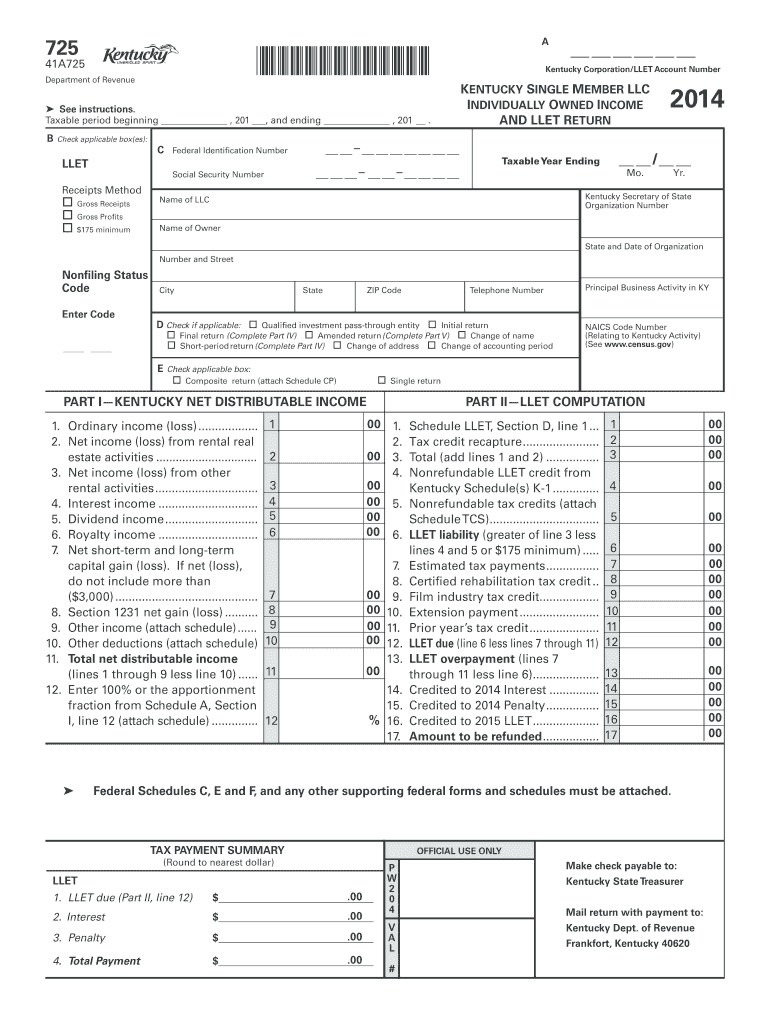

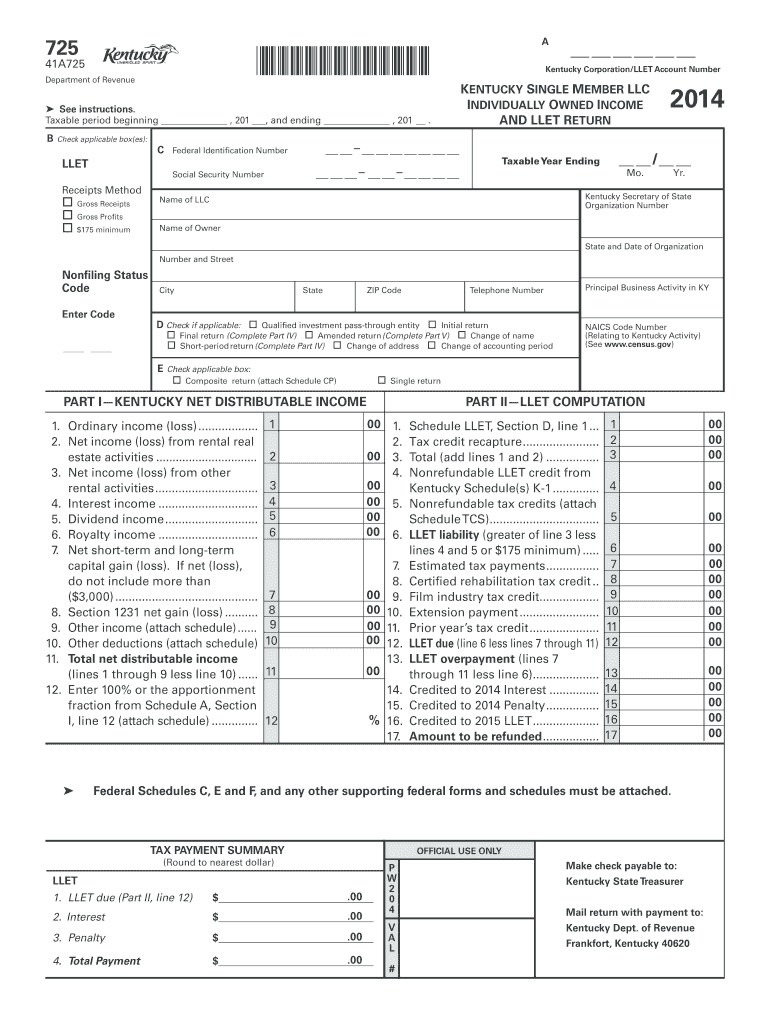

KY DoR 725 (41A725) 2014 free printable template

Get, Create, Make and Sign 2014 kentucky 725 form

Editing 2014 kentucky 725 form online

Uncompromising security for your PDF editing and eSignature needs

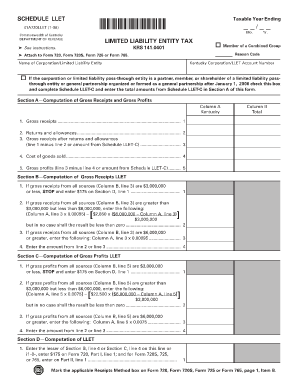

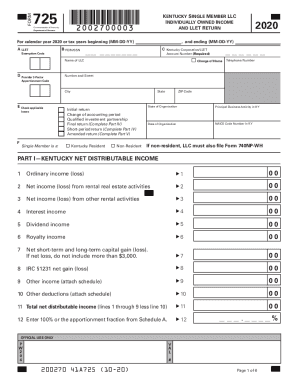

KY DoR 725 (41A725) Form Versions

How to fill out 2014 kentucky 725 form

How to fill out KY DoR 725 (41A725)

Who needs KY DoR 725 (41A725)?

Instructions and Help about 2014 kentucky 725 form

This is Joel from how to form an LLC org, and today we are going to form an LLC in the state of Kentucky now the first step in filing an LLC before we can actually get started with these instructions the number one reason why an LLC will get rejected in Kentucky is because someone will register a name that's already registered so the first thing you want to do is click on this Kentucky LLC search and what this will do is let you search the Kentucky state's records for any businesses that might have the same name as yours so for example while this loads if you have is you're looking for the name say real estate Idaho LLC you just type in real estate Idaho hit continue and there are no matches no results, so that means that our name real estate Idaho is available, so we'll do is just click back, and hopefully you'll let us go back, and we can start on the first step for a paper filing some states have online filings right now Kentucky only has a paper which is fine because they're very, very cheap if we look ahead to the next step they're only forty dollars to file, so we'll click this connects Kentucky articles of organization and this is the actual form from the state and while loads it's a fill in the blanks form that's an Adobe PDF and so as you can see there's the logo for it this is all from the state of Kentucky and so you'll just start right here the name of the little of liability company is, and you just write in a real state I'm sorry Chucky's LLC the street address of the registered office you just type that in here in the name of the registered agent at