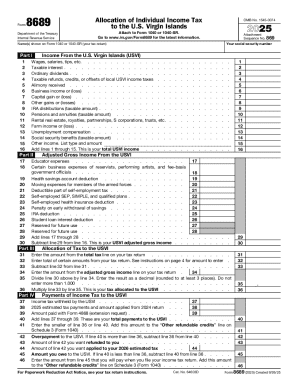

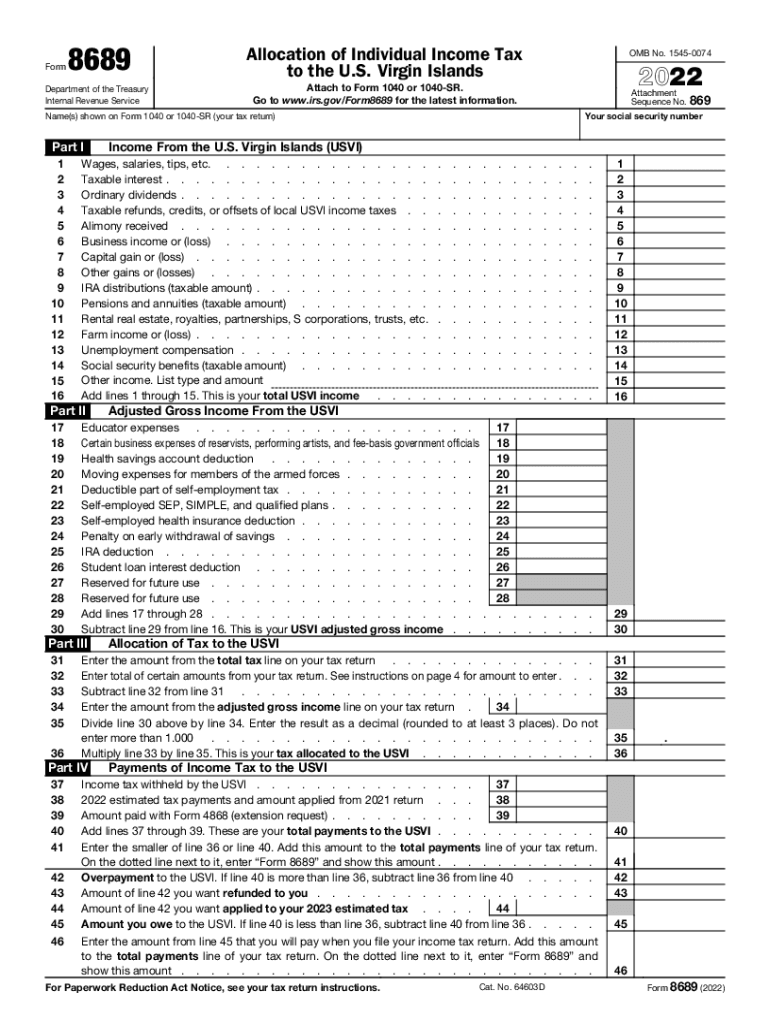

IRS 8689 2022 free printable template

Instructions and Help about IRS 8689

How to edit IRS 8689

How to fill out IRS 8689

About IRS 8 previous version

What is IRS 8689?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8689

What should I do if I realize I've made an error on my IRS 8689 after filing?

If you've discovered an error after submitting your IRS 8689, you can correct it by filing an amended return. Follow the steps outlined by the IRS for filing corrections, typically using Form 1040-X. Ensure to highlight the specific changes made to avoid confusion and ensure proper processing.

How can I check the status of my IRS 8689 once submitted?

You can verify the status of your IRS 8689 submission through the IRS online portal or by contacting their support service. Keep your submission details handy, as you may need them to retrieve your status. Be aware of common e-file rejection codes as they may affect your submission status.

Are there any specific privacy concerns I should be aware of when filing the IRS 8689 online?

When filing the IRS 8689 online, ensure that you are utilizing trusted e-filing software that complies with IRS security standards. Pay attention to data encryption practices and ensure your internet connection is secure to protect your personal information during transmission.

What are common errors associated with filing the IRS 8689, and how can I avoid them?

Common errors when submitting IRS 8689 include incorrect personal information and failing to include necessary attachments. To avoid these mistakes, double-check your entries against official documentation and use a reputable e-filing service that offers error-checking features.

If I'm a nonresident filing the IRS 8689, are there special considerations I should keep in mind?

Nonresidents filing IRS 8689 need to be aware of specific guidelines that may differ from resident filers, including tax treaties and withholdings. It is advisable to consult with a tax professional familiar with international tax laws to ensure compliance and optimize your filing.