KY DoR 725 (41A725) 2021 free printable template

Show details

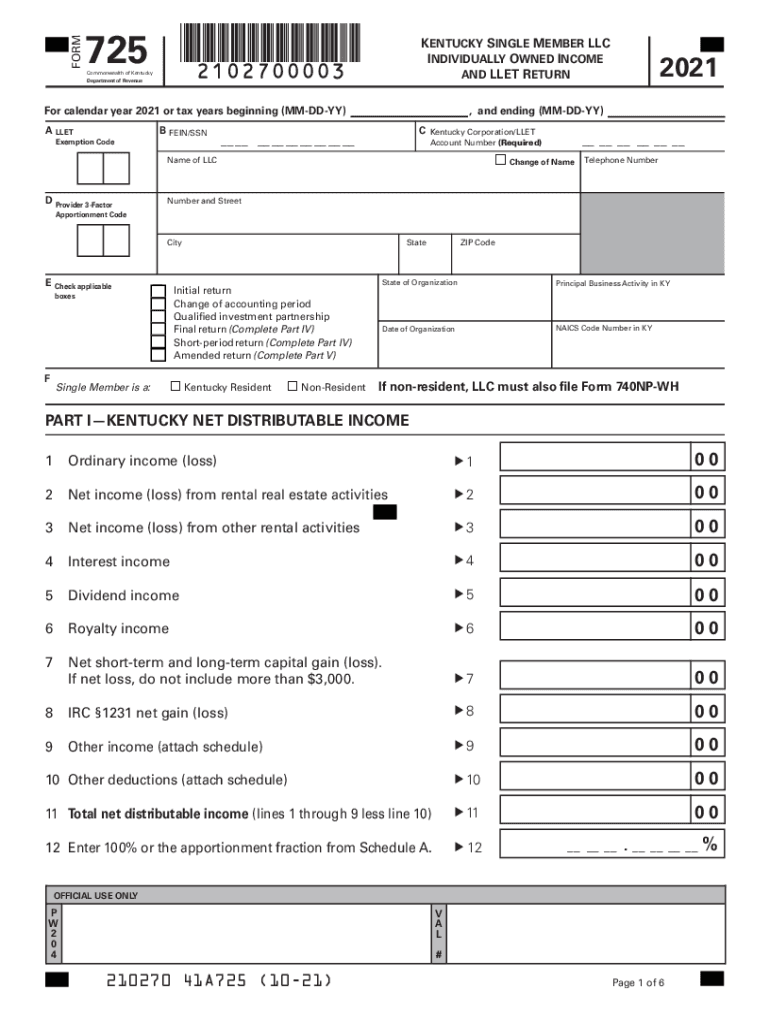

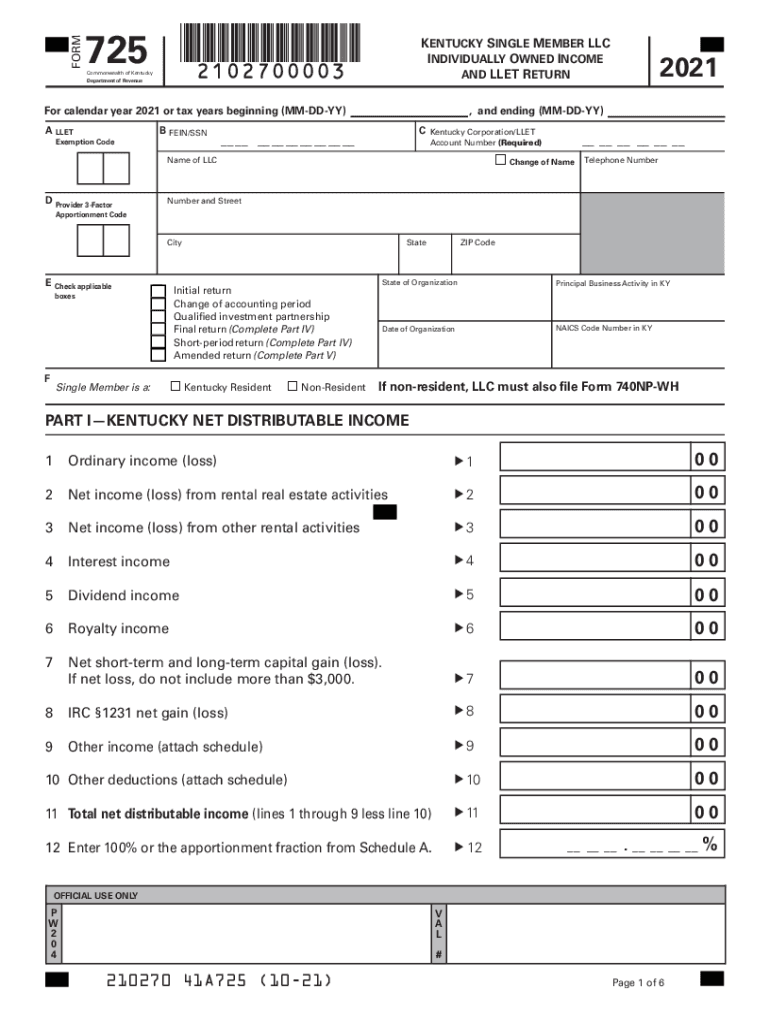

FORM725KENTUCKY SINGLE MEMBER LLC INDIVIDUALLY OWNED INCOME AND LET RETURN Commonwealth of Kentucky Department of Revenue2021For calendar year 2021 or tax years beginning (MIDDAY) __ ____ __20__ __,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 725 41A725

Edit your KY DoR 725 41A725 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 725 41A725 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR 725 41A725 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY DoR 725 41A725. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 725 (41A725) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 725 41A725

How to fill out KY DoR 725 (41A725)

01

Obtain the KY DoR 725 (41A725) form from the Kentucky Department of Revenue website or local office.

02

Read the instructions provided with the form to understand the requirements.

03

Fill out your personal information in the designated sections, including name, address, and social security number.

04

Enter the type of application you are submitting in the appropriate fields.

05

Provide any necessary details regarding your tax situation or the specific deductions or credits you are applying for.

06

Review all information entered to ensure accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate Kentucky Department of Revenue office or follow the online submission process if available.

Who needs KY DoR 725 (41A725)?

01

Individuals or businesses in Kentucky who are seeking tax credits, deductions, or are responding to tax assessments.

02

