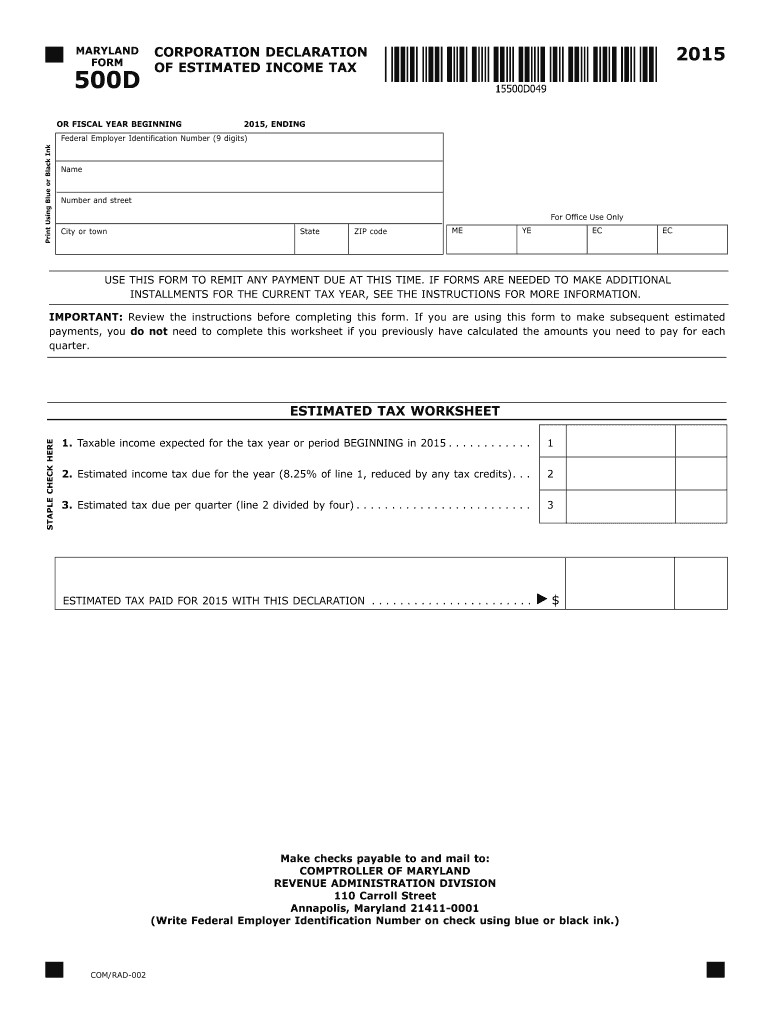

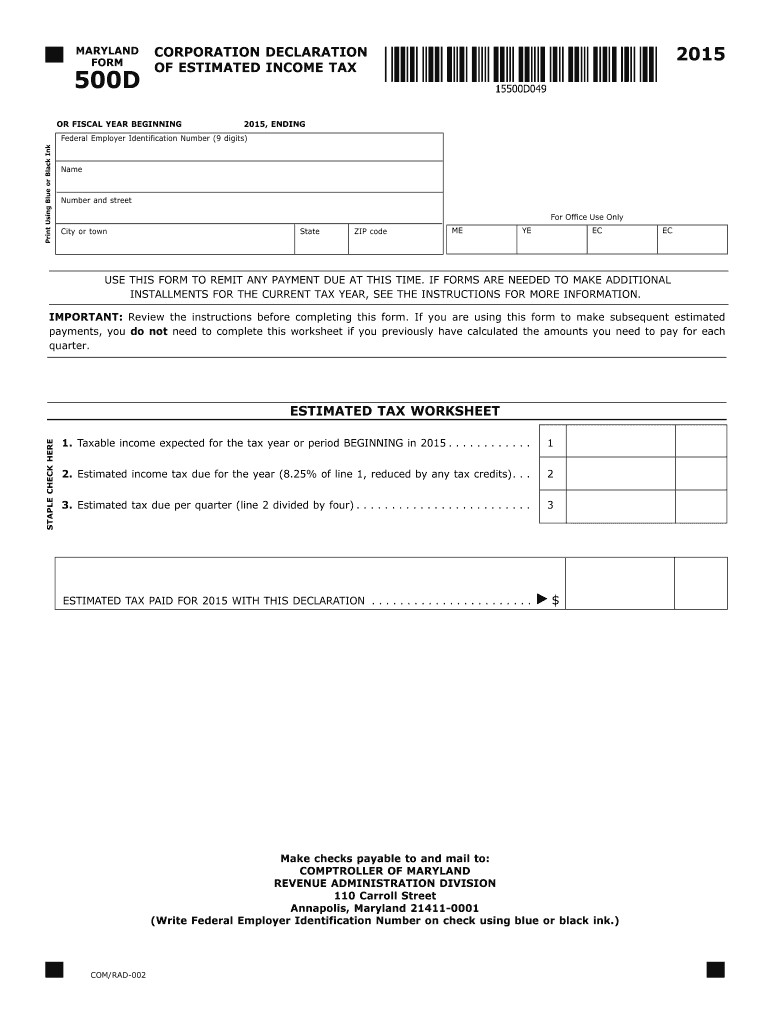

MD Comptroller 500D 2015 free printable template

Show details

Marylandtaxes. com and download another Form 500D. 3 M ailing Instructions Mail payment and completed Form 500D to Comptroller of Maryland Revenue Administration Division Annapolis MD 21411-0001. In addition to payments with Form 500D the corporation may partially or fully apply any overpayment from the prior year Form 500 Maryland Corporation Income Tax Return to the estimated tax obligation for this year. However if the corporation has a short tax period of less than 4 months it does not...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maryland 500d 2015 form

Edit your maryland 500d 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland 500d 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 500D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maryland 500d 2015 form

How to fill out MD Comptroller 500D

01

Obtain the MD Comptroller 500D form from the official website or your local comptroller's office.

02

Fill in your personal information at the top of the form, including name, address, and contact details.

03

Provide any required identification numbers, such as your Social Security Number or Employer Identification Number.

04

Complete the income section by detailing all sources of income as per the form's instructions.

05

If applicable, list any deductions or credits you're claiming that may affect the final calculation.

06

Review all the information for accuracy to ensure there are no mistakes or omissions.

07

Sign and date the form at the designated areas to validate your submission.

08

Submit the completed form to the appropriate office, either by mail or electronically, as per the instructions.

Who needs MD Comptroller 500D?

01

Individuals or businesses in Maryland who are filing for a specific tax exemption or credit.

02

Tax preparers or accountants filling out forms on behalf of their clients.

03

Property owners who need to report income, deductions, or credits related to property taxes.

04

Anyone seeking to comply with Maryland tax regulations for accurate reporting and documentation.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay Maryland corporate estimated taxes online?

EFT allows you to electronically pay your state withholding tax, motor fuel tax and corporation tax payments.

Can I pay Maryland business estimated taxes online?

Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. This system may be used to make bill payments on business taxes using electronic funds withdrawal (direct debit) from a U.S. bank or financial institution. Foreign facilities will not be accepted.

What is MD form PV?

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the “Total Amount Due” line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

