Get the free Business Debt Schedule: Examples, Templates & More

Show details

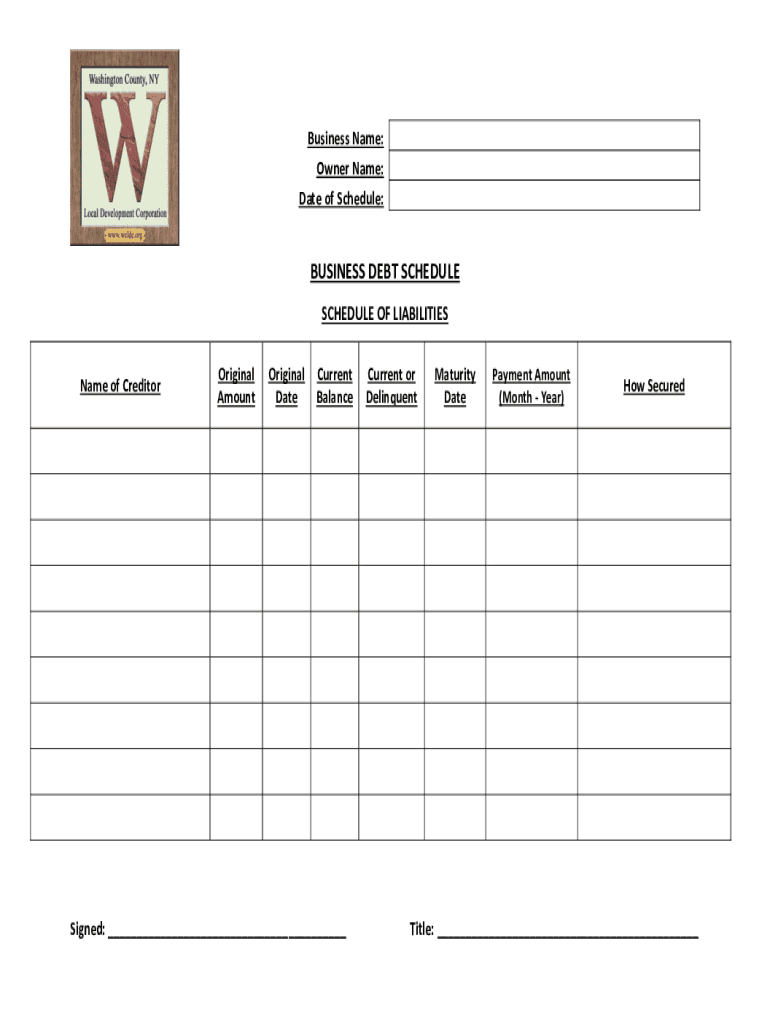

Business Name:

Owner Name:

Date of Schedule:BUSINESS DEBT SCHEDULE OF LIABILITIES

Name of CreditorOriginal

AmountOriginal

Deterrent

BalanceSigned: ___Current or

DelinquentMaturity

Repayment Amount

(Month

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business debt schedule examples

Edit your business debt schedule examples form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business debt schedule examples form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business debt schedule examples online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business debt schedule examples. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business debt schedule examples

How to fill out business debt schedule examples

01

Start by gathering all the necessary information about your business debt. This includes the name of the creditor, the outstanding balance of the debt, the interest rate, the repayment terms, and any collateral associated with the debt.

02

Organize the information in a spreadsheet or a debt schedule template. You can use software like Microsoft Excel or Google Sheets to create a structured format for your debt schedule.

03

Create separate rows for each debt obligation, and list the information gathered in step 1 in the respective columns.

04

Calculate the total outstanding debt by adding up the balances of all the debts.

05

Determine the allocation of repayments by considering factors like interest rates, maturity dates, and collateral. This will help you prioritize the payment of certain debts over others.

06

In the spreadsheet, track the payments made towards each debt over time. Update the schedule regularly to reflect any changes or adjustments.

07

Include a summary section in your debt schedule that provides an overview of all the debts, such as the total outstanding balance, interest rate, and repayment terms.

08

Review and analyze the debt schedule periodically to assess your business's financial health and identify opportunities for debt management or restructuring.

09

Make sure to keep accurate records and retain all supporting documentation related to your business debt schedule.

Who needs business debt schedule examples?

01

Business owners who have multiple debts and want to have a clear overview of their outstanding obligations.

02

Financial managers or accountants responsible for tracking and managing company debts.

03

Lenders or potential investors who require a comprehensive understanding of a business's debt obligations before making lending or investment decisions.

04

Business consultants or advisors who assist companies with financial planning or debt restructuring.

05

Entrepreneurs or individuals considering starting a business and want to understand the importance of managing debt effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business debt schedule examples without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including business debt schedule examples. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find business debt schedule examples?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the business debt schedule examples in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit business debt schedule examples in Chrome?

Install the pdfFiller Google Chrome Extension to edit business debt schedule examples and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is business debt schedule examples?

Business debt schedule examples are documents that outline the debts a business owes, including the amount owed, interest rates, and payment schedules.

Who is required to file business debt schedule examples?

Businesses of all sizes and types may be required to file business debt schedule examples, especially when seeking financing or going through bankruptcy proceedings.

How to fill out business debt schedule examples?

To fill out a business debt schedule examples, gather information on all outstanding debts, including creditor information, debt amounts, interest rates, and payment terms. Then organize this information into a clear, easy-to-read schedule.

What is the purpose of business debt schedule examples?

The purpose of business debt schedule examples is to provide a detailed overview of a company's outstanding debts, helping to assess financial health, make informed decisions, and plan for debt repayment.

What information must be reported on business debt schedule examples?

Business debt schedule examples must include details on each debt, such as creditor name, debt amount, interest rate, payment terms, and maturity date.

Fill out your business debt schedule examples online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Debt Schedule Examples is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.