IRS W-9 2013 free printable template

Show details

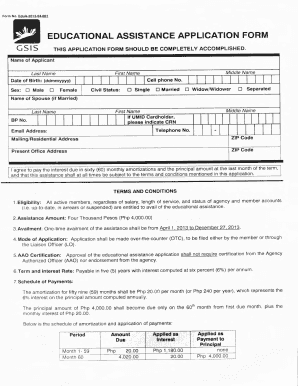

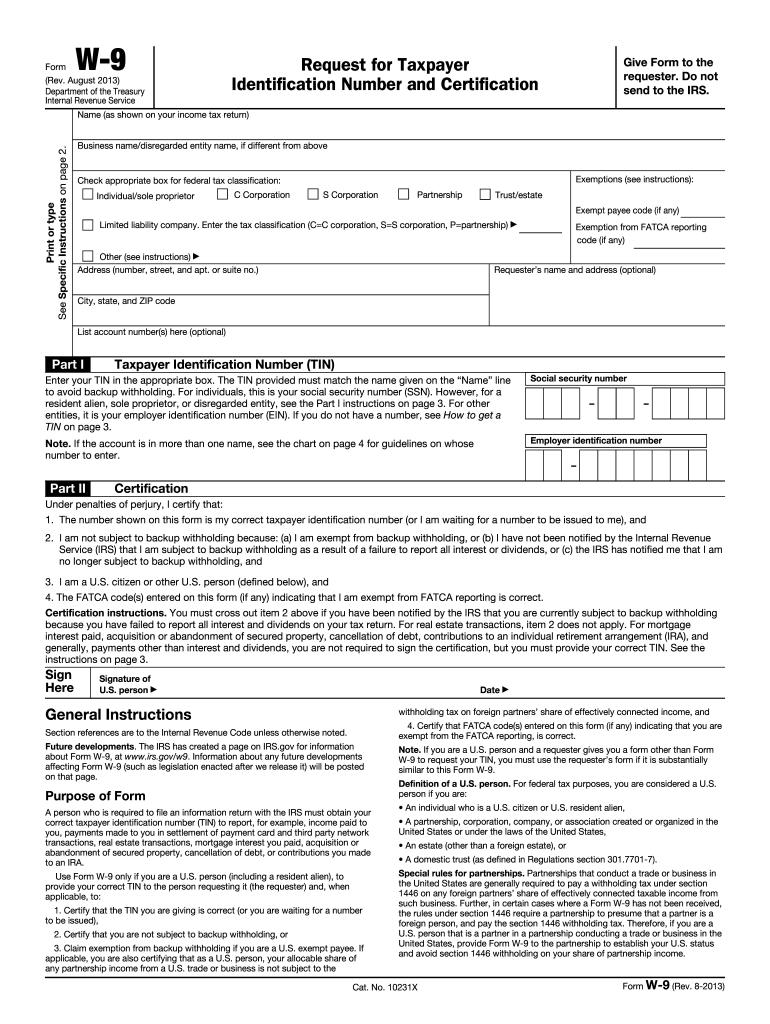

W-9 Form Rev. August 2013 Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification Give Form to the requester. Cat. No. 10231X Form W-9 Rev. 8-2013 Page 2 In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business Updating Your Information In the case of a grantor...trust with a U.S. grantor or other U.S. owner generally the U.S. grantor or other U.S. owner of the grantor trust and not the trust and You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example you may need to provide updated information if you are a C corporation that elects to be an S corporation or if you no longer are tax exempt. Do...not send to the IRS* Print or type See Specific Instructions on page 2. Name as shown on your income tax return Business name/disregarded entity name if different from above Exemptions see instructions Check appropriate box for federal tax classification Individual/sole proprietor C Corporation Partnership Trust/estate Exempt payee code if any Limited liability company. Enter the tax classification C C corporation S S corporation P partnership Other see instructions Address number street and...apt. or suite no. Exemption from FATCA reporting code if any Requester s name and address optional City state and ZIP code List account number s here optional Part I Taxpayer Identification Number TIN Enter your TIN in the appropriate box. The TIN provided must match the name given on the Name line to avoid backup withholding. For individuals this is your social security number SSN. However for a resident alien sole proprietor or disregarded entity see the Part I instructions on page 3. For...other entities it is your employer identification number EIN. If you do not have a number see How to get a TIN on page 3. Social security number Note. If the account is in more than one name see the chart on page 4 for guidelines on whose number to enter. Employer identification number Certification Under penalties of perjury I certify that 1. The number shown on this form is my correct taxpayer identification number or I am waiting for a number to be issued to me and 2. I am not subject to...backup withholding because a I am exempt from backup withholding or b I have not been notified by the Internal Revenue Service IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends or c the IRS has notified me that I am no longer subject to backup withholding and 3. I am a U*S* citizen or other U*S* person defined below and 4. The FATCA code s entered on this form if any indicating that I am exempt from FATCA reporting is correct. because you...have failed to report all interest and dividends on your tax return* For real estate transactions item 2 does not apply.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

