MI Form 4884 2020 free printable template

Show details

Reset Form

Michigan Department of Treasury

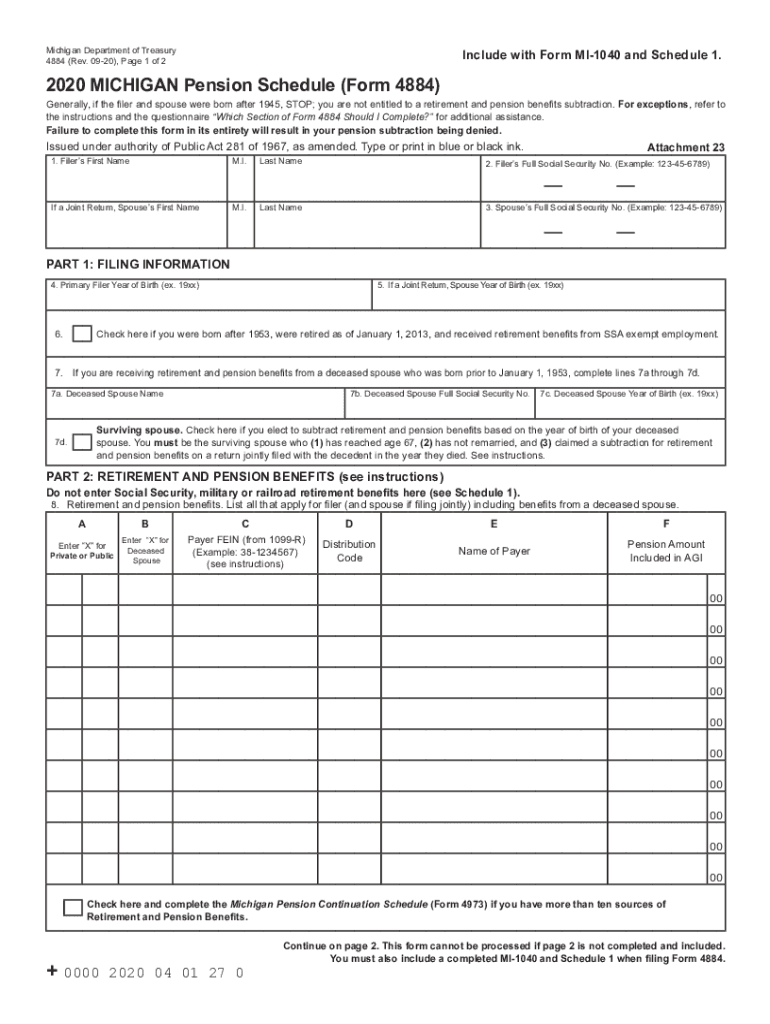

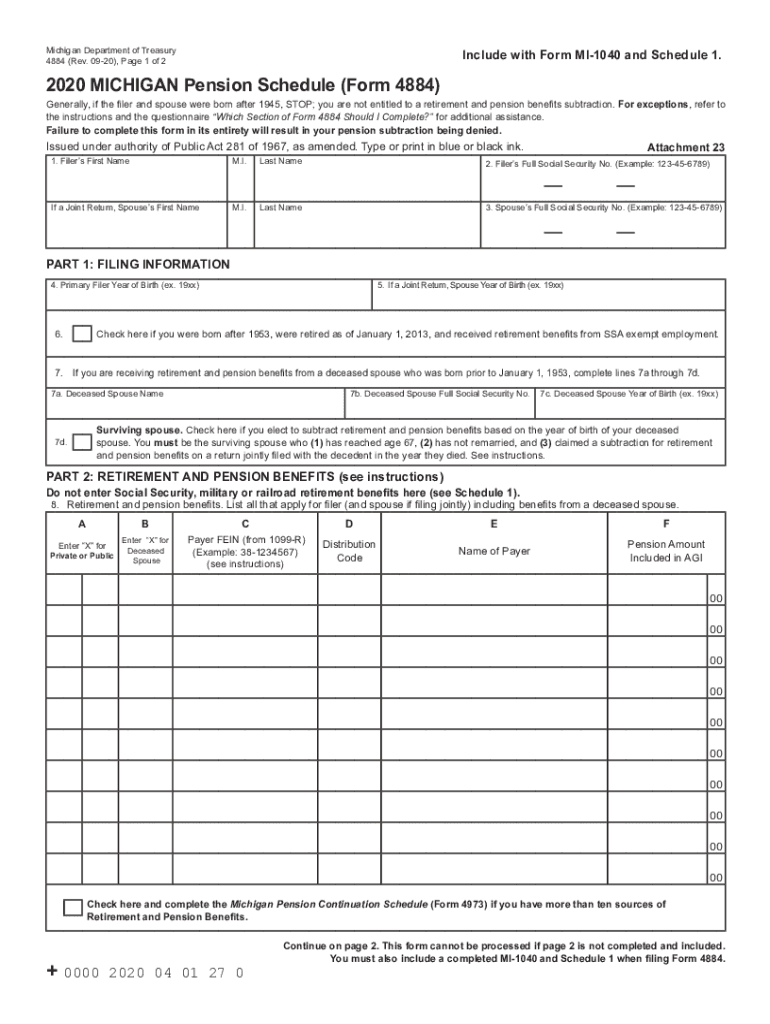

4884 (Rev. 0920), Page 1 of 2Include with Form MI1040 and Schedule 1.2020 MICHIGAN Pension Schedule (Form 4884)Generally, if the filer and spouse were born

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Form 4884

Edit your MI Form 4884 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Form 4884 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Form 4884 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI Form 4884. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 4884 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Form 4884

How to fill out MI Form 4884

01

Obtain MI Form 4884 from the Michigan Department of Treasury website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Report your income details in the appropriate sections, ensuring accuracy in your reported earnings.

