Canada RC65 E 2021 free printable template

Show details

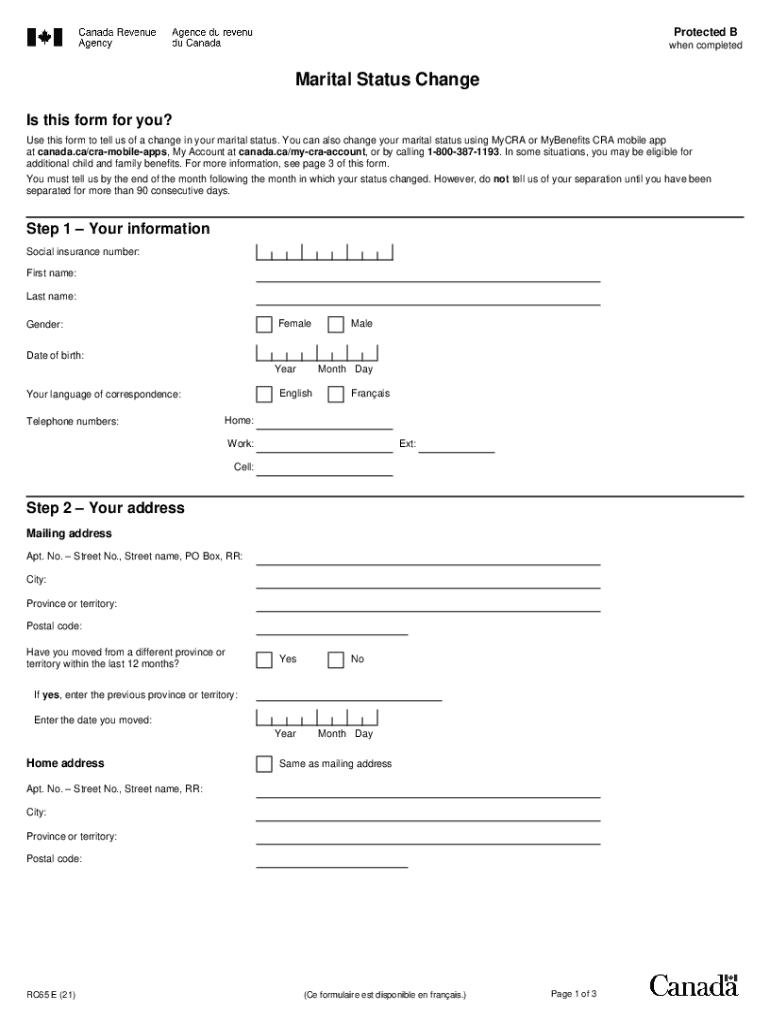

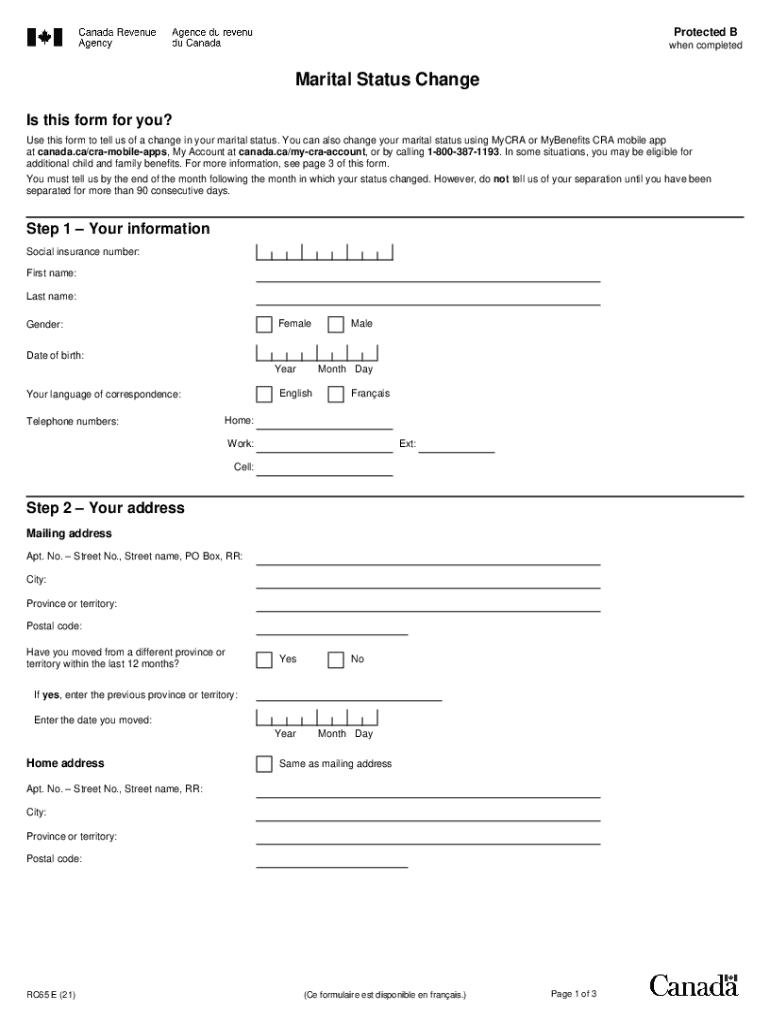

Clear Data Help Protected B Marital Status Change when completed Do not use this area Use this form to tell us of a change in your marital status. You can also change your marital status online at www.cra*gc*ca/myaccount. In some situations you may be eligible for additional Canada child tax benefit CCTB or goods and services tax/harmonized sales tax GST/HST credit payments. For more information see the back of this form* You should tell us as soon as possible after your marital status...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC65 E

Edit your Canada RC65 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC65 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada RC65 E online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada RC65 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC65 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC65 E

How to fill out Canada RC65 E

01

Gather necessary personal information such as your Social Insurance Number (SIN) and tax information.

02

Obtain the Canada RC65 E form from the Canada Revenue Agency (CRA) website or your local CRA office.

03

Begin by filling out your personal details at the top of the form, including your name, address, and postal code.

04

Specify the type of benefit you are applying for by checking the appropriate box.

05

Provide any required information regarding your spouse or common-law partner, if applicable.

06

Review the eligibility criteria and ensure that you meet them before proceeding.

07

Complete any additional sections that apply to your situation, such as income details.

08

Double-check all entries for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the completed form either electronically or by mailing it to the address specified in the instructions.

Who needs Canada RC65 E?

01

Individuals who are applying for the Canada child benefit or any related benefits.

02

Parents or guardians of children under the age of 18 who are seeking financial assistance.

03

Those who have recently had a change in family status, such as marriage, separation, or the birth of a child.

Fill

form

: Try Risk Free

People Also Ask about

How can I change my marital status in CIC?

call 1-800-387-1193. send us a completed Form RC65, Marital Status Change.

Do you have to declare common-law in Canada?

In Canada, if you meet the definition of common-law, you must disclose that on your tax return. You are also considered married for tax purposes, so file ingly.

Do I need to inform IRCC if I got married?

Yes, it is required that you inform IRCC about your marriage. Unfortunately, this is not optional and is something that you must do ing to current Canadian immigration rules. Your admissibility depends on your spouse's admissibility as well.

