AZ AZ-140V 2021 free printable template

Show details

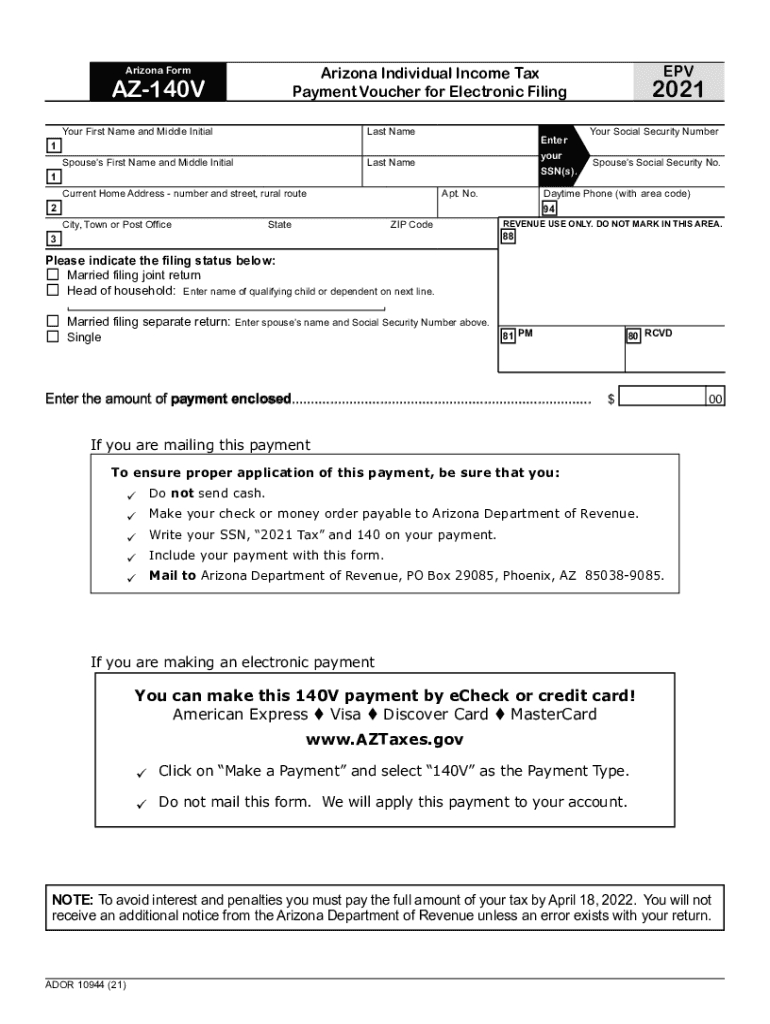

AZ140V Your First Name and Middle Initially Espouses First Name and Middle Initially Carpenter your SSN(s).1 1 Current Home Address number and street, rural route. No. State ZIP Code32021 Your Social

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

How to fill out AZ AZ-140V

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

To edit the AZ AZ-140V tax form, utilize tools like pdfFiller which allows users to modify fields directly within the document. You can upload the form, make necessary changes, and save the updated version for your records. Ensure all information is accurate before submitting to avoid issues with the filing process.

How to fill out AZ AZ-140V

To fill out the AZ AZ-140V form accurately, follow these steps:

01

Obtain the latest version of the form from an official source or a reputable tax preparation tool.

02

Enter your personal information, including your name, address, and Social Security number in the required fields.

03

Provide any financial details as specified in the form's instructions, ensuring they match your relevant tax documents.

04

Review the information entered for correctness before finalizing the form.

About AZ AZ-140V 2021 previous version

What is AZ AZ-140V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ AZ-140V 2021 previous version

What is AZ AZ-140V?

The AZ AZ-140V tax form is a state-specific document used in Arizona for reporting certain tax-related information. This form is essential for compliance with state tax regulations and is used by individuals and businesses to accurately report income, expenses, and other tax obligations.

What is the purpose of this form?

The purpose of the AZ AZ-140V is to provide the Arizona Department of Revenue with detailed information about income and transactions as part of the state tax filing process. This form helps ensure that taxpayers meet their obligations and report their financial activities correctly, aiding in the overall accuracy of tax assessments.

Who needs the form?

Individuals and businesses that conduct activities subject to taxation in Arizona may need to file the AZ AZ-140V form. Taxpayers including sole proprietors, partnerships, and corporations who report income, claim deductions, or require credits should be familiar with this form to ensure compliance with state laws.

When am I exempt from filling out this form?

Exemptions from filing the AZ AZ-140V may apply to certain individuals or entities based on their income level, type of income, or transactional activity. For instance, if your income falls below a particular threshold or if you do not engage in taxable transactions, you may not need to submit this form. It is important to review Arizona Department of Revenue guidelines or consult a tax professional to confirm your status.

Components of the form

The AZ AZ-140V form consists of several sections that require specific information, including personal identification details, income sources, and tax liability figures. Each component must be filled out accurately to ensure the proper processing of your tax obligations. Familiarize yourself with each section to minimize errors during completion.

What are the penalties for not issuing the form?

Failure to issue the AZ AZ-140V form when required can result in penalties, including fines and interest on unpaid taxes. Penalties may vary based on the length of the delay and the amount of tax owed. Ensuring timely and accurate submission is critical to avoid these consequences.

What information do you need when you file the form?

When filing the AZ AZ-140V form, you will need the following information:

01

Your personal identification details, including your name, address, and Social Security number.

02

A breakdown of your income sources, including wages, dividends, and other earnings.

03

Any applicable deductions or credits that may offset your tax liability.

Is the form accompanied by other forms?

The AZ AZ-140V form may need to be filed alongside other supporting documents or forms, especially if there are specific deductions or credits being claimed. Always check the filing instructions or consult a tax advisor to determine what additional documentation is necessary to accompany your form.

Where do I send the form?

Once completed, the AZ AZ-140V form should be submitted to the Arizona Department of Revenue. Ensure that you check the latest mailing address on their official website or the form instructions to avoid routing delays.

See what our users say