NY DTF IT-201 2021 free printable template

Show details

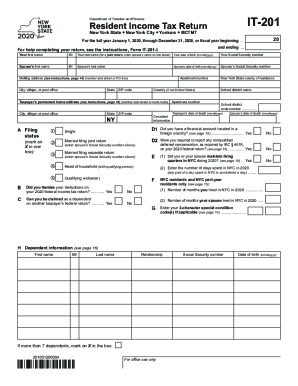

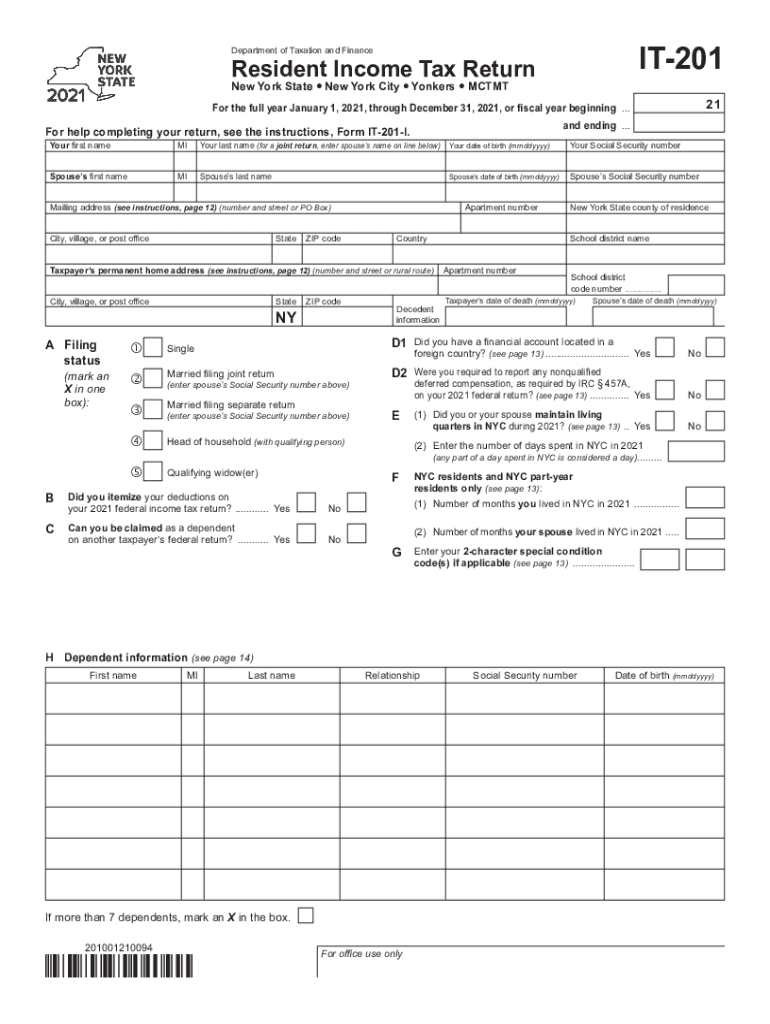

IT201Department of Taxation and FinanceResident Income Tax Return

New York State New York City Yonkers MCTMT21For the full year January 1, 2021, through December 31, 2021, or fiscal year beginning

