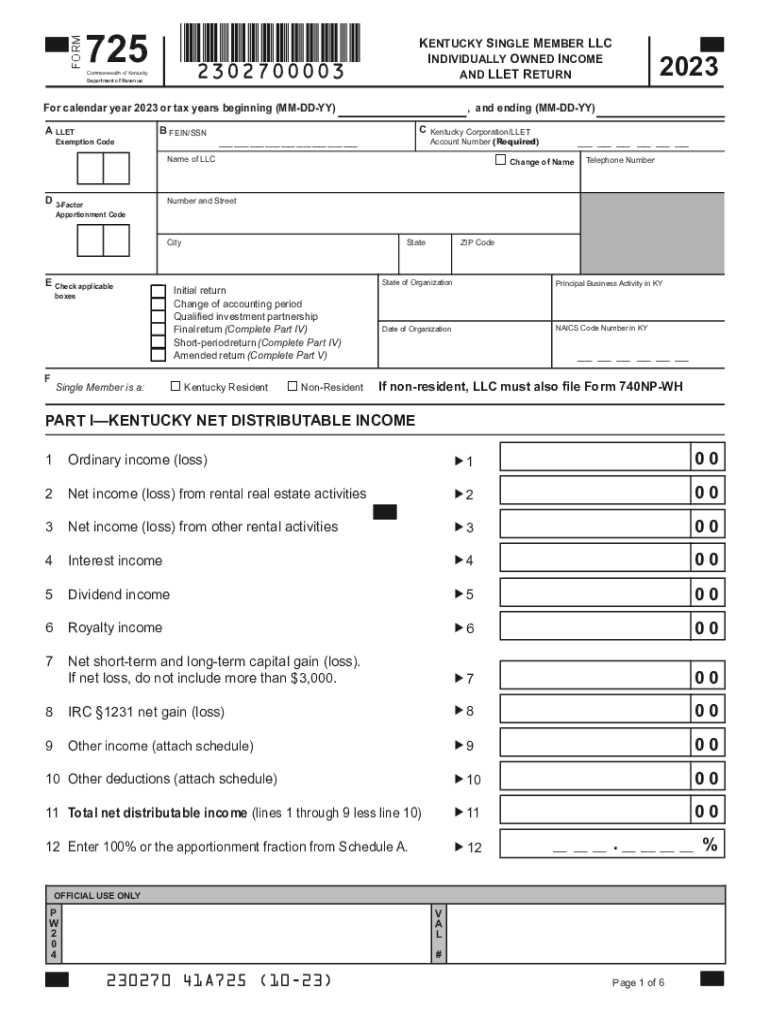

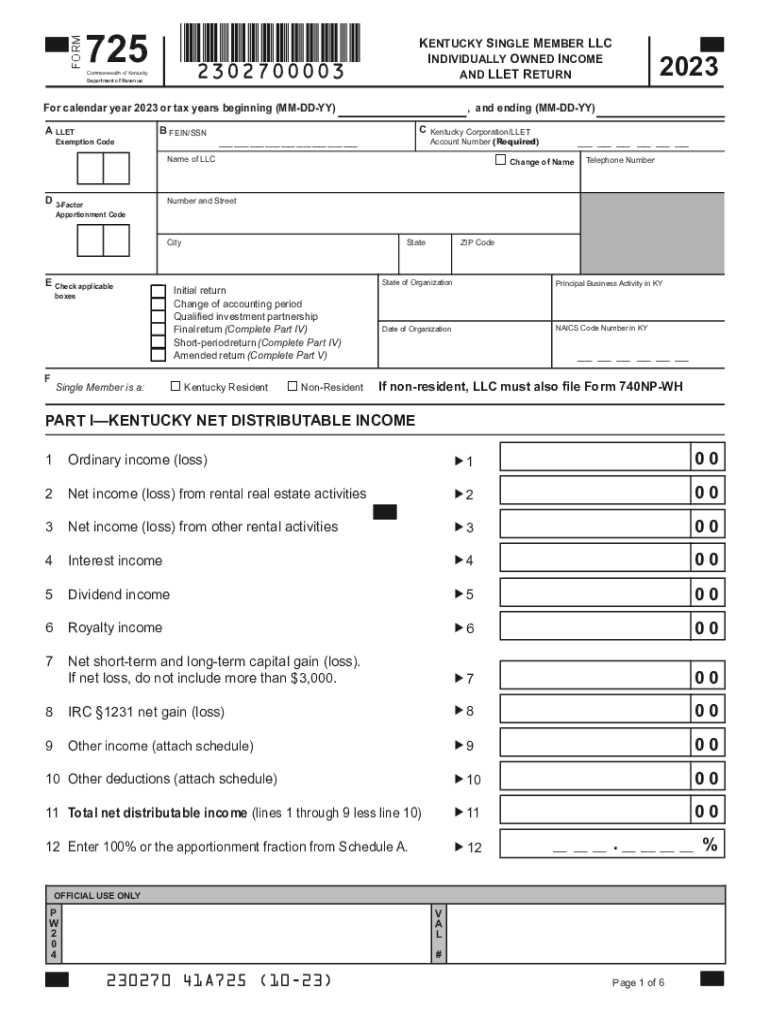

KY DoR 725 (41A725) 2023 free printable template

Get, Create, Make and Sign form 725 kentucky

How to edit kentucky form 725 online

Uncompromising security for your PDF editing and eSignature needs

KY DoR 725 (41A725) Form Versions

How to fill out ky form 725

How to fill out KY DoR 725 (41A725)

Who needs KY DoR 725 (41A725)?

Video instructions and help with filling out and completing ky form 725

Instructions and Help about form 725 2023

This video takes you step-by-step prepare year 2018 form 1040 in under four minutes this video is for the single individual with a form w2 that is your only source of income you can be claimed as a dependent and another return, and you made over 12000 if you made less than 12000 I have another video that will take you step by step in preparation of your return you can find it at my channel how to tax or the link at the bottom of this video your tax form for the year 2018 will be form 1040 there is no longer a form 1040ez or 1040a for the 2018 tax year to begin preparation at the top of the form check the single box on her filing status add your name address and social security number under your standard deduction check the box thing someone can claim you as a dependent and lastly sign date and write in your occupation I'm page 2 of your form 1040 I'm line one labeled wages salaries and tips place the amount from box one of your from w2 which will also be labeled wages and salaries in our example it is twelve thousand two hundred dollars since you have no other income line six will be the same as line one since you have no adjustments to income line seven will be the same as line one line eight your standard deduction will be twelve thousand dollars because if you make over twelve thousand dollars your standard deduction is twelve thousand your taxable income is your standard deduction subtracted from your adjusted gross income in our