Taxpayers who need to make adjustments to their tax filings or seek specific exemptions or allowances.

Fill

form

: Try Risk Free

People Also Ask about

Who must file ky form 725?

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

What states have combined reporting?

Today, 24 states (including Connecticut starting in tax year 2016) and the District of Columbia require combined reporting. These include Illinois (1982), Maine (1986), Massachusetts (2008), New Hampshire (1981), New York (2007), Rhode Island (2014), Vermont (2004), and Wisconsin (2009). Vermont010Wisconsin02012 more rows

Does Ky take federal extension?

Taxpayers who request a federal extension are not required to file a separate Kentucky extension, unless an amount is due with the extension. The requirement may be met by attaching federal Form 4868 (automatic extension) to the Kentucky return.

Does Kentucky require a separate extension?

You may choose to electronically file your Kentucky extension for Individual returns. Filing Taxpayers who request a federal extension are not required to file a separate Kentucky extension, unless an amount is due with the extension.

Does Kentucky have a composite return?

Kentucky House Bill (HB) 249 amended Kentucky Revised Statute 141.206(15) by striking provisions related to composite returns (filed on behalf of nonresident individual partners, members, or shareholders) for tax years beginning on or after January 1, 2022.

Can you e file Kentucky extension?

The extended IRS/Kentucky eFile deadline is Oct. 16, 2023 - eFileIT. If you plan to file or mail-in a Kentucky tax return on paper - the Forms and Mailing Address are below - your due date is Oct. 16, 2023.

Does California accept federal extension?

