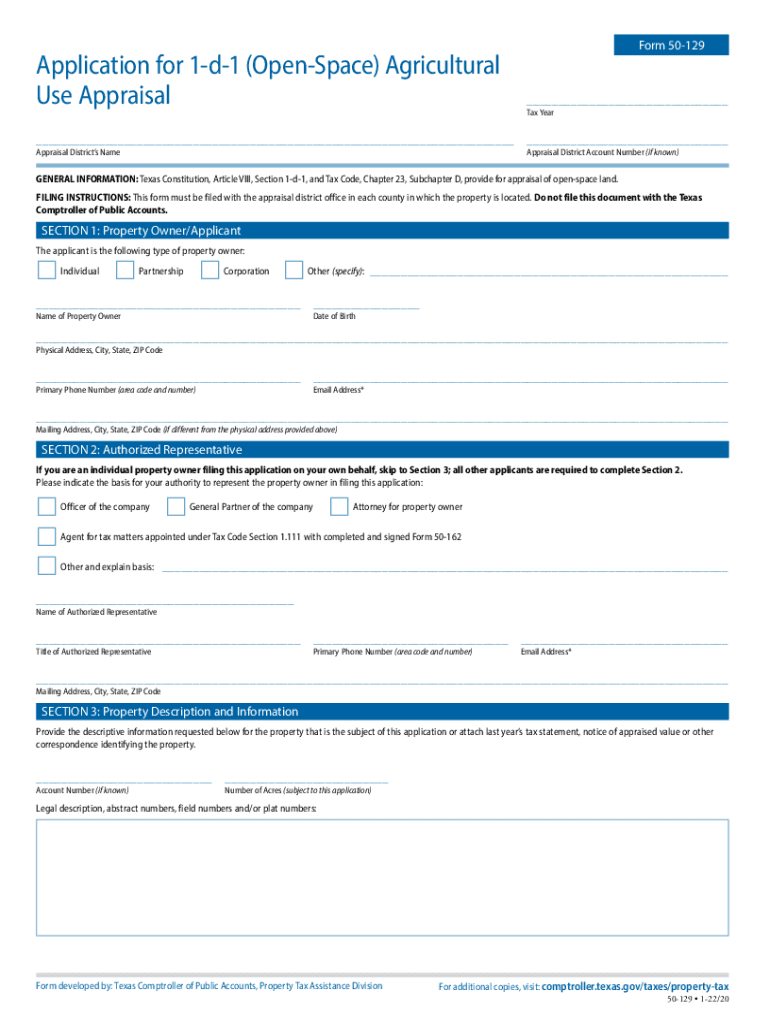

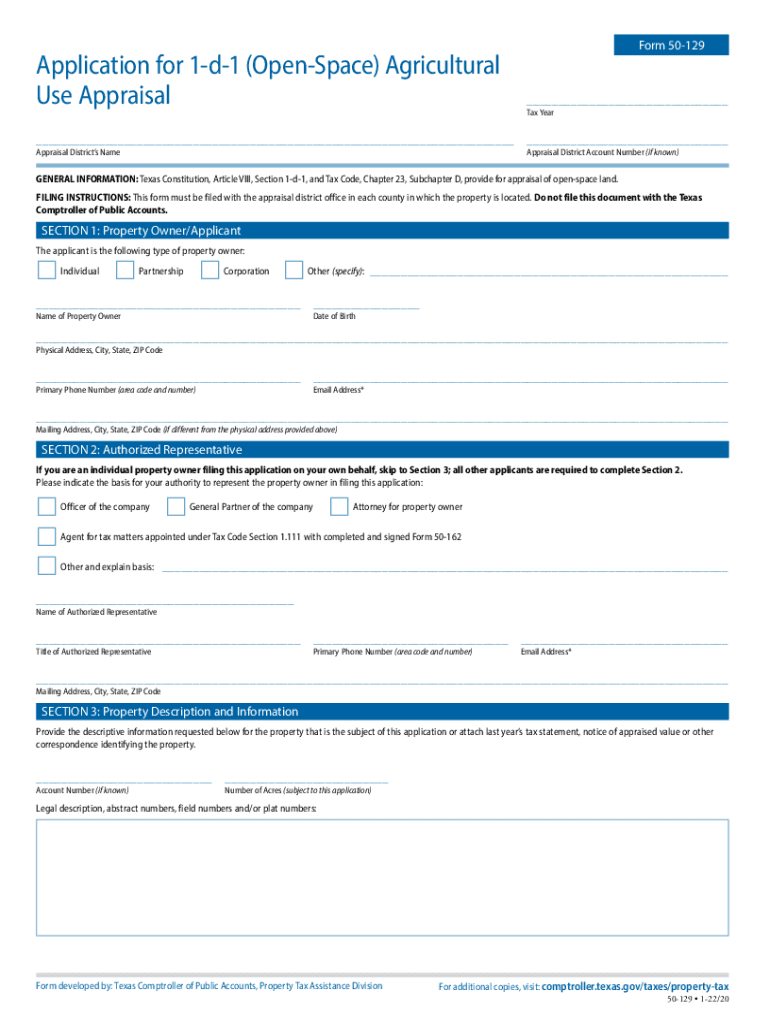

TX Form 50-129 2022 free printable template

Get, Create, Make and Sign 1 d 1 agricultural

Editing 1 d 1 agricultural online

Uncompromising security for your PDF editing and eSignature needs

TX Form 50-129 Form Versions

How to fill out 1 d 1 agricultural

How to fill out TX Form 50-129

Who needs TX Form 50-129?

Instructions and Help about 1 d 1 agricultural

If you don't have a Web file account view our how to create a Web file account video to learn how to sign up If you already have an account let's continue Welcome to the franchise tax no tax due information report video Before moving on with the rest of the form confirm you are eligible to file a no tax due information report Your business can qualify to file a no tax due report if any of the following statements are true Your business is an entity or a combined group with annualized total revenue less than or equal to the no tax due threshold Your business has zero Texas receipts Your business is a passive entity as define din Chapter 171 of the Texas Tax Code Or your business is a real estate investment trust as specified in Section 1710002c4 of the Texas Tax Code So if you are eligible let's continue From our home page select the Web file button Enter your user ID and password and select login From the systems' menu select Web file pay taxes and fees Select the 11 digit taxpayer number next tithe franchise tax account you previously assigned If your account is not listed you'll need to add it to your profile Enter the 11 digit taxpayer number If you don't know your number go to our how to find your 11 digit taxpayer number video Select continue to add additional available taxes and fees Select file a no tax due information report and select continue Select the report year If you receive the error message no period of obligation contact the franchise tax section at 1-800-531-5441 Ext 34402 for more information about this error Select continue Now you can confirm your eligibility to file no tax due information report Gather