TX Form 50-129 2011 free printable template

Show details

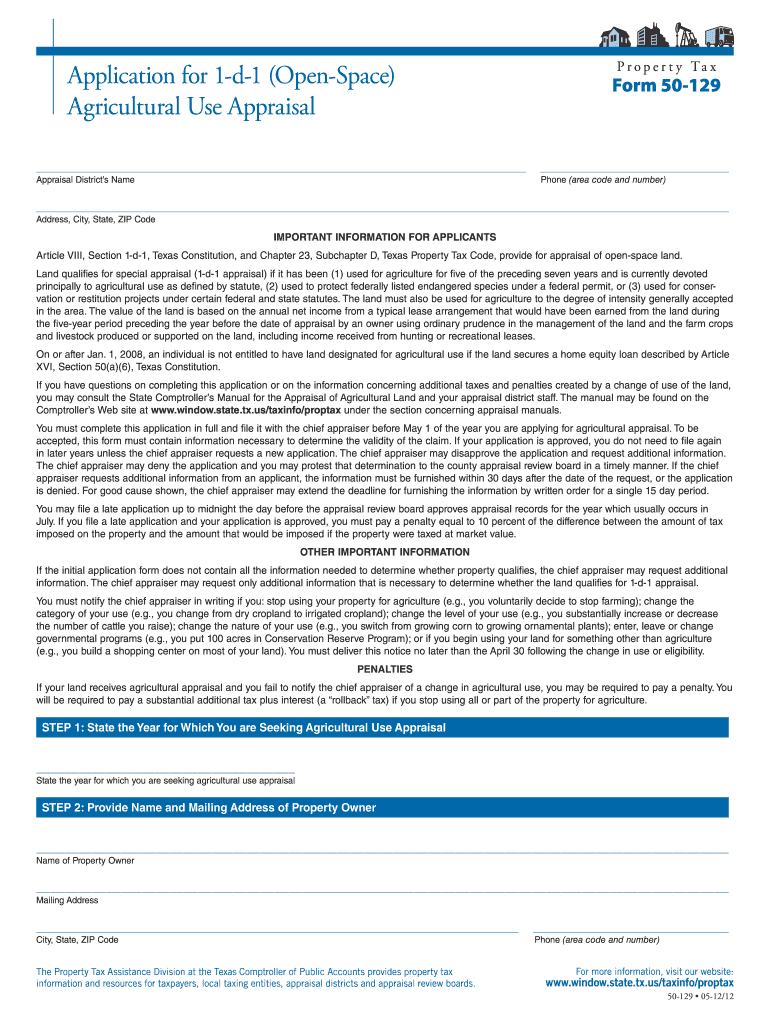

2. Last year were you allowed 1-d-1 appraisal on this property by the chief appraiser of this appraisal district. A Was the land subject to wildlife management a part of a larger tract of land qualified for 1-d-1 or timber land appraisal on January 1 of the previous year. Application for 1-d-1 Open-Space Agricultural Use Appraisal P r o p e r t y Ta x Form 50-129 Appraisal District s Name Phone area code and number Address City State ZIP Code IMPORTANT INFORMATION FOR APPLICANTS Article VIII...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 1 d 1 2011

Edit your 1 d 1 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 d 1 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1 d 1 2011 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1 d 1 2011. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form 50-129 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1 d 1 2011

How to fill out TX Form 50-129

01

Go to the Texas Comptroller's website to access TX Form 50-129.

02

Download and print the form.

03

Fill in the property owner's name and address in the designated sections.

04

Provide the account number and location of the property.

05

Indicate the type of exemption being requested by checking the appropriate box.

06

Attach any required supporting documentation, such as proof of eligibility.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the form to the appropriate appraisal district by mail or in person.

Who needs TX Form 50-129?

01

Property owners in Texas who are seeking a property tax exemption.

02

Individuals who have recently purchased property and need to apply for exemptions.

03

Non-profit organizations and other entities that qualify for specific tax exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What is the easiest ag exemption in Texas?

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land.

How do you qualify for agricultural property tax exemption in Texas?

All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to claim exemption from Texas tax. If you do not have a valid Ag/Timber Number, you must pay tax to retailers on your purchases.

How many acres do you need for ag exemption in Texas?

Ag exemption requirements vary by county, but generally you need at least 10 acres of qualified agricultural land to be eligible. Check with your county to verify.

What qualifies for agricultural exemption in Texas?

What qualifies as ag exemption in Texas? Only land that is primarily being used – and has been used for at least five of the past seven years – for agricultural purposes may qualify for an ag exemption in Texas. Agricultural purposes include crop production, livestock, beekeeping, and similar activities.

What is the ag exempt form 01 924 in Texas?

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in the production of agricultural products for sale.

What form do I need for tax exemption in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 1 d 1 2011 online?

pdfFiller has made it easy to fill out and sign 1 d 1 2011. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the 1 d 1 2011 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 1 d 1 2011.

How do I fill out the 1 d 1 2011 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 1 d 1 2011 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is TX Form 50-129?

TX Form 50-129 is a property tax form used in Texas for reporting information related to the appraisal of property for property tax purposes.

Who is required to file TX Form 50-129?

Property owners, including individuals and businesses, who own property in Texas and need to report specifics about their property for tax assessment purposes are required to file TX Form 50-129.

How to fill out TX Form 50-129?

To fill out TX Form 50-129, one must provide accurate property details such as the owner's name, property address, and description of the property, along with any required financial data and signatures.

What is the purpose of TX Form 50-129?

The purpose of TX Form 50-129 is to gather specific information to assist tax assessors in determining the fair market value of properties for tax assessment purposes.

What information must be reported on TX Form 50-129?

The information that must be reported on TX Form 50-129 includes property owner's details, property address, property type, and any applicable legal descriptions or financial information relevant to the property.

Fill out your 1 d 1 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 D 1 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.