OH SD 100 (Formerly SD 100X) 2021 free printable template

Show details

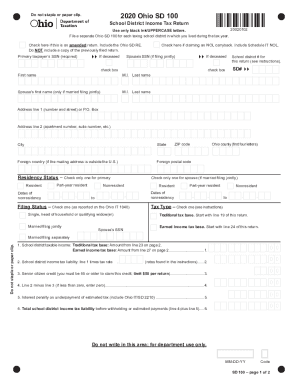

Clear Form2021 Ohio SD 100Do not staple or paper clip. School District Income Tax Return

21020106

Use only black ink/UPPERCASE letters.

File a separate Ohio SD 100 for each taxing school district

pdfFiller is not affiliated with any government organization

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

How to fill out OH SD 100 Formerly SD 100X

Instructions and Help about OH SD 100 Formerly SD 100X

How to edit OH SD 100 Formerly SD 100X

To edit the OH SD 100 tax form, you can use pdfFiller's online editor. This tool allows you to make changes directly on the form, ensuring all information is accurately reflected before submission. Editing is straightforward; simply upload the form to pdfFiller, make necessary adjustments, and save your updates.

How to fill out OH SD 100 Formerly SD 100X

Filling out the OH SD 100 requires collecting specific financial information related to the taxable transactions made during the tax year. Follow these steps to ensure proper completion:

01

Download the form from a reliable source or access it via pdfFiller.

02

Provide identifying details such as your name, address, and social security number.

03

Input the total amount of taxable sales, including the applicable tax rate.

04

Review the form for any required signatures or additional attachments.

Ensure each section is filled accurately to avoid penalties or delays with the submission.

About OH SD 100 Formerly SD 100X 2021 previous version

What is OH SD 100 Formerly SD 100X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH SD 100 Formerly SD 100X 2021 previous version

What is OH SD 100 Formerly SD 100X?

OH SD 100 is a tax form previously known as SD 100X, utilized in Ohio for reporting certain income and sales transactions. This form is essential for allowing the state to track and assess tax compliance for businesses and individuals. Although the form may be revised over the years, the fundamental reporting requirements remain consistent.

What is the purpose of this form?

The purpose of the OH SD 100 is to provide the Ohio Department of Taxation with a record of taxable transactions that are subject to state income tax. This includes detailed reporting of sales and other taxable activities. Proper completion of the form assists the state in ensuring fair tax collection and compliance among taxpayers.

Who needs the form?

Individuals and businesses engaged in taxable sales within Ohio are required to fill out the OH SD 100. This includes retailers, service providers, and anyone receiving income subject to Ohio tax law. Understanding your obligations regarding this form is crucial for maintaining compliance with state tax regulations.

When am I exempt from filling out this form?

Exemptions from filing the OH SD 100 may apply to certain categories of income or specific individuals who do not meet the minimum income thresholds required for tax purposes. For example, if your taxable sales are below a certain amount established by the state, you may not need to file this form. It is important to verify your eligibility for exemption with the Ohio Department of Taxation.

Components of the form

The OH SD 100's primary components include your contact information, details of taxable sales, itemized deductions (if applicable), and a declaration at the end requiring your signature. Each section must be completed accurately to ensure correct processing by the tax authorities.

What are the penalties for not issuing the form?

Failing to file the OH SD 100 can result in significant penalties, including fines and interest on unpaid taxes. The Ohio Department of Taxation enforces these penalties to encourage timely and accurate filing. It is advisable to file the form even if you believe you are not obligated to avoid any potential consequences.

What information do you need when you file the form?

When filing the OH SD 100, gather all necessary documentation regarding your sales transactions throughout the tax year. This includes sales receipts, records of expenditures, and any previous tax returns that may support your current filing. Accurate documentation can facilitate smoother processing and reduce the risk of audits.

Is the form accompanied by other forms?

The OH SD 100 may require accompanying forms depending on the specific circumstances of your tax situation. If you are claiming deductions or exemptions, supplementary documentation may be necessary. Always check instructions related to the OH SD 100 for requirements of additional forms or schedules.

Where do I send the form?

The completed OH SD 100 should be sent to the Ohio Department of Taxation. Ensure that you use the correct mailing address as stated in the form instructions or the department's official website. Timely submission of the form allows for efficient processing and compliance with state laws.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.