MD Comptroller 500D 2020 free printable template

Show details

MARYLAND

FORM500D2020CORPORATION

DECLARATION OF

ESTIMATED INCOME TAXON FISCAL YEAR BEGINNING20500D0492020, Endangering Using Blue or Black Ink Only Federal Employer Identification Number (9 digits)Recurrent

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign md estimated

Edit your md estimated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your md estimated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit md estimated online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit md estimated. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 500D Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out md estimated

How to fill out MD Comptroller 500D

01

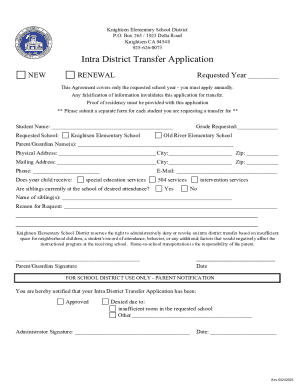

Obtain the MD Comptroller 500D form from the official website or local office.

02

Fill in your personal information including name, address, and contact details.

03

Provide your business information, including the business name, address, and tax identification number.

04

Detail the type of income you are reporting on the form.

05

Calculate and enter the total amount of income.

06

Sign and date the form to certify the information is accurate.

07

Submit the completed form to the appropriate MD Comptroller office or online portal.

Who needs MD Comptroller 500D?

01

Individuals and businesses in Maryland who are required to report certain types of income.

02

Taxpayers seeking to document their income for compliance purposes.

03

Entities that have received income that is taxable under Maryland state law.

Fill

form

: Try Risk Free

People Also Ask about

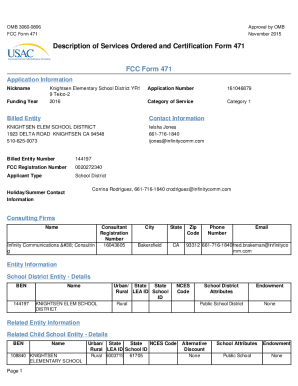

Can I pay Maryland corporate estimated taxes online?

EFT allows you to electronically pay your state withholding tax, motor fuel tax and corporation tax payments.

Can I pay Maryland business estimated taxes online?

Online Bill Pay is an easy, convenient and secure way to pay your Maryland tax liabilities online for free. This system may be used to make bill payments on business taxes using electronic funds withdrawal (direct debit) from a U.S. bank or financial institution. Foreign facilities will not be accepted.

What is MD form PV?

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the “Total Amount Due” line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

Is estimated tax payment mandatory?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Can I choose not to pay estimated taxes?

You can even skip making the single estimated tax payment as long as you file your tax return by March 1 and pay any tax due in full.

Do I have to pay estimated taxes?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

What is a IND PV?

The Form IND PV is a payment voucher you will send with your check or. money order for any balance due on the “Total Amount Due” line of your. Form 502 or Form 505. If you are paying electronically (not sending a check. or money order) for your balance due, you do not need to complete this.

Do I need to pay Maryland estimated taxes?

If your employer does withhold Maryland taxes from your pay, you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount withheld by your employer by more than $500.

Can I pay Maryland form PV online?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

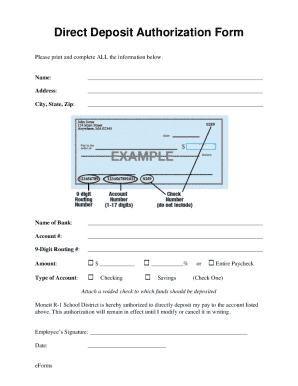

How do I write a check to the Comptroller of Maryland?

Make your check or money order payable to “Comptroller of Maryland.” • Use blue or black ink only. Write the type of tax and year of tax being paid on your check. It is recommended that you include your Social Security number on your check. DO NOT SEND CASH.

How do I pay my Maryland estimated taxes?

You can make estimated payments online using iFile, which also allows you to review your history of previous payments made through iFile and also schedule the payments. You can also submit estimated payments using Form PV.

What happens if I don't pay estimated taxes?

What does the tax underpayment penalty for quarterly taxes work? Once a due date has passed, the IRS will typically dock 0.5% of the entire amount you owe. For each partial or full month you don't pay the tax in full, the penalty increases. It's capped at 25%.

How can I avoid underpayment penalty in Maryland?

To avoid an underpayment penalty, you need to make sure that the total amount of estimated taxes you pay during the year equals at least 90 percent of what you owe in taxes for the current year or 100 percent of what you owed in taxes last year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find md estimated?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific md estimated and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete md estimated online?

With pdfFiller, you may easily complete and sign md estimated online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete md estimated on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your md estimated by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is MD Comptroller 500D?

MD Comptroller 500D is a tax form used by the Maryland Comptroller's office, typically related to the reporting of income and tax credits for certain taxpayers.

Who is required to file MD Comptroller 500D?

Individuals or entities who are claiming specific tax credits or exemptions, or who have received certain types of income that need to be reported, may be required to file MD Comptroller 500D.

How to fill out MD Comptroller 500D?

To fill out MD Comptroller 500D, taxpayers must provide their personal details, income information, and any applicable credits or deductions, ensuring all required sections are completed accurately.

What is the purpose of MD Comptroller 500D?

The purpose of MD Comptroller 500D is to allow taxpayers to report specific tax information, claim credits and deductions, and ensure compliance with Maryland state tax laws.

What information must be reported on MD Comptroller 500D?

MD Comptroller 500D requires reporting personal identification information, income details, and any relevant tax credits or deductions applicable to the taxpayer's financial situation.

Fill out your md estimated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Md Estimated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.