MD Comptroller 500D 2022 free printable template

Show details

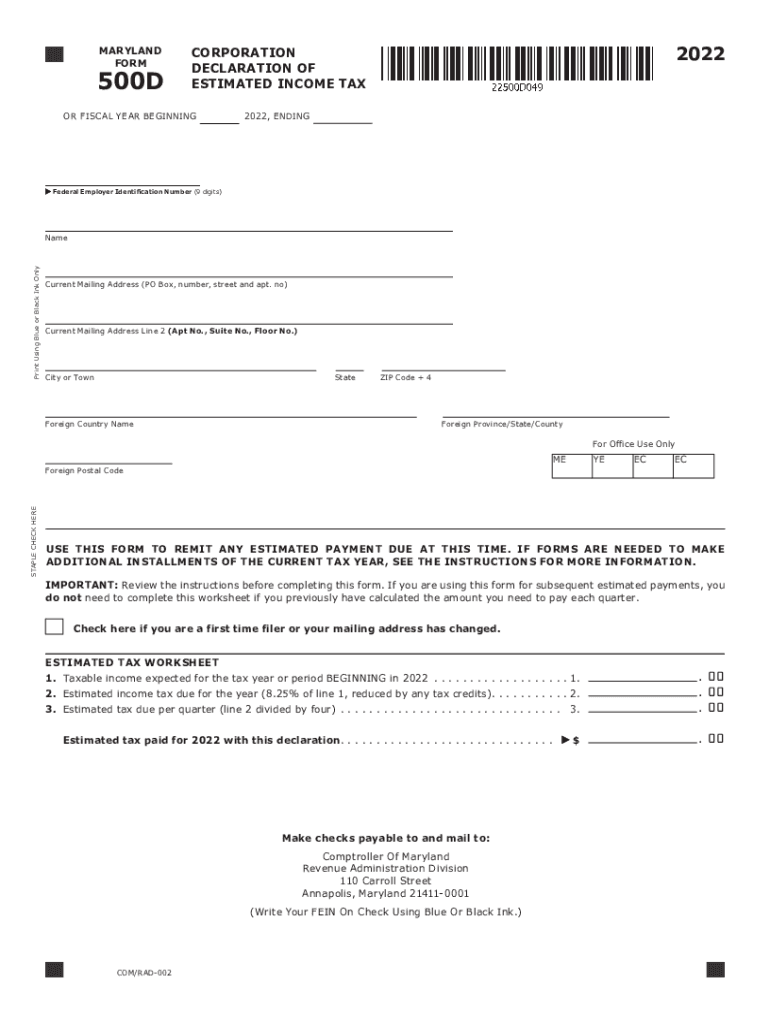

MARYLAND

FORM500D2022CORPORATION

DECLARATION OF

ESTIMATED INCOME TAXON FISCAL YEAR BEGINNING2022, ENDING Federal Employer Identification Number (9 digits)Print Using Blue or Black Ink OnlyNameCurrent

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign md estimated

Edit your md estimated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your md estimated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing md estimated online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit md estimated. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 500D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out md estimated

How to fill out MD Comptroller 500D

01

Begin by downloading the MD Comptroller 500D form from the Maryland State Comptroller's website.

02

Fill in the taxpayer's identification information, including name, address, and Social Security number or Employer Identification Number.

03

Indicate the type of tax return being filed (individual, business, etc.).

04

Provide detailed income information, including wages, salaries, and other sources of income.

05

Complete the deduction and credit sections to accurately reflect your tax obligations.

06

Review all entered information for accuracy.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate MD Comptroller office, either by mail or electronically if permitted.

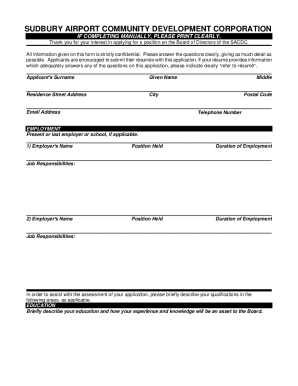

Who needs MD Comptroller 500D?

01

Individuals and businesses in Maryland who are required to report and pay state taxes.

02

Tax professionals assisting clients with state tax obligations.

03

Entities seeking tax refunds or credits related to previously filed returns.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay Maryland corporate estimated taxes online?

EFT allows you to electronically pay your state withholding tax, motor fuel tax and corporation tax payments.

Can I pay Maryland business estimated taxes online?

Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. This system may be used to make bill payments on business taxes using electronic funds withdrawal (direct debit) from a U.S. bank or financial institution. Foreign facilities will not be accepted.

What is MD form PV?

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the “Total Amount Due” line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

Is estimated tax payment mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Can I choose not to pay estimated taxes?

You can even skip making the single estimated tax payment as long as you file your tax return by March 1 and pay any tax due in full.

Do I have to pay estimated taxes?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

What is a IND PV?

The Form IND PV is a payment voucher you will send with your check or. money order for any balance due on the “Total Amount Due” line of your. Form 502 or Form 505. If you are paying electronically (not sending a check. or money order) for your balance due, you do not need to complete this.

Do I need to pay Maryland estimated taxes?

If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500.

Can I pay Maryland form PV online?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

How do I write a check to the Comptroller of Maryland?

Make your check or money order payable to “Comptroller of Maryland.” • Use blue or black ink only. Write the type of tax and year of tax being paid on your check. It is recommended that you include your Social Security number on your check. DO NOT SEND CASH.

How do I pay my Maryland estimated taxes?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

What happens if I don't pay estimated taxes?

What does the tax underpayment penalty for quarterly taxes work? Once a due date has passed, the IRS will typically dock 0.5% of the entire amount you owe. For each partial or full month you don't pay the tax in full, the penalty increases. It's capped at 25%.

How can I avoid underpayment penalty in Maryland?

To avoid an underpayment penalty, you need to make sure that the total amount of estimated taxes you pay during the year equals at least 90 percent of what you owe in taxes for the current year or 100 percent of what you owed in taxes last year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit md estimated from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including md estimated, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit md estimated straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing md estimated, you can start right away.

How do I complete md estimated on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your md estimated. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MD Comptroller 500D?

MD Comptroller 500D is a form used for reporting certain financial information to the Maryland Comptroller's office, typically related to income taxes or business taxes.

Who is required to file MD Comptroller 500D?

Individuals or businesses operating in Maryland that are subject to specific tax obligations must file MD Comptroller 500D.

How to fill out MD Comptroller 500D?

To fill out MD Comptroller 500D, you need to provide personal or business identification information, income details, deductions, and any other relevant financial data as required by the form.

What is the purpose of MD Comptroller 500D?

The purpose of MD Comptroller 500D is to ensure compliance with Maryland tax laws by accurately reporting income and determining tax liabilities.

What information must be reported on MD Comptroller 500D?

Information that must be reported includes income earned, applicable deductions, tax credits, and any other financial details relevant to the taxpayer’s situation.

Fill out your md estimated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Md Estimated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.