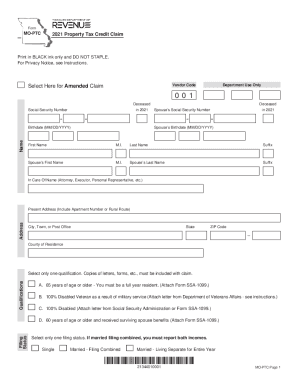

MO MO-CRP 2021 free printable template

Show details

Reset Footprint Hormone Form MO CRP must be provided for each rental location in which you resided. Failure to provide landlord information will result in denial or delay of your claim. FormMOCRP2021

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-CRP

Edit your MO MO-CRP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-CRP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO MO-CRP online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO MO-CRP. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-CRP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-CRP

How to fill out MO MO-CRP

01

Gather your financial documents such as income statements, tax returns, and any relevant deductions.

02

Obtain the MO MO-CRP form from the Missouri Department of Revenue's website or your local tax office.

03

Fill out your personal information in the designated sections, including your name, address, and Social Security number.

04

Input your income details accurately, including wages, investment income, and any other revenue sources.

05

List any deductions or credits you're claiming, ensuring you have proper documentation to support them.

06

Review all entries for accuracy and completeness.

07

Sign and date the form at the bottom once you have confirmed all information is correct.

08

Submit the completed form to the appropriate tax authority as per the instructions provided.

Who needs MO MO-CRP?

01

Individuals or businesses in Missouri who are required to report and pay a personal income tax.

02

Taxpayers who are claiming specific credits or deductions as outlined in the MO MO-CRP instructions.

03

Residents of Missouri seeking to benefit from potential tax reductions based on their financial situation.

Fill

form

: Try Risk Free

People Also Ask about

Is there a Missouri 1040 short form?

Form MO-1040 Missouri Individual Income Tax Long Form. Form MO-1040A Missouri Individual Income Tax Short Form.

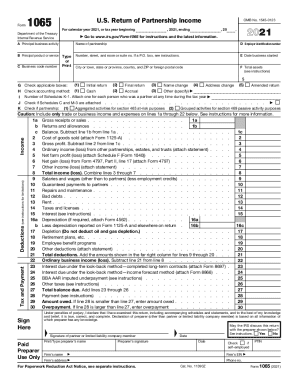

Does the 1040 short form still exist?

In the past, if you had a simple tax return to prepare, you likely filed your return with IRS Form 1040EZ. This form covered a broad range of taxpayers. However, filing with Form 1040EZ is no longer an option. This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation.

Does Missouri use 1040 or 1040A?

The Missouri income tax form is pretty easy to fill out once you have calculated your federal taxes, because the Missouri form uses numbers from the federal 1040. In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A.

What is a 1040 mo?

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any individual taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form (Form MO-1040A).

What is a CRP form in Minnesota?

Certificate of Rent Paid (CRP) Requirements If you own or manage a rental property and rent living space to someone, you must provide a CRP to each renter if either of these are true: Property tax was payable in 2022 on the property. The property is tax-exempt, but you made payments in lieu of property taxes.

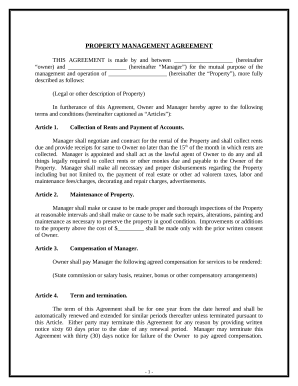

What is the Missouri PTC refund?

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Do I have to file CRP in MN?

You must include all CRPs with your return. The CRP shows how much rent you paid during the previous year. You must include all CRPs when applying for your Renter's Property Tax Refund. Your landlord must give you a completed CRP by January 31.

Where do I file my CRP in MN?

You can get it from a library, call (651) 296-3781, or write to: MN Tax Forms, Mail Station 1421, St. Paul, MN 55146-1421. You can also get all forms and information to file online at .revenue.state.mn.us.

How do I declare my personal property tax in Missouri?

In-Person Complete the Tangible Personal Property Tax Return form mailed to you and update as needed, or. If a form was not mailed to you or you do not have the mailed form download the appropriate blank form(s) - individual or business and update as needed. Bring the forms in person to:

How do I pay my car property tax in Missouri?

Ways to Pay Pay online using e-check ($2.00 fee) or debit/credit card (fee of about 2.5 percent of the total amount due). By mail using check, money order or cashier's check. By phone using e-check ($2.00 fee) or debit/credit card (fee of about 2.5 percent of the total amount due).

How do I file a CRP in MN?

If your landlord does not provide a CRP by March 1, 2021, call the Minnesota Department of Revenue at 651-296-3781 or 1-800-652-9094. To fill out the Certificate of Rent Paid information in the TaxAct program: From within your TaxAct return (Online or Desktop), click State, then click Minnesota (or MN).

How do I file my personal property taxes in Missouri?

In-Person Complete the Tangible Personal Property Tax Return form mailed to you and update as needed, or. If a form was not mailed to you or you do not have the mailed form download the appropriate blank form(s) - individual or business and update as needed. Bring the forms in person to:

What is a mo cr form?

Form MO-CR - 2021 Credit for Income Taxes Paid To Other States or Political Subdivisions.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MO MO-CRP without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your MO MO-CRP into a dynamic fillable form that you can manage and eSign from anywhere.

How can I edit MO MO-CRP on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MO MO-CRP right away.

How do I fill out MO MO-CRP on an Android device?

Use the pdfFiller Android app to finish your MO MO-CRP and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is MO MO-CRP?

MO MO-CRP is the Missouri Corporate Reporting Permit, a form used by corporations to report certain information to the state of Missouri.

Who is required to file MO MO-CRP?

Any corporation doing business in Missouri or formed under Missouri law is required to file the MO MO-CRP.

How to fill out MO MO-CRP?

To fill out the MO MO-CRP, provide the necessary corporate information such as the corporation name, address, and details of the registered agent, and submit the form according to state guidelines.

What is the purpose of MO MO-CRP?

The purpose of the MO MO-CRP is to ensure that corporations are in compliance with Missouri state laws and to maintain updated records for regulatory purposes.

What information must be reported on MO MO-CRP?

The information required on the MO MO-CRP includes the corporation's name, business address, registered agent details, and the nature of the business activities.

Fill out your MO MO-CRP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-CRP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.