that office now what you have to know about registered agent is that with an LLC you have of Representative now it can be the owner but the LLC the state gives you the right to have a representative that's called a registered agent now again it doesn't have to exactly be the owner it can be most of the time if you look up other LLC's you'll see attorneys be the registered agent you'll see accountants be the registered agent it's basically where the person's going to get legal notice of anything so when the state asks to re-up every year on the filing fees they're going to send it to this person in this address or if you get contacted legally for any anything they'll be going after this address, so you want to make sure that this is just as correct as anything else that's on here you don't want to overlook it the mailing address for the limited liabilities principal office principal offices just headquarters you want to write that in here a limited liability company is to be managed by a manager if you are the owner, and you're going to have someone else manage the LLC you want to click this but if you are the owner, and you are going to be managing it you want to click this I would assume that if you're just starting your own LLC most of the time you're going to hit B its members because in the land of LLC's members mean owners are members so let me get down here to the date what is...

People Also Ask about

Do I have to file a Kentucky nonresident tax return?

Who must file KY state tax return?

What is a 725 form in Kentucky?

Can Ky form 725 be filed electronically?

What is the non resident tax form for Kentucky?

What is Kentucky form 720 payment voucher?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2014 kentucky 725 form in Gmail?

How can I modify 2014 kentucky 725 form without leaving Google Drive?

How do I edit 2014 kentucky 725 form online?

What is KY DoR 725 (41A725)?

Who is required to file KY DoR 725 (41A725)?

How to fill out KY DoR 725 (41A725)?

What is the purpose of KY DoR 725 (41A725)?

What information must be reported on KY DoR 725 (41A725)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.