TX Form 50-129 2019 free printable template

Show details

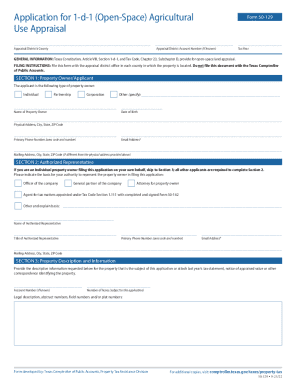

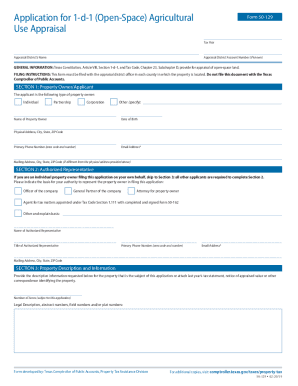

Form Texas Comptroller of Public Accounts 50-129 Application for 1-d-1 Open-Space Agricultural Use Appraisal Appraisal District s Name Phone area code and number Address City State ZIP Code GENERAL INFORMATION Texas Constitution Article VIII Section 1-d-1 and Tax Code Chapter 23 Subchapter D provide for appraisal of open-space land. Yes No For more information visit our website comptroller. texas. gov/taxes/property-tax 50-129 1-18/16 SECTION 1 Property Owner/Applicant The applicant is the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Form 50-129

Edit your TX Form 50-129 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Form 50-129 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Form 50-129 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Form 50-129. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form 50-129 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Form 50-129

How to fill out TX Form 50-129

01

Obtain the TX Form 50-129 from the Texas Comptroller's website or your local tax office.

02

Fill in your business name as it appears on your tax documents.

03

Provide the physical address of your business location.

04

Enter the mailing address if it differs from your business location.

05

Include your Texas taxpayer identification number, if applicable.

06

Select the appropriate status for your business (e.g., sole proprietorship, partnership, corporation).

07

List the names and addresses of the owners or partners involved.

08

Sign and date the form to certify the information provided is accurate.

09

Submit the completed form to the appropriate taxing authority or office.

Who needs TX Form 50-129?

01

Any business operating in Texas that is seeking a state franchise or sales tax permit.

02

Individuals or entities looking to register their business with the Texas Comptroller.

03

Businesses that need to update their existing information or make changes to their tax status.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get a wildlife tax exemption in Texas?

Texas wildlife exemption eligibility requires actively using the land. To meet this requirement, landowners must conduct at least three of seven wildlife management practices, also known as activities, each year to keep a wildlife exemption in good standing.

How many acres do you need for ag exemption in Texas?

Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be eligible. Check with your county to verify.

How to get an agricultural property tax exemption in Texas?

What qualifies as ag exemption in Texas? Only land that is primarily being used – and has been used for at least five of the past seven years – for agricultural purposes may qualify for an ag exemption in Texas. Agricultural purposes include crop production, livestock, beekeeping, and similar activities.

How many acres do you need to qualify for ag exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

How do you qualify for agricultural tax exemption in Texas?

All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to claim exemption from Texas tax. If you do not have a valid Ag/Timber Number, you must pay tax to retailers on your purchases.

What form is required for wildlife exemption in Texas?

Property owners must submit Form 50-129 and a wildlife management plan that details the native wildlife managed for and the specific management practices that will occur on the property. This form is required when initially applying for agricultural use or for a change in the type of agricultural use.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TX Form 50-129 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing TX Form 50-129 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit TX Form 50-129 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing TX Form 50-129.

How do I complete TX Form 50-129 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your TX Form 50-129, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is TX Form 50-129?

TX Form 50-129 is a property tax form used in Texas for reporting the ownership and use of property to the appraisal district.

Who is required to file TX Form 50-129?

Entities or individuals who own tangible personal property that is used for business purposes in Texas are required to file TX Form 50-129.

How to fill out TX Form 50-129?

To fill out TX Form 50-129, you must provide information about the property, including its description, location, and the owner's details, while also indicating its use and value.

What is the purpose of TX Form 50-129?

The purpose of TX Form 50-129 is to assess the value of tangible personal property for taxation purposes within the state of Texas.

What information must be reported on TX Form 50-129?

Information that must be reported on TX Form 50-129 includes the owner's name and address, a description of the property, its location, and its estimated market value as of January 1st.

Fill out your TX Form 50-129 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Form 50-129 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.