IRS 1040 - Schedule 8812 2022 free printable template

Show details

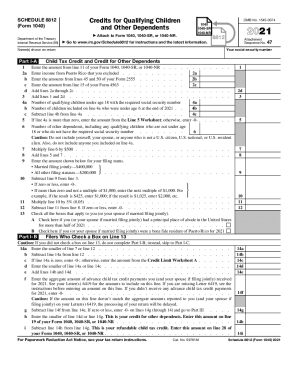

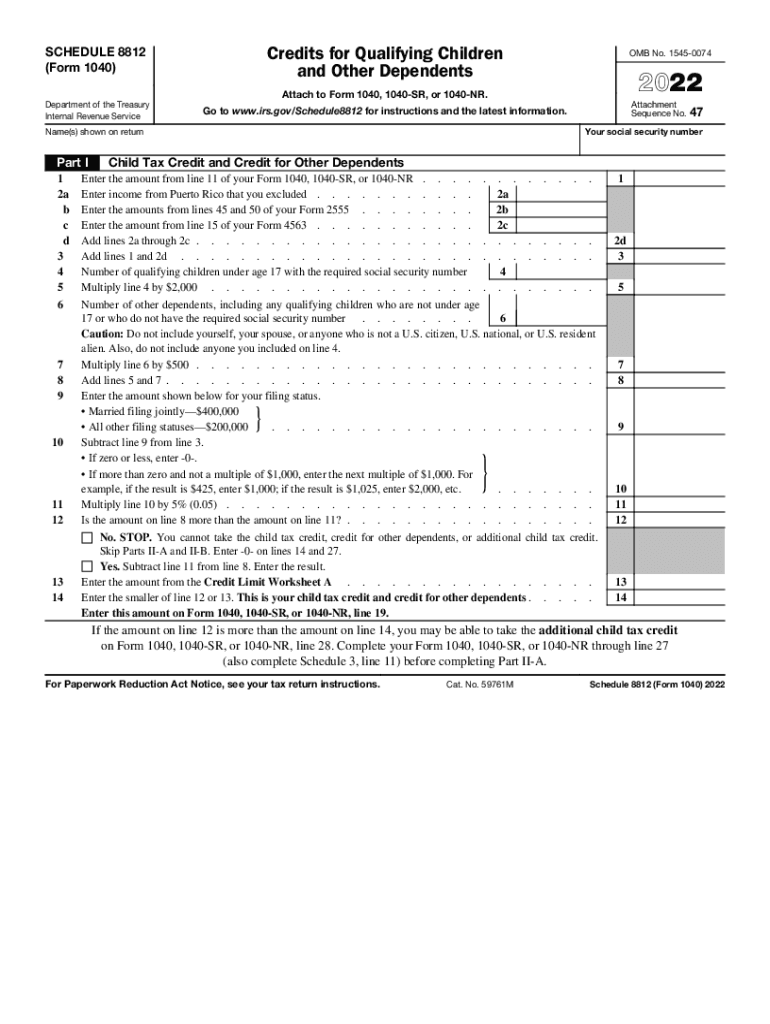

No. STOP. You cannot take the child tax credit credit for other dependents or additional child tax credit. For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 59761M Schedule 8812 Form 1040 2022 Page 2 Part II-A Additional Child Tax Credit for All Filers Caution If you file Form 2555 you cannot claim the additional child tax credit. Check this box if you do not want to claim the additional child tax credit. Skip Parts II-A and II-B. This is your child tax credit and...credit for other dependents. 2d on Form 1040 1040-SR or 1040-NR line 28. Enter -0- on line 27. 16a Subtract line 14 from line 12. If zero stop here you cannot take the additional child tax credit. Enter the larger of line 20 or line 25. Next enter the smaller of line 17 or line 26 on line 27. This is your additional child tax credit. Skip Parts II-A and II-B. Enter -0- on line 27. 16a x 1 500. Enter the result. If zero stop here you cannot claim the additional child tax credit. Credits for...Qualifying Children and Other Dependents SCHEDULE 8812 Form 1040 Department of the Treasury Internal Revenue Service 2a b c d Attach to Form 1040 1040-SR or 1040-NR. Attachment Sequence No. 47 Go to www.irs.gov/Schedule8812 for instructions and the latest information. Your social security number Name s shown on return Part I OMB No. 1545-0074 Child Tax Credit and Credit for Other Dependents Enter the amount from line 11 of your Form 1040 1040-SR or 1040-NR. Enter income from Puerto Rico that you...excluded. 2b 2c Add lines 2a through 2c. Add lines 1 and 2d. Number of qualifying children under age 17 with the required social security number Multiply line 4 by 2 000. Number of other dependents including any qualifying children who are not under age 17 or who do not have the required social security number. Caution Do not include yourself your spouse or anyone who is not a U*S* citizen U*S* national or U*S* resident alien* Also do not include anyone you included on line 4. Add lines 5 and 7....Married filing jointly 400 000. All other filing statuses 200 000 Subtract line 9 from line 3. If zero or less enter -0-. If more than zero and not a multiple of 1 000 enter the next multiple of 1 000. For example if the result is 425 enter 1 000 if the result is 1 025 enter 2 000 etc*. Is the amount on line 8 more than the amount on line 11. Skip Parts II-A and II-B. Enter -0- on lines 14 and 27. Yes. Subtract line 11 from line 8. Enter the result* Enter the smaller of line 12 or 13. Complete...your Form 1040 1040-SR or 1040-NR through line 27 also complete Schedule 3 line 11 before completing Part II-A. Skip Parts II-A and II-B. 16b Enter -0- on line 27. TIP The number of children you use for this line is the same as the number of children you used for line 4. 18a Earned income see instructions. 18a b Nontaxable combat pay see instructions. 18b No* Leave line 19 blank and enter -0- on line 20. Yes. Subtract 2 500 from the amount on line 18a* Enter the result. Multiply the amount on...line 19 by 15 0.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule 8812

