MI Form 4884 2021 free printable template

Show details

Reset Form

Michigan Department of Treasury

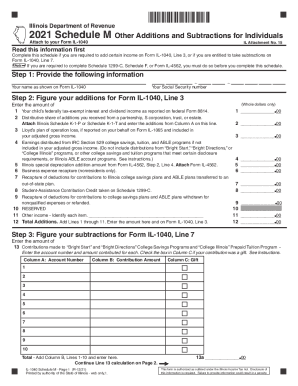

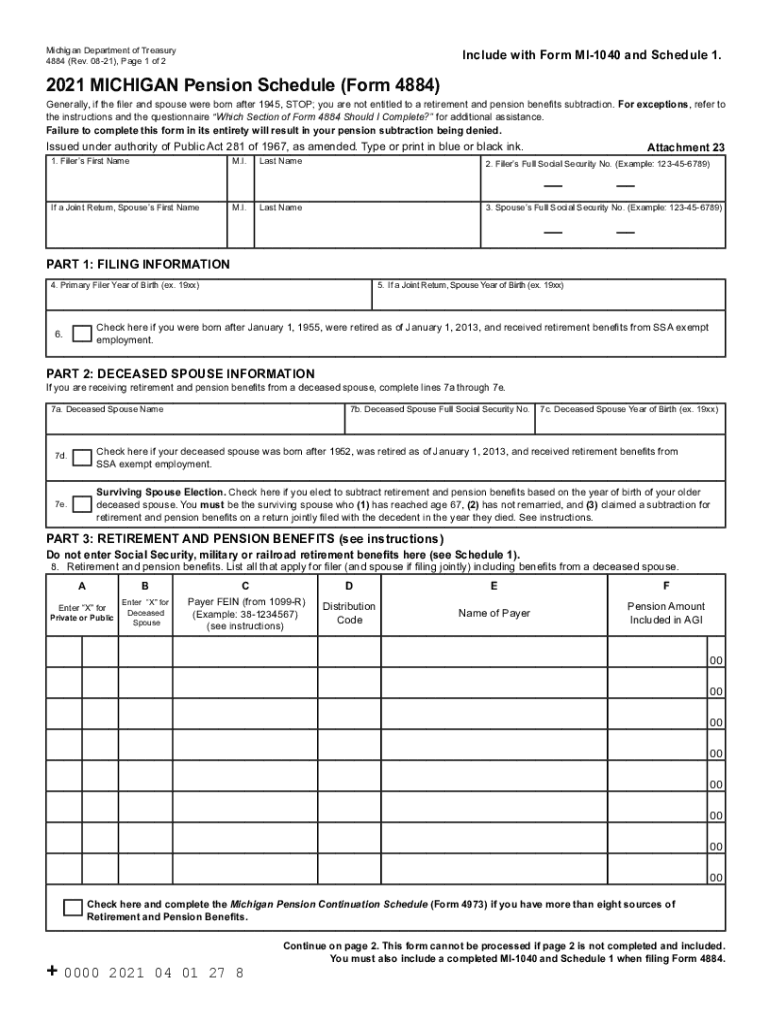

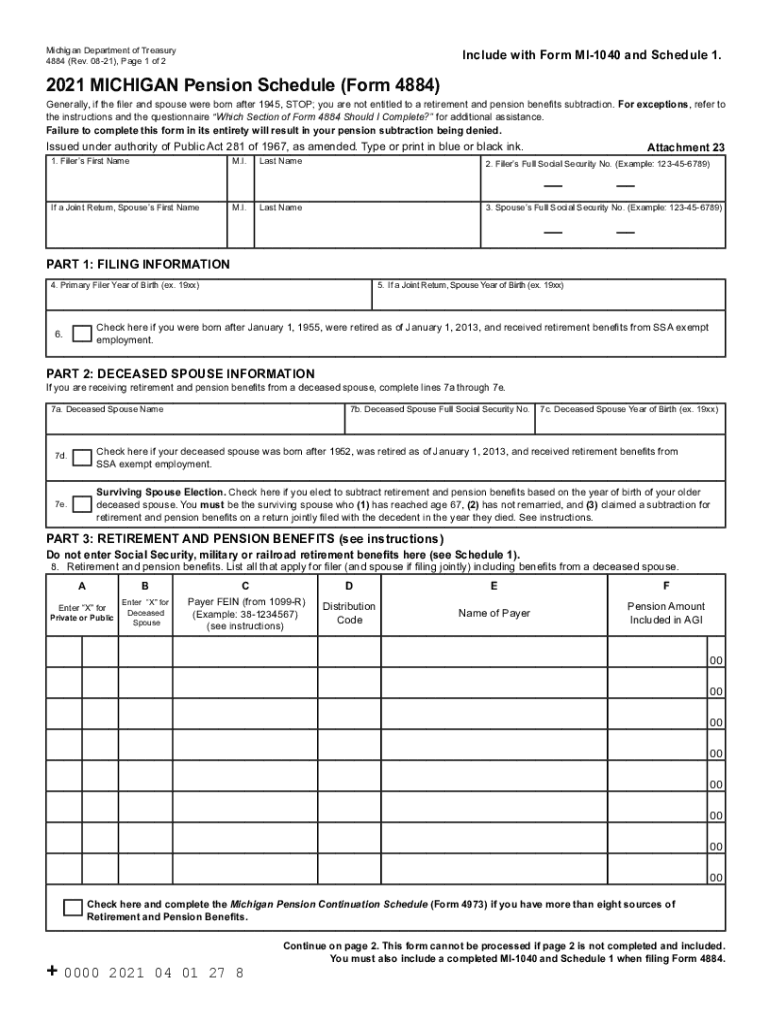

4884 (Rev. 0821), Page 1 of 2Include with Form MI1040 and Schedule 1.2021 MICHIGAN Pension Schedule (Form 4884)Generally, if the filer and spouse were born

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Form 4884

Edit your MI Form 4884 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Form 4884 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI Form 4884 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI Form 4884. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 4884 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Form 4884

How to fill out MI Form 4884

01

Obtain MI Form 4884 from the relevant Michigan government website or office.

