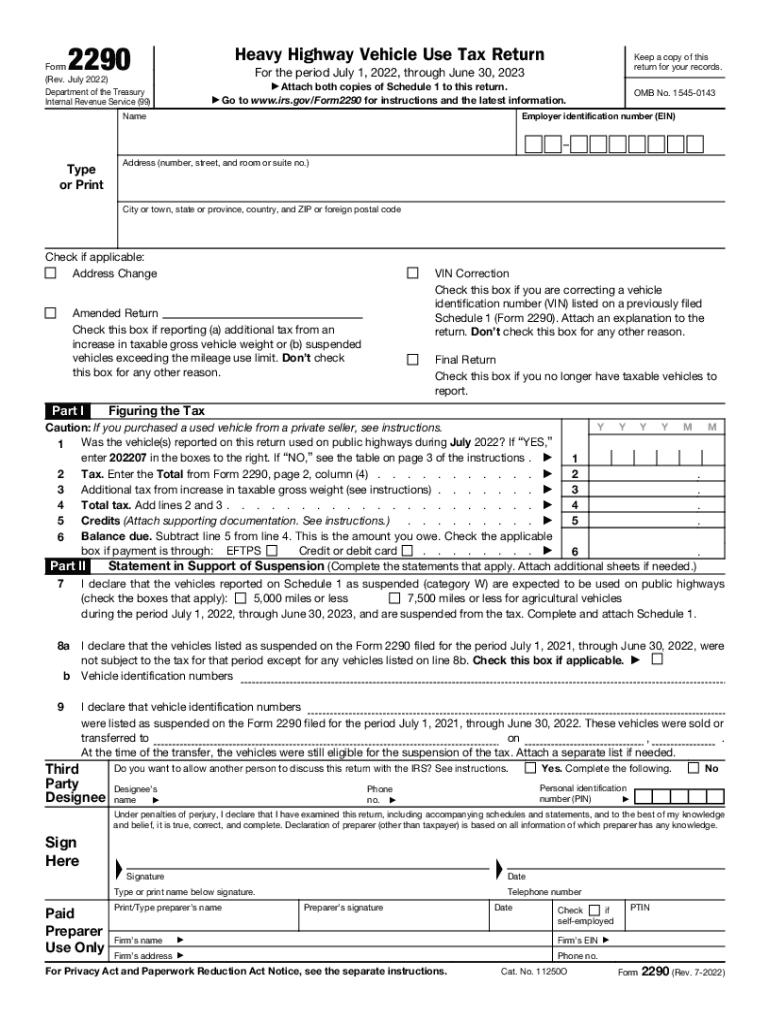

IRS 2290 2022 free printable template

Instructions and Help about IRS 2290

How to edit IRS 2290

How to fill out IRS 2290

About IRS 2 previous version

What is IRS 2290?

Who needs the form?

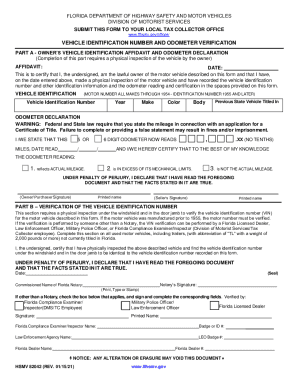

Components of the form

What information do you need when you file the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about IRS 2290

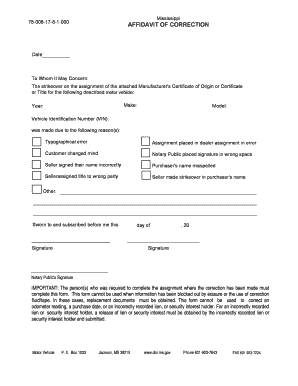

What should I do if I realize I made an error after filing my IRS 2290?

If you discover a mistake on your filed IRS 2290, you can submit a Form 2290 amendment. This allows you to correct errors and ensure that your filing reflects accurate information. It's essential to promptly address any discrepancies to avoid potential penalties or complications with your tax obligations.

How can I verify that my IRS 2290 was processed successfully?

To confirm the status of your IRS 2290, you can use the IRS e-File status tool available on their website. This tool allows you to check the receipt and processing status of your form. Be sure to have your information handy, such as your Employer Identification Number (EIN) and the tax year to track your submission effectively.

What should I be aware of regarding the e-signature when filing my IRS 2290 electronically?

When e-filing your IRS 2290, the IRS accepts electronic signatures provided you use an authorized e-filing software. It's crucial to ensure that the software you are using complies with IRS regulations to maintain the integrity and security of your filing. Always keep records of your submission and any IRS communications for your files.

What are common errors to avoid when submitting my IRS 2290?

Common errors when filing an IRS 2290 include incorrect EINs, misspelled names, and choosing the wrong tax year. Double-check all the information entered to avoid rejections and delays in processing. If your form is rejected due to errors, you may incur additional service fees for resubmission, so taking the extra time to verify details is essential.

What technical requirements should I consider when e-filing my IRS 2290?

When e-filing your IRS 2290, ensure that your software is compatible with the IRS e-file system and that your browser is updated for optimal performance. Use a secure internet connection to prevent data breaches. It's also advisable to check for specific requirements outlined by your e-filing provider to ensure a smooth submission process.

See what our users say