Canada RC65 E 2022 free printable template

Show details

Protected B

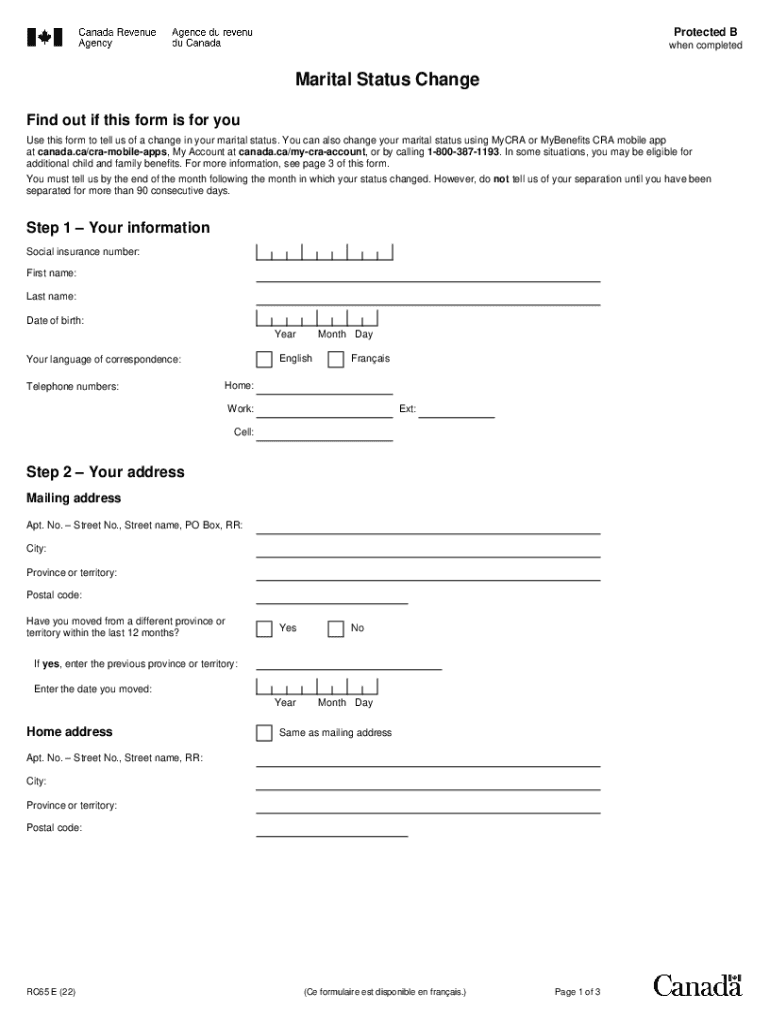

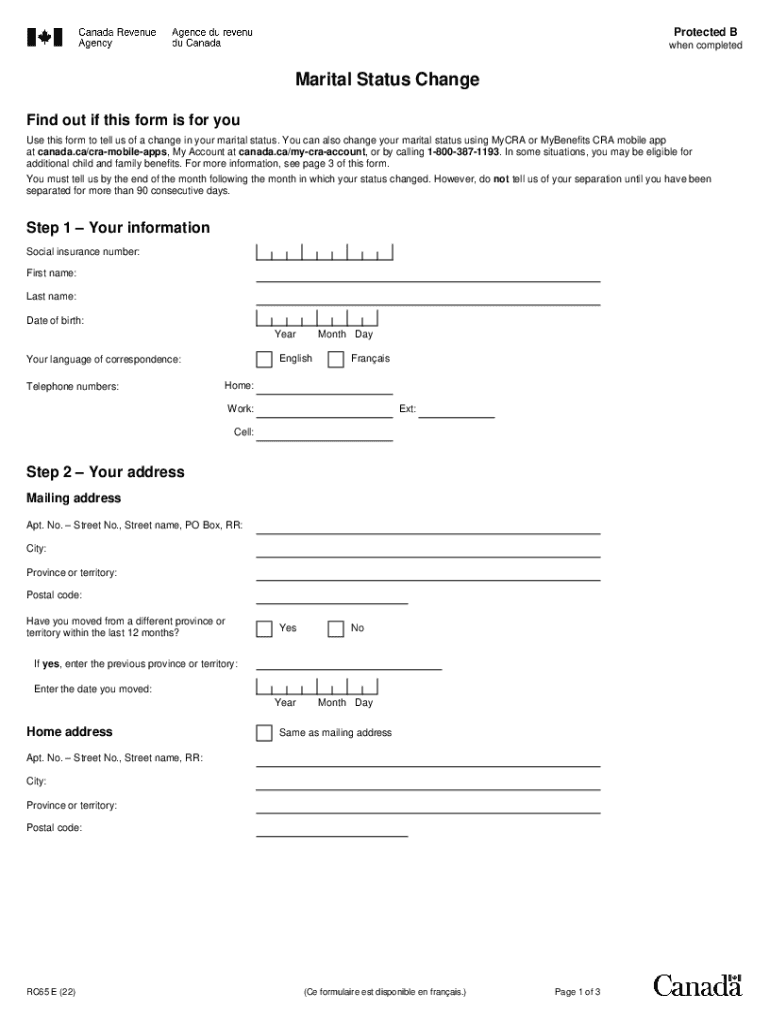

when completedMarital Status Change

Find out if this form is for you

Use this form to tell us of a change in your marital status. You can also change your marital status using Myra or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ca rc65 modify form

Edit your rc65 marital status change form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form marital status change form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cra form rc65 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit canada marital status change form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC65 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rc65 form

How to fill out Canada RC65 E

01

Obtain the Canada RC65 E form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

Fill in your personal information, including your name, address, and social insurance number (SIN).

03

Indicate the type of adjustment you are requesting, whether it's for a previous tax return or a change in personal circumstances.

04

Provide details regarding the specific income amounts or deductions that need to be adjusted.

05

Attach any relevant documentation that supports your adjustment request.

06

Review the completed form to ensure all information is accurate.

07

Submit the form to the appropriate CRA office, either by mail or through the CRA's online services.

Who needs Canada RC65 E?

01

Individuals who have previously filed a tax return in Canada and need to make an adjustment due to errors or changes in their personal situation.

02

Individuals seeking to claim additional deductions or credits that were not included in their original tax return.

Fill

rc65

: Try Risk Free

People Also Ask about canada rc65 fill

How can I change my marital status in CIC?

call 1-800-387-1193. send us a completed Form RC65, Marital Status Change.

Do you have to declare common-law in Canada?

In Canada, if you meet the definition of common-law, you must disclose that on your tax return. You are also considered married for tax purposes, so file ingly.

Do I need to inform IRCC if I got married?

Yes, it is required that you inform IRCC about your marriage. Unfortunately, this is not optional and is something that you must do ing to current Canadian immigration rules. Your admissibility depends on your spouse's admissibility as well.

How can I prove my marital status in Canada?