02

Start by filling in your personal information at the top of the form, including your name, address, and contact details.

03

Provide your Social Security Number or ITIN in the designated field.

04

Fill out the sections related to your income, including wages, salaries, and other sources of income.

05

Complete deductions and credits sections as applicable to your financial situation.

06

Review all provided information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form by the specified deadline, either electronically or by mailing it to the appropriate address.

Who needs MI Form 4884?

01

Individuals who are residents of Michigan and are required to file a state income tax return.

02

Taxpayers seeking to claim deductions or credits related to their income.

03

Anyone who has received specific instructions to use this form from the Michigan Department of Treasury.

Fill

form

: Try Risk Free

People Also Ask about

What is Michigan income tax rate 2022?

Michigan Tax Rates, Collections, and Burdens Michigan has a flat 4.25 percent individual income tax rate.

At what age does Michigan stop taxing pensions?

If the older of you or your spouse (if married filing jointly) was born during the period January 1, 1946 through December 31, 1952, and reached the age of 67, you are eligible for a deduction against all income and will no longer deduct retirement and pension benefits.

Who qualifies for Michigan Homestead property tax credit?

Who qualifies for a homestead property tax credit? You may qualify for a property tax credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes and/or service fees were levied.

Do you still pay income tax after retirement?

If you have income that is not tax-exempt, you may have to pay income taxes in retirement. For tax year 2022, if you are filing jointly with a spouse who is also 65 or older, you will file a return and pay taxes if your income exceeds $28,700 ($27,300 if your spouse isn't 65).

What pensions are not taxable in Michigan?

What are Pensions and Retirement Benefits? Military pensions, Social Security & Railroad benefits continue to be exempt from tax. Rollovers not included in the Federal Adjusted Gross Income (AGI) will not be taxed in Michigan.

At what age do seniors stop paying property taxes in Michigan?

a. Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

What is retirement income subtraction?

The retirement benefits subtraction would follow the form of the current Social Security subtraction, allowing a portion of qualified retirement benefits to be subtracted, subject to a maximum subtraction amount, which is reduced by 20 percent of provisional income above a phase out threshold specific to a taxpayer's

What taxes do you pay as a retiree?

You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

How much will my pension be taxed in Michigan?

Do not withhold on benefits paid to pension recipients born before 1946 unless the benefits exceed private pension limits. If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

What is the retirement tax rate in Michigan?

Filing MI W-4P If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

Who is exempt from paying property taxes in Michigan?

Pursuant to MCL 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to postpone paying property taxes. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer.

What is a Form 4884?

2021 MICHIGAN Pension Schedule (Form 4884)

What is Michigan tax form 4884?

More about the Michigan Form 4884 Individual Income Tax TY 2021. Use this form to report retirement and pension benefits, and attach to Form MI-1040 and Schedule 1. We last updated the Pension Schedule in January 2022, so this is the latest version of Form 4884, fully updated for tax year 2021.

How long do you have to pay property taxes in Michigan?

1. Taxes are levied twice a year, July and December (Summer/Winter bills) 2. Taxes are payable to the local Township or City through February 28th of the following year 3. Taxes become “Delinquent” on March 1st in the year after they were due and are sent to the County Treasurer's Office for collection 4.

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

Do retirees pay income tax in Michigan?

All retirement (private and public) and pension benefits are taxable to Michigan, unless one of following applies: Taxpayers born January 1, 1953 through January 1, 1955 should not file Form 4884. Instead, taxpayers may be eligible for a Tier 3 Michigan Standard Deduction.

Do you have to pay Michigan income tax on Social Security?

Is Social Security taxable in Michigan? Social Security payments are not taxed in Michigan. Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income (AGI) when filing your state taxes in Michigan.

What is the Michigan retirement subtraction?

TaxAct automatically transfers the taxable social security benefits from the federal return to the Michigan return (Line 14 of Michigan Schedule 1).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MI Form 4884 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MI Form 4884 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send MI Form 4884 for eSignature?

Once your MI Form 4884 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out MI Form 4884 using my mobile device?

Use the pdfFiller mobile app to fill out and sign MI Form 4884. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is MI Form 4884?

MI Form 4884 is a Michigan tax form used for reporting corporate income tax and related information for businesses operating in the state of Michigan.

Who is required to file MI Form 4884?

Corporations doing business in Michigan and that have gross receipts exceeding a certain threshold must file MI Form 4884.

How to fill out MI Form 4884?

To fill out MI Form 4884, you need to provide information regarding your business's gross receipts, deductions, and any applicable credits, following the instructions provided with the form.

What is the purpose of MI Form 4884?

The purpose of MI Form 4884 is to calculate and report the corporate income tax owed by corporations operating in Michigan.

What information must be reported on MI Form 4884?

Information that must be reported on MI Form 4884 includes the corporation's gross receipts, any deductions claimed, tax credits, and the total tax liability.

Fill out your MI Form 4884 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Form 4884 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.