05

Complete any necessary schedules that are relevant to your financial situation.

06

Review the instructions for any applicable credits or deductions that may apply to your situation.

07

Sign and date the form once you have filled it out completely.

08

Submit the completed form either electronically or by mailing it to the designated address.

Who needs MI Form 4884?

01

Individuals who need to report their income tax for the state of Michigan.

02

Taxpayers seeking to claim adjustments or corrections to their previous tax filings.

03

Residents who are required to comply with Michigan tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is Michigan income tax rate 2022?

Michigan Tax Rates, Collections, and Burdens Michigan has a flat 4.25 percent individual income tax rate.

At what age does Michigan stop taxing pensions?

If the older of you or your spouse (if married filing jointly) was born during the period January 1, 1946 through December 31, 1952, and reached the age of 67, you are eligible for a deduction against all income and will no longer deduct retirement and pension benefits.

Who qualifies for Michigan Homestead property tax credit?

Who qualifies for a homestead property tax credit? You may qualify for a property tax credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes and/or service fees were levied.

Do you still pay income tax after retirement?

If you have income that is not tax-exempt, you may have to pay income taxes in retirement. For tax year 2022, if you are filing jointly with a spouse who is also 65 or older, you will file a return and pay taxes if your income exceeds $28,700 ($27,300 if your spouse isn't 65).

What pensions are not taxable in Michigan?

What are Pensions and Retirement Benefits? Military pensions, Social Security & Railroad benefits continue to be exempt from tax. Rollovers not included in the Federal Adjusted Gross Income (AGI) will not be taxed in Michigan.

At what age do seniors stop paying property taxes in Michigan?

a. Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

What is retirement income subtraction?

The retirement benefits subtraction would follow the form of the current Social Security subtraction, allowing a portion of qualified retirement benefits to be subtracted, subject to a maximum subtraction amount, which is reduced by 20 percent of provisional income above a phase out threshold specific to a taxpayer's

What taxes do you pay as a retiree?

You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

How much will my pension be taxed in Michigan?

Do not withhold on benefits paid to pension recipients born before 1946 unless the benefits exceed private pension limits. If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

What is the retirement tax rate in Michigan?

Filing MI W-4P If the recipient was born in 1946 or after, withhold on all taxable pension distributions at 4.25%.

Who is exempt from paying property taxes in Michigan?

Pursuant to MCL 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to postpone paying property taxes. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer.

What is a Form 4884?

2021 MICHIGAN Pension Schedule (Form 4884)

What is Michigan tax form 4884?

More about the Michigan Form 4884 Individual Income Tax TY 2021. Use this form to report retirement and pension benefits, and attach to Form MI-1040 and Schedule 1. We last updated the Pension Schedule in January 2022, so this is the latest version of Form 4884, fully updated for tax year 2021.

How long do you have to pay property taxes in Michigan?

1. Taxes are levied twice a year, July and December (Summer/Winter bills) 2. Taxes are payable to the local Township or City through February 28th of the following year 3. Taxes become “Delinquent” on March 1st in the year after they were due and are sent to the County Treasurer's Office for collection 4.

Who are exempted from paying real property tax?

“Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques, non-profit or religious cemeteries and all lands, buildings and improvements actually, directly, and exclusively used for religious, charitable, or educational purposes.”

Do retirees pay income tax in Michigan?

All retirement (private and public) and pension benefits are taxable to Michigan, unless one of following applies: Taxpayers born January 1, 1953 through January 1, 1955 should not file Form 4884. Instead, taxpayers may be eligible for a Tier 3 Michigan Standard Deduction.

Do you have to pay Michigan income tax on Social Security?

Is Social Security taxable in Michigan? Social Security payments are not taxed in Michigan. Any Social Security retirement income that is considered taxable on your federal income tax return can be subtracted from your Adjusted Gross Income (AGI) when filing your state taxes in Michigan.

What is the Michigan retirement subtraction?

TaxAct automatically transfers the taxable social security benefits from the federal return to the Michigan return (Line 14 of Michigan Schedule 1).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MI Form 4884 online?

pdfFiller has made filling out and eSigning MI Form 4884 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit MI Form 4884 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing MI Form 4884.

How do I fill out MI Form 4884 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign MI Form 4884 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MI Form 4884?

MI Form 4884 is a tax form used in Michigan for claiming a subtraction from income for certain types of retirement income.

Who is required to file MI Form 4884?

Individuals who receive retirement income that is eligible for a subtraction under Michigan tax law are required to file MI Form 4884.

How to fill out MI Form 4884?

To fill out MI Form 4884, taxpayers must enter their personal information and report their eligible retirement income, along with any deductions or credits applicable.

What is the purpose of MI Form 4884?

The purpose of MI Form 4884 is to allow qualified taxpayers to subtract certain retirement income from their taxable income when filing their Michigan state taxes.

What information must be reported on MI Form 4884?

Taxpayers must report their name, Social Security number, and details about the types and amounts of retirement income being claimed for the subtraction.

Fill out your MI Form 4884 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Form 4884 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.