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

Instructions and Help about NY DTF IT-201

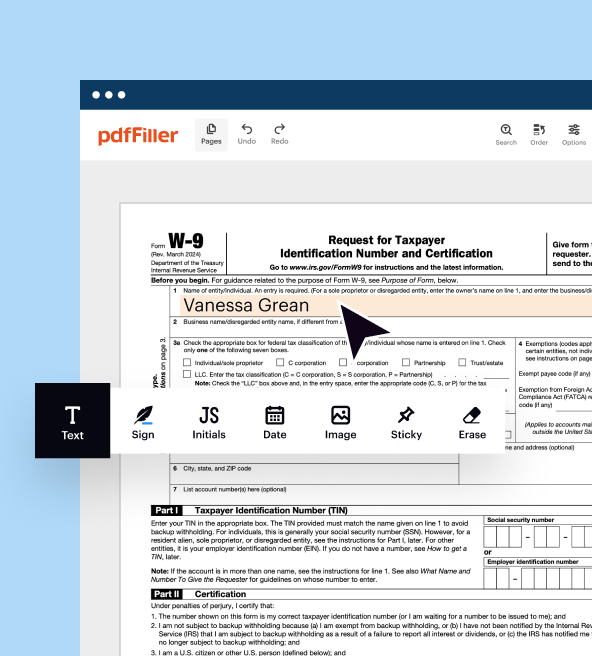

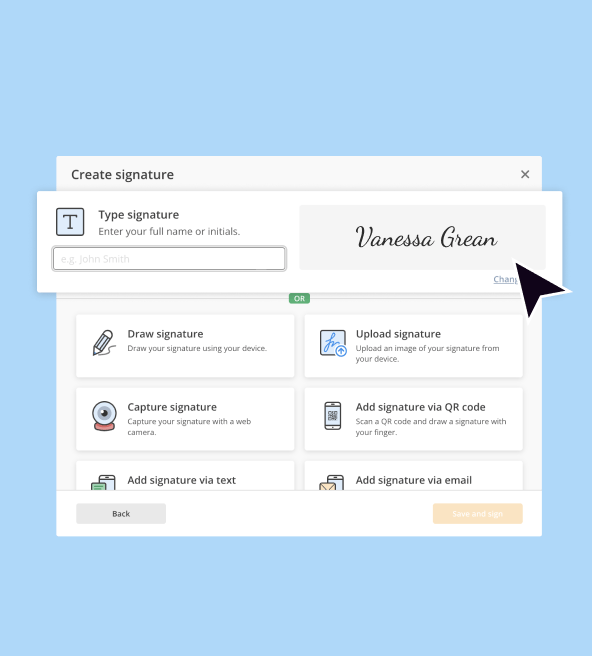

How to edit NY DTF IT-201

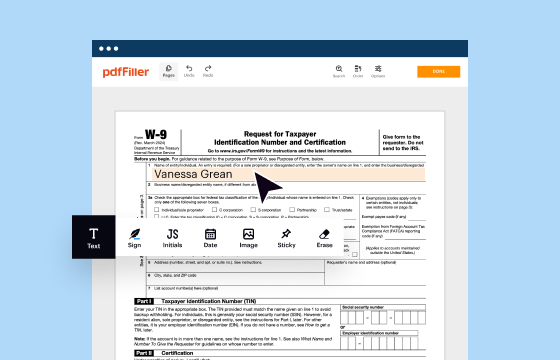

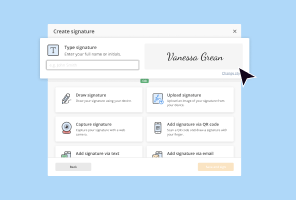

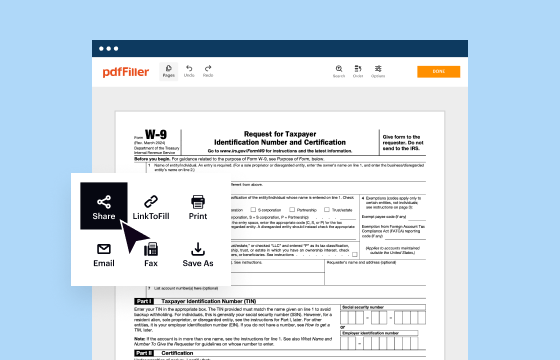

To edit the NY DTF IT-201 tax form, you can use pdfFiller. This platform allows you to import the form, make necessary adjustments, and save the updated version for submission. Start by uploading the completed form into pdfFiller's editor, where you can modify any fields as required.

How to fill out NY DTF IT-201

Filling out the NY DTF IT-201 involves several steps:

01

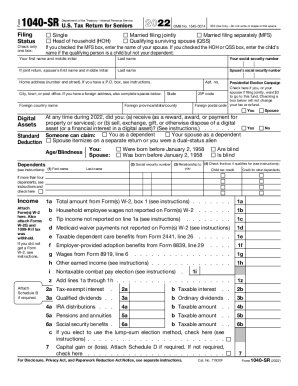

Gather all necessary financial documents, including W-2s, 1099s, and other income records.