Marital status mortgage papers or your property tax bill(s) lease agreement, rent receipts or letter from the landlord. recent utility bill(s) (gas, electricity, cable, telephone) insurance policies. registered retirement savings or employment pension plans. health care coverage.

How do I file taxes when I separate Canada?

You must claim your status as “separated” on your tax return. If you were not separated by December 31st of that tax year then you will file as married and then file as separated on the next tax year. Separation impacts some of your deductions. You can't claim mortgage interest and property taxes separately.

When can I change my marital status?

You must tell the Canada Revenue Agency (CRA) about your new marital status by the end of the following month after your status changed. For example, if your status changed in March, you must tell us by the end of April.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit canada marital status change fillable from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your canada rc65 get into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in rc65 cra without leaving Chrome?

canada form marital status change printable can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the canada rc65 document electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your canada rc65 print in seconds.

What is Canada RC65 E?

Canada RC65 E is a form used in Canada for the purpose of reporting the amounts paid or payable to a person for the year related to registered retirement savings plans (RRSPs) or pooled registered pension plans (PRPPs).

Who is required to file Canada RC65 E?

Financial institutions, pension plan administrators, and others who make payments related to RRSPs or PRPPs are required to file Canada RC65 E.

How to fill out Canada RC65 E?

To fill out Canada RC65 E, the filer needs to provide information such as the issuer's name, address, the recipient's details, payment amounts, and any applicable deductions.

What is the purpose of Canada RC65 E?

The purpose of Canada RC65 E is to ensure that income from RRSPs and PRPPs is properly reported to the Canada Revenue Agency (CRA) for tax purposes.

What information must be reported on Canada RC65 E?

The information that must be reported on Canada RC65 E includes the recipient's name and address, the total amounts paid, tax withheld, and any other relevant details regarding the payments made.

Fill out your Canada RC65 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Marital Status Change Form is not the form you're looking for?Search for another form here.

Keywords relevant to canada form marital status change trial

Related to canada form marital status change download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.