example that will be two hundred dollars to calculate your tax we will look at the tech schedule on the next slide this is the tax table that can be found in the IRS instructions starting on page 67 in our example you made 200 so since you made at least 200 but less than 225 if you follow the single box down your tax will be 21 place the amount of calculated tax on line 11 which in our example is 21 you will not have a child tax credit, so the same amount will go on line 13 you will also not have any other taxes, so again the same amount will go on line 15 line 16 your federal income tax withheld can be found in box 2 of your form w-2 it will also be labeled federal income tax withheld in our example it is 100 note that in boxes 4 & 6 on your firm w-2 is your Social Security and Medicare tax withheld these are not deductions on your federal income tax return on line 18 is your total payments in our example 100 in our example we have an overpayment which would be 79 so 100 less the 21 this will be placed on line 19 in line 20 an as you would want it refunded if you want to place directly into your bank account you can complete the routing and account information on lines 20 B C and D

People Also Ask about form 725

What is a KY form 740?

What percentage of my paycheck is withheld for federal tax 2022?

What is KY form Pte?

Who Must file Ky Form 725?

What is Form 740 NPR?

What is the federal withholding limit for 2022?

How do I register for KY withholding?

What is the 2022 federal payroll tax rate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ky form 725 2023 from Google Drive?

How can I send kentucky form to be eSigned by others?

How can I edit ky form fillable on a smartphone?

What is KY DoR 725 (41A725)?

Who is required to file KY DoR 725 (41A725)?

How to fill out KY DoR 725 (41A725)?

What is the purpose of KY DoR 725 (41A725)?

What information must be reported on KY DoR 725 (41A725)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.