02

Provide your personal details, including name, address, and Social Security number at the top of the form.

03

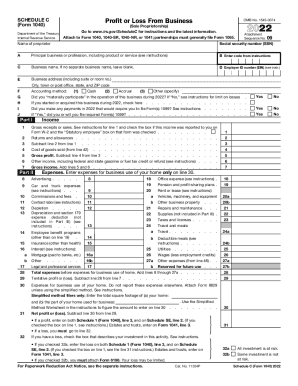

Detail your income sources in the designated sections, ensuring to correctly report all earnings.

04

Adjust any deductions or credits applicable to your tax situation.

05

Review the completed form for accuracy before submission.

About NY DTF IT previous version

What is NY DTF IT-201?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-201?

The NY DTF IT-201 is the New York State personal income tax return form. It is specifically designed for individuals to report their annual income and calculates the amount of tax owed or the refund due to them.

What is the purpose of this form?

The purpose of the NY DTF IT-201 is to provide a comprehensive declaration of an individual's income, deductions, credits, and tax liability for the year. This form is essential for ensuring compliance with New York State tax regulations.

Who needs the form?

Individuals who are residents of New York State, as well as non-residents who have income sourced from New York, need to file the NY DTF IT-201 form. Additionally, anyone who is claiming a refund or has a tax liability must complete this form.

When am I exempt from filling out this form?

You may be exempt from filing the NY DTF IT-201 if your income falls below certain thresholds set by New York State tax law. Certain individuals, such as dependents with minimal income or some senior citizens, may also qualify for exemptions. Consult the latest guidelines to confirm your filing requirements.

Components of the form

The NY DTF IT-201 consists of various sections, including personal information, income, deductions, credits, and tax calculations. Each section requires specific information, which is crucial for accurately determining your tax obligation or refund.

What are the penalties for not issuing the form?

Failing to file the NY DTF IT-201 form by the due date can result in significant penalties. These may include a failure-to-file penalty, interest on owed taxes, and possible enforcement actions from the state. It is essential to comply with filing requirements to avoid these consequences.

What information do you need when you file the form?

When filing the NY DTF IT-201, you will need essential information such as your Social Security number, details of all sources of income, any applicable deductions, and tax credits. Additionally, have your previous tax returns on hand for reference.

Is the form accompanied by other forms?

The NY DTF IT-201 may require accompanying schedules or forms, particularly if you are claiming specific credits or deductions. Review the form instructions to determine if additional documentation is necessary for your submission.

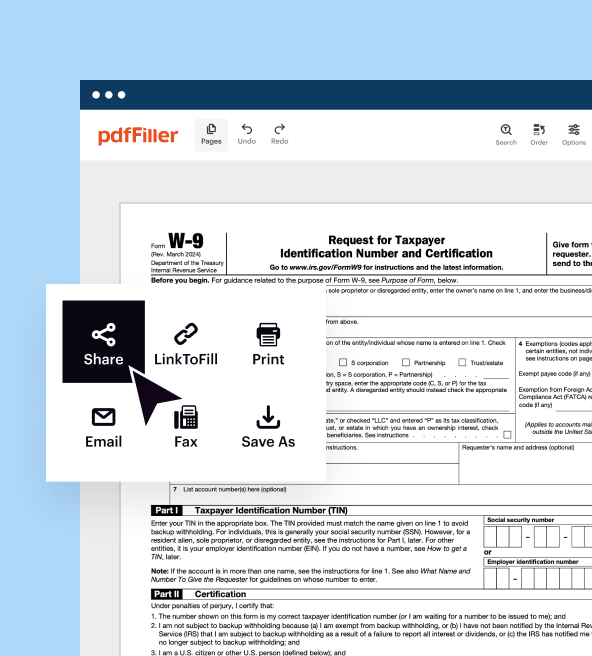

Where do I send the form?

The completed NY DTF IT-201 form should be sent to the New York State Department of Taxation and Finance. The exact mailing address may vary based on your filing status and location, so it is important to refer to the instructions included with the form for the correct submission address.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.