the information you need to file the report and select continue Answer the questions by selecting yes or no and then select continue to Remember if there are any terms you don'ttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttttunderstand you can click on help for definitions Enter your SIC and NAILS code If you don't have your SIC or NAILS code you may still continue to file your report Enter the accounting year beginning and end dates Respond to the qualification questions To qualify to file a no tax due report the answer to at least one of these questions must be yes Now enter the total revenue for your business for the accounting year you designated above and select continue On the current mailing address screen verify the information is correct and make any necessary updates Note that any updates you make will only update the franchise mailing address on file with the Comptroller's office Select continue On the public information report page update any incorrect information In the registered agent and office section select yes or no to designate whether you need forms to change the information Read the declaration statement and check on the box to confirm the information is accurate Select continue The franchise tax review report page allows you to review the data you've entered before...

People Also Ask about

What is the easiest ag exemption in Texas?

How do you qualify for agricultural property tax exemption in Texas?

How many acres do you need for ag exemption in Texas?

What qualifies for agricultural exemption in Texas?

What is the ag exempt form 01 924 in Texas?

What form do I need for tax exemption in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1 d 1 agricultural in Gmail?

How can I send 1 d 1 agricultural to be eSigned by others?

How do I complete 1 d 1 agricultural on an Android device?

What is TX Form 50-129?

Who is required to file TX Form 50-129?

How to fill out TX Form 50-129?

What is the purpose of TX Form 50-129?

What information must be reported on TX Form 50-129?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.