How to edit IRS 1040 - Schedule 8812

How to fill out IRS 1040 - Schedule 8812

Instructions and Help about IRS 1040 - Schedule 8812

How to edit IRS 1040 - Schedule 8812

To edit IRS 1040 - Schedule 8812, use pdfFiller's editing tools that allow for easy adjustments. Simply upload the form to the platform, and select the text or fields you want to modify. You can add, delete, or change information directly on the form. After completing your edits, you can save the document or print it for submission.

How to fill out IRS 1040 - Schedule 8812

To fill out IRS 1040 - Schedule 8812, follow these steps:

01

Download and open the form.

02

Gather necessary information such as your Social Security number, the names, and SSNs of qualifying children, and your filing status.

03

Complete the identification section at the top of the form.

04

Fill in the appropriate lines according to the instructions provided in each section.

05

Double-check all entries for accuracy before submission.

About IRS 1040 - Schedule 8 previous version

What is IRS 1040 - Schedule 8812?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule 8 previous version

What is IRS 1040 - Schedule 8812?

IRS 1040 - Schedule 8812 is a supplementary tax form used by taxpayers to claim the Child Tax Credit (CTC) and the Additional Child Tax Credit (ACTC). This form helps determine eligibility for credits based on the number of qualifying children and their ages. The information provided on Schedule 8812 is crucial for accurately calculating the credits, which can significantly reduce tax liability.

What is the purpose of this form?

The primary purpose of IRS 1040 - Schedule 8812 is to allow taxpayers with dependent children to claim tax credits that can offset their tax liability. The Child Tax Credit reduces the taxes owed and directly affects a taxpayer's overall financial responsibility. In addition, the Additional Child Tax Credit provides a means for taxpayers to receive a refund even if they have no tax liability, offered to those who qualify.

Who needs the form?

Taxpayers who have dependent children and wish to claim the Child Tax Credit or the Additional Child Tax Credit must complete and submit IRS 1040 - Schedule 8812. This applies to individuals filing jointly, single filers, and head of household filers who meet specific income and dependency requirements as defined by the IRS.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1040 - Schedule 8812 if you do not have any qualifying children or if your income exceeds the allowable limits for the Child Tax Credit. Additionally, if you are not eligible for any child-related tax credits, you will not need this form. Always check the most recent IRS guidelines or consult a tax professional for specific scenarios related to your filing status.

Components of the form

IRS 1040 - Schedule 8812 includes several key components. The form consists of sections requiring taxpayer identification information, computation of the Child Tax Credit amounts, and specific eligibility questions regarding qualifying children. Each section must be carefully filled out to ensure accurate processing and eligibility verification for tax credits.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule 8812 when required can result in the loss of potential tax credits, leading to a higher tax liability. While specific penalties may not apply for not submitting this form, taxpayers may face audits or requests for additional documentation to verify claimed credits. Properly filing the form ensures compliance and helps avoid complications with the IRS.

What information do you need when you file the form?

When filing IRS 1040 - Schedule 8812, you will need several key pieces of information, including your taxpayer identification number, Social Security numbers of qualifying children, dates of birth for each child, and your filing status. Additionally, you should have knowledge of your total income and any potential deductions or credits that may affect your tax situation.

Is the form accompanied by other forms?

IRS 1040 - Schedule 8812 is typically filed alongside Form 1040 or Form 1040-SR, which is the main income tax form. Depending on your individual situation, additional forms may be necessary for reporting specific income or deductions. Always ensure that all required forms are submitted together for accurate processing of your tax return.

Where do I send the form?

Once you have completed IRS 1040 - Schedule 8812, you must attach it to your IRS Form 1040 or Form 1040-SR when submitting your tax return. If you are filing by mail, send your complete return to the address specified in the Form 1040 instructions. If you are filing electronically, the submission system will process the form automatically.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Very good application. Extremely helpful, fast, very easy to use, VERY inventive processes. I highly recommend to anyone.

This is exactly what I was looking for. I have found other uses that I wasn't even aware were possible. Very satisfied!

See what our users say