How can I prove my marital status in Canada?

Marital status mortgage papers or your property tax bill(s) lease agreement, rent receipts or letter from the landlord. recent utility bill(s) (gas, electricity, cable, telephone) insurance policies. registered retirement savings or employment pension plans. health care coverage.

How do I file taxes when I separate Canada?

You must claim your status as “separated” on your tax return. If you were not separated by December 31st of that tax year then you will file as married and then file as separated on the next tax year. Separation impacts some of your deductions. You can't claim mortgage interest and property taxes separately.

When can I change my marital status?

You must tell the Canada Revenue Agency (CRA) about your new marital status by the end of the following month after your status changed. For example, if your status changed in March, you must tell us by the end of April.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada RC65 E directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your Canada RC65 E and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out Canada RC65 E using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada RC65 E and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit Canada RC65 E on an iOS device?

You certainly can. You can quickly edit, distribute, and sign Canada RC65 E on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada RC65 E?

Canada RC65 E is a form used by individuals or organizations to request a reassessment of their tax returns from the Canada Revenue Agency (CRA) or to provide updated information.

Who is required to file Canada RC65 E?

Taxpayers who need to correct or update their tax information, such as those who have received tax assessments or want to claim additional deductions or benefits, are required to file the Canada RC65 E.

How to fill out Canada RC65 E?

To fill out Canada RC65 E, you should provide your personal information, specify the tax year you are addressing, explain the reasons for the reassessment request, and include relevant documents or information that supports your claim.

What is the purpose of Canada RC65 E?

The purpose of Canada RC65 E is to facilitate communication with the CRA regarding necessary corrections or updates to a taxpayer's tax records, ensuring accuracy and compliance in taxation.

What information must be reported on Canada RC65 E?

The information that must be reported on Canada RC65 E includes the taxpayer's identification details, the specific tax year in question, an explanation of the changes or corrections needed, and any supporting documentation for the request.

Fill out your Canada RC65 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc65 E is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.