Is estimated tax payment mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Can I choose not to pay estimated taxes?

You can even skip making the single estimated tax payment as long as you file your tax return by March 1 and pay any tax due in full.

Do I have to pay estimated taxes?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

What is a IND PV?

The Form IND PV is a payment voucher you will send with your check or. money order for any balance due on the “Total Amount Due” line of your. Form 502 or Form 505. If you are paying electronically (not sending a check. or money order) for your balance due, you do not need to complete this.

Do I need to pay Maryland estimated taxes?

If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500.

Can I pay Maryland form PV online?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

How do I write a check to the Comptroller of Maryland?

Make your check or money order payable to “Comptroller of Maryland.” • Use blue or black ink only. Write the type of tax and year of tax being paid on your check. It is recommended that you include your Social Security number on your check. DO NOT SEND CASH.

How do I pay my Maryland estimated taxes?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

What happens if I don't pay estimated taxes?

What does the tax underpayment penalty for quarterly taxes work? Once a due date has passed, the IRS will typically dock 0.5% of the entire amount you owe. For each partial or full month you don't pay the tax in full, the penalty increases. It's capped at 25%.

How can I avoid underpayment penalty in Maryland?

To avoid an underpayment penalty, you need to make sure that the total amount of estimated taxes you pay during the year equals at least 90 percent of what you owe in taxes for the current year or 100 percent of what you owed in taxes last year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MD Comptroller 500D?

MD Comptroller 500D is a tax form used for reporting Maryland income tax information for certain businesses.

Who is required to file MD Comptroller 500D?

Businesses that have taxable income or are required to report income for tax purposes in Maryland must file MD Comptroller 500D.

How to fill out MD Comptroller 500D?

To fill out MD Comptroller 500D, taxpayers must provide information such as business income, deductions, credits, and other relevant tax details as specified in the instructions.

What is the purpose of MD Comptroller 500D?

The purpose of MD Comptroller 500D is to report business income and calculate the tax owed to the state of Maryland.

What information must be reported on MD Comptroller 500D?

MD Comptroller 500D requires reporting of business name, address, federal employer identification number (FEIN), gross income, deductions, and any tax credits applicable.

Fill out your maryland 500d 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland 500d 2015 Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.