California grants taxpayers an automatic six-month filing extension. You do not need to file any forms to claim this extension, unlike the federal filing extension, which taxpayers apply for using Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return).

Does Kentucky accept federal extension for individuals?

Extensions - Kentucky allows an automatic extension of six months if no additional tax is due AND a federal extension has been filed. Any extension granted is for time to file and does NOT extend time to pay. The Kentucky extension application can be e-filed.

Does Kentucky require combined reporting?

Combined reporting, effective in Kentucky as of January 1, 2019, requires all corporations within one business group file a consolidated return for their activities in the state. It is distinct from separate reporting, a filing method where each subsidiary files its taxes as a distinct entity.

Is it better to be a single-member LLC or multi member LLC?

A single-member LLC is easier for tax purposes because no federal tax return is required, unless the business decides to be treated as a corporation for tax purposes. The income is reported on the member's tax return. A multiple member LLC must file tax return, and give the members K-1 forms to file with their returns.

Does NY accept federal extension?

New York does not recognize a federal extension. If you cannot meet the filing deadline for a NY business return, you should request a six-month extension of time by filing Form CT-5, Request for Six-Month Extension to File (For Franchise/Business Taxes, MTA Surcharge, or Both), on or before the due date of the return.

Which states accept the federal extension form?

16498: States That Accept Federal Extension StateReturn TypeMississippi1040, 1120, 1120S, 1065, 1041Missouri1040, 1120, 1120S, 1065, 1041Nebraska1040, 1120, 1120S, 1065, 1041New Jersey1040, 1065, 104124 more rows

What are the disadvantages of a single-member LLC?

The pros and cons of a single member LLC ProsConsFlexible federal income tax filing (choose to file as a sole prop or corporation)Must maintain corporate veil—piercing it puts your assets at riskCan pass on ownership to others, eg. family members2 more rows • Aug 23, 2022

Can you file married filing separately in Kentucky?

Spouses who want to keep their Kentucky personal income tax liabilities and/or refunds separate may choose a filing status of married filing separate returns and file separate tax forms.

How much does it cost to register an LLC in Kentucky?

No matter which form you file, the fee will be $40. You can form your LLC online, or you can submit a paper form with a check payable to the “Kentucky State Treasurer.”

Does NJ accept federal extension?

Requests for Extension There is no extension of time to pay your taxes; You must pay at least 80% of any owed taxes no later than April 18, 2023, to avoid a late filing penalty; You will have until October 16, 2023, to file your New Jersey return.

Can I file extension for federal and not state?

Not only do most states follow the federal government in granting automatic six-month extensions, many of them accept the federal extension form (Form 4868) in lieu of a state tax form and a significant number do not require any extension form to be filed with the state, if a valid federal extension has been filed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out KY DoR 725 41A725 using my mobile device?

Use the pdfFiller mobile app to complete and sign KY DoR 725 41A725 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit KY DoR 725 41A725 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign KY DoR 725 41A725 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete KY DoR 725 41A725 on an Android device?

Complete your KY DoR 725 41A725 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is KY DoR 725 (41A725)?

KY DoR 725 (41A725) is a form used by individuals and entities to report income and taxes owed to the Commonwealth of Kentucky.

Who is required to file KY DoR 725 (41A725)?

Individuals, businesses, and organizations that have income or tax liabilities in Kentucky are required to file KY DoR 725 (41A725).

How to fill out KY DoR 725 (41A725)?

To fill out KY DoR 725 (41A725), taxpayers must provide personal and financial information, report income, calculate tax owed, and ensure all sections of the form are complete and accurate before submission.

What is the purpose of KY DoR 725 (41A725)?

The purpose of KY DoR 725 (41A725) is to enable taxpayers to report and reconcile their income and tax obligations to the state of Kentucky.

What information must be reported on KY DoR 725 (41A725)?

The information required includes taxpayer identification details, income sources, deductions, credits, and the total tax liability owed.

Fill out your KY DoR 725 41A725 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 725 41A725 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.