Instructions and Help about IRS W-9

How to edit IRS W-9

You can edit the IRS W-9 form using pdfFiller's online tools. Simply upload your W-9 form, click on the appropriate fields to enter or update information, and save your changes. This process ensures that you maintain a correct and updated version of your form.

How to fill out IRS W-9

Filling out the IRS W-9 form involves several essential steps. Begin by entering your name as it appears on your tax return. Next, provide your business name if applicable. Follow with your address, indicating whether it’s residential or business. Importantly, include your Tax Identification Number (TIN), which could be your Social Security Number (SSN) or Employer Identification Number (EIN). Finally, sign and date the form at the bottom.

About IRS W-9 2013 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-9 2013 previous version

What is IRS W-9?

The IRS W-9 form is a Taxpayer Identification Number and Certification form used in the United States. This form is utilized by individuals and businesses to provide their Tax Identification Numbers to those who will report payments to the IRS. The W-9 is essential for correct tax reporting and compliance purposes.

What is the purpose of this form?

The primary purpose of the IRS W-9 form is to collect and verify the taxpayer information to ensure accurate reporting of income paid to independent contractors, freelancers, and vendors. The form enables payers to acquire the necessary details for issuing tax documents such as Form 1099, which reports various types of income received throughout the year.

Who needs the form?

Individuals and entities that engage in business transactions where they receive payments that could be taxable must complete the IRS W-9 form. This includes independent contractors, freelancers, partnerships, and corporations that provide services in exchange for compensation. Essentially, anyone who will receive income that needs to be reported to the IRS may need to submit a W-9.

When am I exempt from filling out this form?

You are generally exempt from filling out the W-9 form if you are a foreign entity, providing services outside the U.S., or if you are a tax-exempt organization. Additionally, certain government entities may not be required to complete the form, but it is important to confirm with the requester if they require specific information for reporting purposes.

Components of the form

The IRS W-9 contains several key components: the taxpayer's name, business name (if applicable), address, Tax Identification Number (TIN), and signature. Each component is crucial for accurate identification and reporting. Additionally, the form includes a certification section where the taxpayer certifies that the information provided is correct and that they are not subject to backup withholding.

What are the penalties for not issuing the form?

Failure to issue the IRS W-9 form when required can lead to potential penalties. Specifically, businesses that do not collect W-9 forms may face issues when filing Form 1099, potentially resulting in incorrect reporting and fees. The penalties can include fines enforced by the IRS for non-compliance or incorrect tax filings.

What information do you need when you file the form?

When filing the IRS W-9 form, you must provide the following information: your full legal name, business name (if applicable), mailing address, Tax Identification Number (Social Security Number or Employer Identification Number), and your signature to certify the accuracy of the information provided. Accurate and complete information ensures compliance with IRS regulations.

Is the form accompanied by other forms?

The IRS W-9 generally does not require accompanying forms when submitted. However, when used for payment purposes, particularly with the issuance of Form 1099, the W-9 must be collected to ensure the payee's information is complete for tax reporting. Always verify whether the requester has specific additional requirements to accompany the W-9.

Where do I send the form?

The IRS W-9 form is not submitted directly to the IRS. Instead, you need to provide it to the requester who asked for it, such as an employer, contractor, or financial institution. Keep a copy for your records, as this could protect you in the event of any issues regarding your reported income.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It is great to be able to do this online

Been great, easy to work and add documents!!

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.