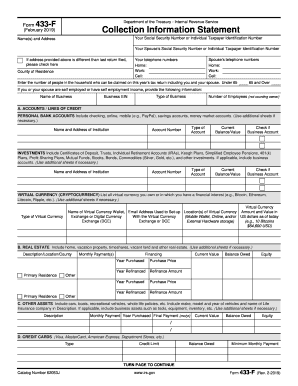

NY DTF NYC-202 2021 free printable template

Show details

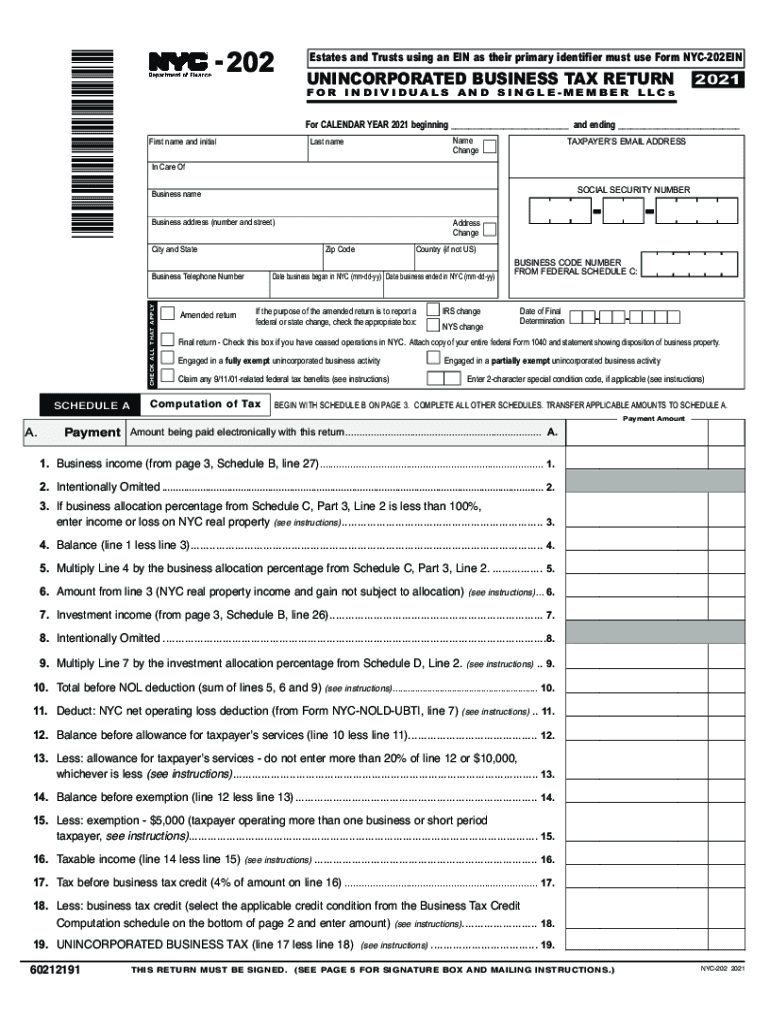

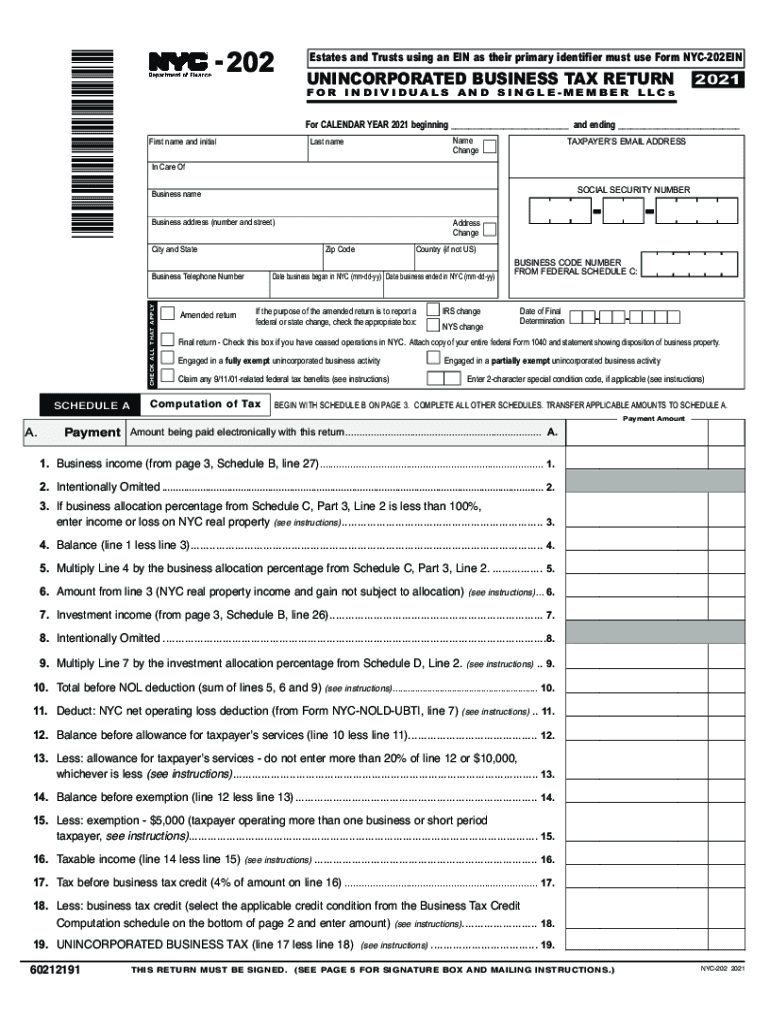

*60212191* 202Estates and Trusts using an EIN as their primary identifier must use Form NYC202EINUNINCORPORATED BUSINESS TAX Returner CALENDAR YEAR 2021 beginning ___ and ending ___

First name and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF NYC-202

Edit your NY DTF NYC-202 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF NYC-202 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF NYC-202 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF NYC-202. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF NYC-202 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF NYC-202

How to fill out NY DTF NYC-202

01

Obtain the NY DTF NYC-202 form from the New York Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security Number or ITIN.

03

Provide information about your income, including all sources such as wages, self-employment, and other taxable income.

04

Deductions: Input any applicable deductions you are eligible for in the designated sections.

05

Calculate your total tax liability using the instructions provided with the form.

06

Review all entries for accuracy to ensure there are no mistakes.

07

Sign and date the form, certifying that the information provided is true and correct.

08

Submit the completed form by the due date to avoid penalties, either by mail or electronically if available.

Who needs NY DTF NYC-202?

01

Individuals who have residency or work in New York City and are required to report their income.

02

Self-employed individuals or freelancers earning income within New York City.

03

People who have received income from multiple sources that need to be reported for tax purposes.

04

Residents of New York City seeking to claim deductions or credits applicable to their local taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Form NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

What is an Article 22 partner New York?

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate.

Who is subject to NYC UBT?

What Activities are Subject to This Tax? Unincorporated Businesses include: trades, professions, and certain occupations of an individual, partnership, limited liability company, fiduciary, association, estate or trust. The business can be active or in the process of being liquidated.

What is NYC Section 1127 withholding?

If you work for the City of New York but live outside New York City and were hired on or after January 4, 1973, you must file Form NYC-1127 and pay the City an amount equal to the personal income tax you would owe if you lived in New York City.

Who must file NYC 4S?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC- 4S, NYC-4S-EZ or NYC-3L, whichever is appli- cable. Under certain limited circumstances, an S Corporation may be permitted or required to file a combined return (Form NYC-3A).

Who is subject to NYC UBT?

