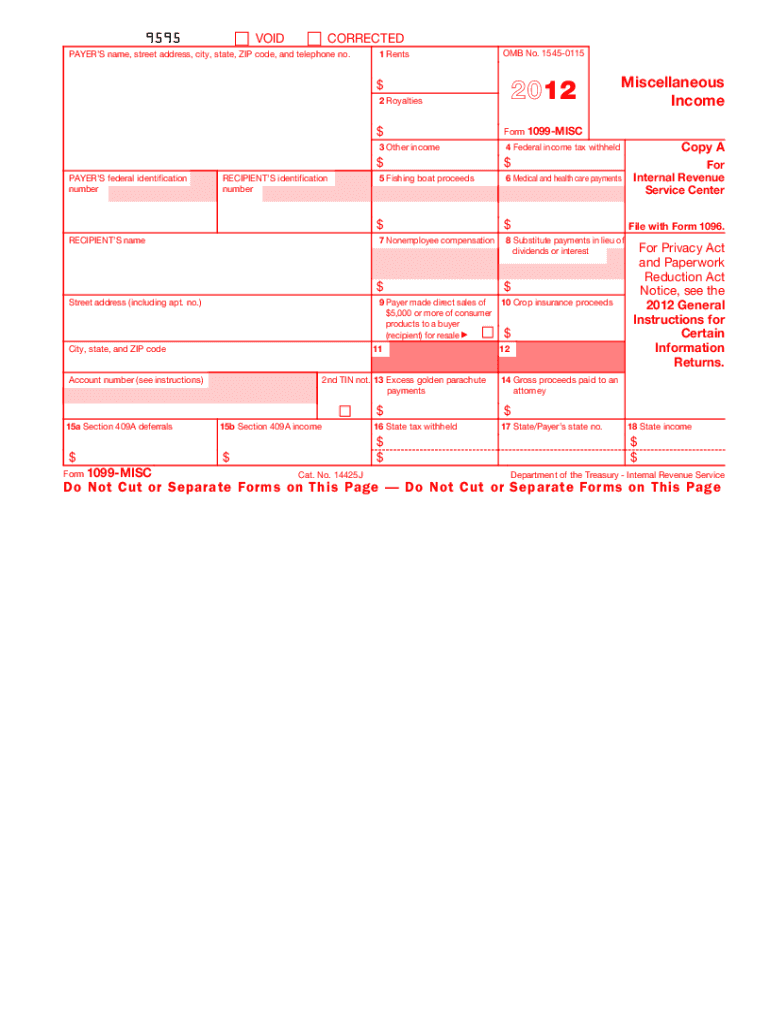

About IRS 1099-MISC 2012 previous version

What is IRS 1099-MISC?

IRS 1099-MISC is a tax form used to report miscellaneous income. This form is primarily employed to inform the IRS about payments made to independent contractors, freelancers, and various non-employee compensation. The information reported on the 1099-MISC helps the IRS ensure compliance with tax regulations by tracking income that may not be reported on traditional employment W-2 forms.

What is the purpose of this form?

The purpose of IRS 1099-MISC is to report payments that are not covered under standard wage reporting processes. This includes rents, prizes, awards, and medical payments among others. By issuing this form, filers ensure that all income streams are accurately reported to the IRS, promoting transparency in financial transactions and compliance with federal tax laws.

Who needs the form?

Any individual or business that has made payments totaling $600 or more to a non-employee, such as independent contractors or freelancers, is required to file IRS 1099-MISC. This form is also necessary for reporting specific payments made in the course of trade or business, such as rent payments, legal fees, or other specified amounts that exceed established thresholds. Entities that fail to submit the form when required may face penalties.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1099-MISC if the payments made were to certain corporations, such as C corporations or S corporations, except for payments for legal services or medical payments. Additionally, if the payments were below the $600 threshold, you are not required to issue a 1099-MISC. Always verify against the most current IRS guidelines for specific exemptions relevant to your situation.

Components of the form

The IRS 1099-MISC form consists of multiple sections, including the payer’s information, recipient’s details, and the amounts paid. Key components include the payer's name, address, TIN, recipient's name, address, TIN, and specific boxes for reporting various types of payments. It's essential that all sections are filled out completely and accurately to avoid issues during tax reviews.

Due date

The due date for filing IRS 1099-MISC forms typically falls on January 31 of the year following the tax year in which payments were made. If the due date lands on a weekend or holiday, the filing deadline may be extended to the next business day. Timely submission is crucial to avoid penalties.

What payments and purchases are reported?

Payments reported on IRS 1099-MISC include earnings to independent contractors, rent payments, royalties, and other forms of miscellaneous income. It's important to assess which types of payments meet the reporting criteria to ensure compliance with IRS regulations. Specific thresholds apply, so review the form instructions to determine relevant amounts needing reporting.

How many copies of the form should I complete?

You should complete multiple copies of the IRS 1099-MISC: the first for the recipient, the second for filing with the IRS, and the third for your records. Additional copies may be required depending on state tax compliance if applicable. Ensuring that the correct number of copies are provided aids in proper tracking and reporting for tax purposes.

What are the penalties for not issuing the form?

Not issuing the IRS 1099-MISC when required can result in significant penalties. The IRS may impose fines ranging from $50 to $550 per form depending on how late the form is filed. Consistent failure to comply with reporting requirements may also lead to increased scrutiny during audits or reviews.

What information do you need when you file the form?

When filing IRS 1099-MISC, you need the following information: your name and TIN, the recipient's name, address, TIN, and the total amounts paid for that tax year. Any withholding amounts should also be noted. Having all this information ready ensures smooth completion and submission of the form.

Is the form accompanied by other forms?

IRS 1099-MISC may need to be submitted alongside Form 1096, which acts as a summary of the information returns filed. Form 1096 is typically required when submitting paper copies of the 1099 forms to the IRS. Ensure that you review IRS guidelines for any other forms that may accompany the 1099-MISC in your specific situation.

Where do I send the form?

IRS 1099-MISC forms must be sent to the IRS at the address specified for your state. If filing form 1099-MISC electronically, submission will occur through the IRS FIRE system. Confirm the current mailing addresses and procedures through the IRS website or tax resources to ensure compliance.