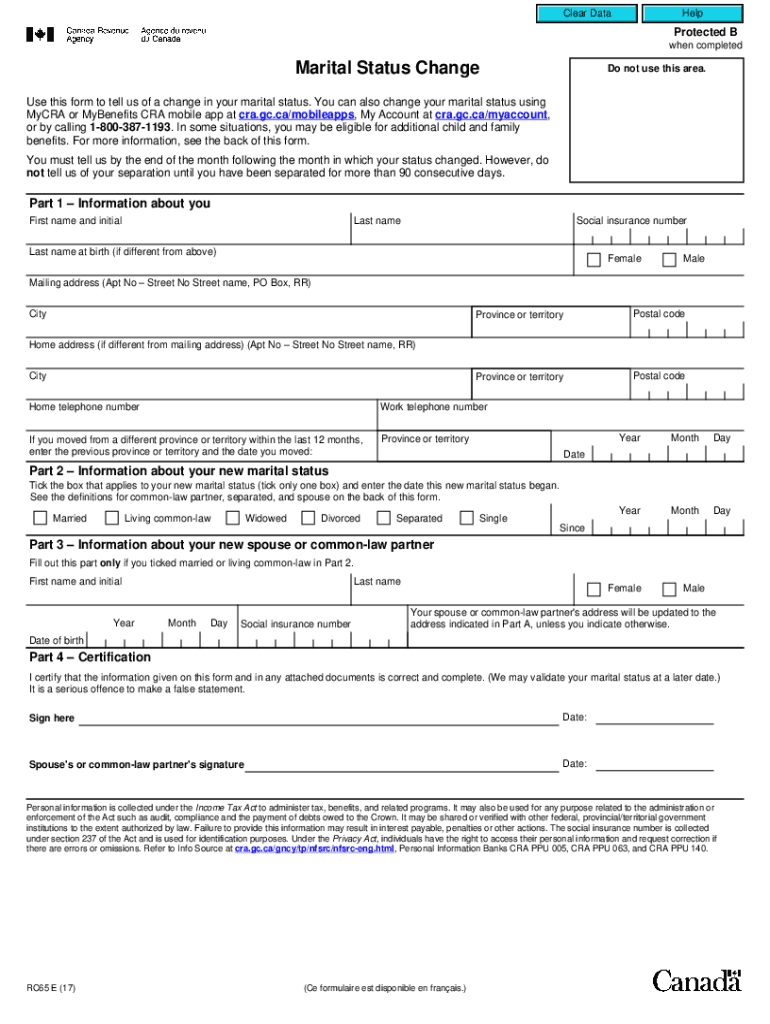

Canada RC65 E 2017 free printable template

Show details

Clear DataHelpProtected B

when completedMarital Status Changed not use this area. Use this form to tell us of a change in your marital status. You can also change your marital status using

Myra or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC65 E

Edit your Canada RC65 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC65 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC65 E online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada RC65 E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC65 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC65 E

How to fill out Canada RC65 E

01

Obtain the Canada RC65 E form from the Canada Revenue Agency (CRA) website or your nearest CRA office.

02

Fill out your personal information in the designated sections, including your name, address, and date of birth.

03

Provide your Social Insurance Number (SIN) accurately.

04

Indicate the period for which you are applying for the benefits.

05

Choose the types of benefits you are applying for by checking the appropriate boxes.

06

Complete any additional information required about your family situation, such as marital status and number of dependents.

07

Review your completed form to ensure all information is accurate and all necessary fields are filled out.

08

Sign and date the form at the bottom before submission.

09

Submit the form either online through the CRA My Account service or send it by mail to the address specified on the form.

Who needs Canada RC65 E?

01

Individuals or families who are applying for benefits or credits related to their taxes in Canada.

02

New parents seeking parental benefits.

03

Individuals who want to claim a special tax credit.

04

Those transitioning into or out of a specific benefit program.

Fill

form

: Try Risk Free

People Also Ask about

How can I change my marital status in CIC?

call 1-800-387-1193. send us a completed Form RC65, Marital Status Change.

Do you have to declare common-law in Canada?

In Canada, if you meet the definition of common-law, you must disclose that on your tax return. You are also considered married for tax purposes, so file ingly.

Do I need to inform IRCC if I got married?

Yes, it is required that you inform IRCC about your marriage. Unfortunately, this is not optional and is something that you must do ing to current Canadian immigration rules. Your admissibility depends on your spouse's admissibility as well.

How can I prove my marital status in Canada?

Marital status mortgage papers or your property tax bill(s) lease agreement, rent receipts or letter from the landlord. recent utility bill(s) (gas, electricity, cable, telephone) insurance policies. registered retirement savings or employment pension plans. health care coverage.

How do I file taxes when I separate Canada?

You must claim your status as “separated” on your tax return. If you were not separated by December 31st of that tax year then you will file as married and then file as separated on the next tax year. Separation impacts some of your deductions. You can't claim mortgage interest and property taxes separately.

When can I change my marital status?

You must tell the Canada Revenue Agency (CRA) about your new marital status by the end of the following month after your status changed. For example, if your status changed in March, you must tell us by the end of April.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada RC65 E?

With pdfFiller, the editing process is straightforward. Open your Canada RC65 E in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the Canada RC65 E form on my smartphone?

Use the pdfFiller mobile app to complete and sign Canada RC65 E on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit Canada RC65 E on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Canada RC65 E on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is Canada RC65 E?

Canada RC65 E is a form used by individuals to apply for and receive retroactive benefits or a reconsideration of their benefits under the Canada Child Benefit program.

Who is required to file Canada RC65 E?

Individuals who believe they are eligible for retroactive Canada Child Benefit payments or those who wish to challenge the amount of benefits they received are required to file Canada RC65 E.

How to fill out Canada RC65 E?

To fill out Canada RC65 E, individuals need to provide personal information, details regarding their income, periods of eligibility, and any other relevant information that supports their claim for retroactive benefits.

What is the purpose of Canada RC65 E?

The purpose of Canada RC65 E is to assist individuals in claiming retroactive payments for the Canada Child Benefit and to facilitate the review of previously determined amounts.

What information must be reported on Canada RC65 E?

The information that must be reported on Canada RC65 E includes personal identification details, dependent children's information, adjusted family net income, and any changes in circumstances that may affect eligibility.

Fill out your Canada RC65 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc65 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.