Get the free Donations valued at $250 or more special reporting required

Show details

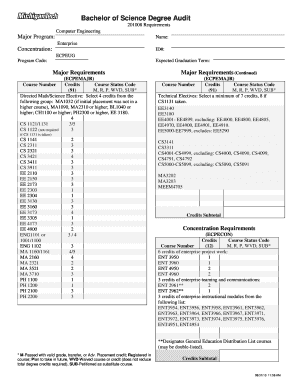

Donations valued at $250 or more special reporting required As a notforprofit organization, Thrive Financial for Lutherans is required to provide special reporting when a chapter service team accepts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donations valued at 250

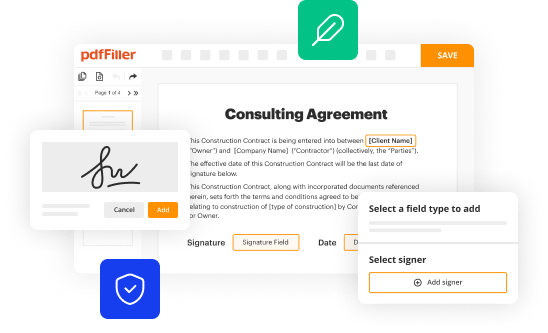

Edit your donations valued at 250 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donations valued at 250 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donations valued at 250 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donations valued at 250. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donations valued at 250

How to fill out donations valued at 250:

01

Start by gathering all the necessary information. This includes the name and contact details of the donor, the date of the donation, and a description of the donated item.

02

Use a donation form or receipt template to fill out the necessary details. You can find such templates online or request them from organizations that accept donations.

03

Begin by writing the name and contact details of the donor at the top of the form. Ensure that the information is accurate and up-to-date.

04

Next, indicate the date of the donation. This is important for record-keeping purposes.

05

Provide a comprehensive description of the donated item. Include any relevant details or specifications that may increase its value or importance. For example, if the donation is a piece of artwork, specify the artist and any notable characteristics.

06

Determine the fair market value of the donation. This can be done through research or by seeking the advice of a professional appraiser. Make sure the valuation reflects the current market value.

07

Record the value of the donation on the form. It is essential to accurately represent the value of the item to comply with tax regulations.

08

If you are unsure about the value of the donation, consult with the organization or individual receiving the donation. They may have specific guidelines or requirements for valuing donations.

Who needs donations valued at 250:

01

Non-profit organizations: Many non-profits rely on donations to sustain their operations and fulfill their missions. Donations valued at 250 can significantly contribute to their funding and support their programs.

02

Charitable foundations: Charitable foundations often provide grants or support to causes aligned with their mission. Donations valued at 250 may qualify for funding or receive special consideration for funding opportunities.

03

Individual recipients: People facing financial hardship, medical conditions, or other challenges can greatly benefit from donations valued at 250. These donations can help cover expenses or provide necessary resources in times of need.

04

Educational institutions: Schools, colleges, and universities often rely on donations to improve facilities, fund scholarships, or enhance educational programs. Donations valued at 250 can contribute to these initiatives and directly impact students' education.

05

Cultural and arts organizations: Museums, galleries, and theaters depend on donations to maintain and expand their cultural offerings. Contributions valued at 250 can support exhibitions, performances, and educational programs in these institutions.

Remember, while these are common recipients for donations valued at 250, there may be specific organizations or individuals in your community with unique needs. It's always best to research and ensure that your donation is going to a worthy cause.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donations valued at 250 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your donations valued at 250 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out the donations valued at 250 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign donations valued at 250. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit donations valued at 250 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute donations valued at 250 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is donations valued at 250?

Donations valued at 250 refer to monetary or non-monetary contributions that are estimated to be worth $250.

Who is required to file donations valued at 250?

Individuals or organizations who receive donations valued at 250 or more are required to file the necessary paperwork with the appropriate authorities.

How to fill out donations valued at 250?

Donations valued at 250 can be filled out by providing detailed information about the donation, including the donor's name, contact information, the value of the donation, and any specific conditions or restrictions attached to the donation.

What is the purpose of donations valued at 250?

The purpose of reporting donations valued at 250 is to ensure transparency and accountability in the donation process, as well as to track and regulate the flow of donations within a community or organization.

What information must be reported on donations valued at 250?

The information that must be reported on donations valued at 250 includes the donor's name, contact information, the value of the donation, and any specific conditions or restrictions attached to the donation.

Fill out your donations valued at 250 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donations Valued At 250 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.