MI Form 4884 2024-2025 free printable template

Show details

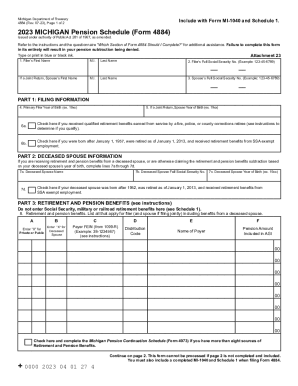

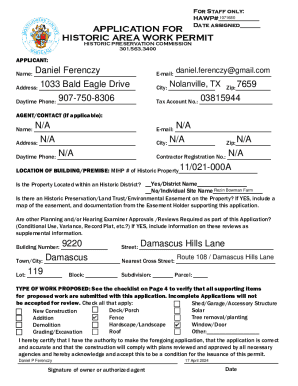

Reset Form Michigan Department of Treasury 4884 (Rev. 0524), Page 1 of 2Include with Form MI1040 and Schedule 1.2024 MICHIGAN Pension Schedule (Form 4884) Issued under authority of Public Act 281

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign michigan 4884 form

Edit your form 4884 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 michigan 4884 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2024 mi form 4884 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mi form 4884. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 4884 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mi 4884 form

How to fill out MI Form 4884

01

Begin by downloading MI Form 4884 from the official Michigan Department of Treasury website.

02

Fill out the form using black or blue ink for clarity.

03

Enter your name, address, and Social Security number in the designated fields.

04

Indicate the type of tax return you are filing (individual, joint, etc.).

05

Provide all necessary income information, including wages, self-employment income, and any other income sources.

06

Deduct any applicable adjustments to income, such as retirement contributions or health savings account contributions.

07

List all applicable deductions, such as standard or itemized deductions.

08

Calculate your taxable income by subtracting deductions from your total income.

09

Use the tax tables provided to calculate your taxes owed.

10

Finally, sign and date the form before submitting it to the designated tax authority.

Who needs MI Form 4884?

01

Individuals who are residents of Michigan and need to report their income for state tax purposes.

02

Taxpayers who are filing income tax returns for the state of Michigan.

03

Anyone who has income that is taxable under Michigan law, including wages, self-employment earnings, and interest income.

Fill

form 4884 pension schedule

: Try Risk Free

People Also Ask about 2024 form 4884

What is Michigan income tax rate 2022?

Michigan Tax Rates, Collections, and Burdens Michigan has a flat 4.25 percent individual income tax rate.

At what age does Michigan stop taxing pensions?

If the older of you or your spouse (if married filing jointly) was born during the period January 1, 1946 through December 31, 1952, and reached the age of 67, you are eligible for a deduction against all income and will no longer deduct retirement and pension benefits.

Who qualifies for Michigan Homestead property tax credit?

Who qualifies for a homestead property tax credit? You may qualify for a property tax credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes and/or service fees were levied.

Do you still pay income tax after retirement?

If you have income that is not tax-exempt, you may have to pay income taxes in retirement. For tax year 2022, if you are filing jointly with a spouse who is also 65 or older, you will file a return and pay taxes if your income exceeds $28,700 ($27,300 if your spouse isn't 65).

What pensions are not taxable in Michigan?

What are Pensions and Retirement Benefits? Military pensions, Social Security & Railroad benefits continue to be exempt from tax. Rollovers not included in the Federal Adjusted Gross Income (AGI) will not be taxed in Michigan.

At what age do seniors stop paying property taxes in Michigan?

a. Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

What is retirement income subtraction?

The retirement benefits subtraction would follow the form of the current Social Security subtraction, allowing a portion of qualified retirement benefits to be subtracted, subject to a maximum subtraction amount, which is reduced by 20 percent of provisional income above a phase out threshold specific to a taxpayer's

What taxes do you pay as a retiree?

You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

How much will my pension be taxed in Michigan?

Do not withhold on benefits paid to pension recipients born before 1946 unless the benefits exceed private pension limits. If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

What is the retirement tax rate in Michigan?

Filing MI W-4P If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

Who is exempt from paying property taxes in Michigan?

Pursuant to MCL 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to postpone paying property taxes. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer.

What is a Form 4884?

2021 MICHIGAN Pension Schedule (Form 4884)

What is Michigan tax form 4884?

More about the Michigan Form 4884 Individual Income Tax TY 2021. Use this form to report retirement and pension benefits, and attach to Form MI-1040 and Schedule 1. We last updated the Pension Schedule in January 2022, so this is the latest version of Form 4884, fully updated for tax year 2021.

How long do you have to pay property taxes in Michigan?

1. Taxes are levied twice a year, July and December (Summer/Winter bills) 2. Taxes are payable to the local Township or City through February 28th of the following year 3. Taxes become “Delinquent” on March 1st in the year after they were due and are sent to the County Treasurer's Office for collection 4.

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

Do retirees pay income tax in Michigan?

All retirement (private and public) and pension benefits are taxable to Michigan, unless one of following applies: Taxpayers born January 1, 1953 through January 1, 1955 should not file Form 4884. Instead, taxpayers may be eligible for a Tier 3 Michigan Standard Deduction.

Do you have to pay Michigan income tax on Social Security?

Is Social Security taxable in Michigan? Social Security payments are not taxed in Michigan. Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income (AGI) when filing your state taxes in Michigan.

What is the Michigan retirement subtraction?

TaxAct automatically transfers the taxable social security benefits from the federal return to the Michigan return (Line 14 of Michigan Schedule 1).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mi form 4884 printable in Gmail?

2024 michigan form 4884 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit michigan 4884 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your michigan pension schedule form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit 4884 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 2024 4884 form, you can start right away.

What is MI Form 4884?

MI Form 4884 is a tax form used in Michigan for reporting income tax credits and adjustments related to business activities.

Who is required to file MI Form 4884?

Businesses operating in Michigan that are claiming specific tax credits or adjustments are required to file MI Form 4884.

How to fill out MI Form 4884?

To fill out MI Form 4884, follow the instructions provided on the form, which typically include entering business information, detailing the specific credits being claimed, and providing calculations to support the claim.

What is the purpose of MI Form 4884?

The purpose of MI Form 4884 is to facilitate the reporting of tax credits and adjustments that businesses can claim to reduce their tax liability in Michigan.

What information must be reported on MI Form 4884?

The information that must be reported on MI Form 4884 includes the business's identification details, the specific tax credits being claimed, supporting calculations, and any required documentation to substantiate the claims.

Fill out your michigan form 4884 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Form Pension is not the form you're looking for?Search for another form here.

Keywords relevant to 2024 mi 4884 form

Related to mi 4884 type

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.