If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax. Tax Rates A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT.

Who must file a NY nonresident return?

If you had any income during your resident period or if you had New York source income during your nonresident period, you are required to file a New York State return. You will file Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Who Must File NYC partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who must file New York City UBT?

If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax. A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT.

Who Must File NYC Partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who files NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

What is New York UBT?

If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax. Tax Rates A 4% tax rate is charged for taxable income allocated to New York City.

What is NYC unincorporated business tax?

A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

How long does it take to receive 1127 refund?

The refund can take up to 60 days to be received. If you haven't received your refund after 60 days, please go to e-Services and check your refund status.

Who is subject to New York City tax?

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

What is nyc 1127?

Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127. This form calculates the City Waiver liability, which is the amount due as if the filer was a resident of NYC.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF NYC-202 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NY DTF NYC-202. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send NY DTF NYC-202 to be eSigned by others?

When your NY DTF NYC-202 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit NY DTF NYC-202 online?

With pdfFiller, the editing process is straightforward. Open your NY DTF NYC-202 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is NY DTF NYC-202?

NY DTF NYC-202 is a tax form used by the New York State Department of Taxation and Finance for reporting and remitting various taxes related to city income.

Who is required to file NY DTF NYC-202?

Individuals who are residents of New York City and have earned income subject to city tax are required to file NY DTF NYC-202.

How to fill out NY DTF NYC-202?

To fill out NY DTF NYC-202, taxpayers should gather their income and tax information, follow the instructions provided on the form, and report all necessary financial data accurately.

What is the purpose of NY DTF NYC-202?

The purpose of NY DTF NYC-202 is to collect and report New York City income taxes owed by residents and to ensure compliance with city tax regulations.

What information must be reported on NY DTF NYC-202?

Information required on NY DTF NYC-202 includes personal identification details, income amounts, deductions, credits, and any tax payments made.

Fill out your NY DTF NYC-202 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF NYC-202 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.