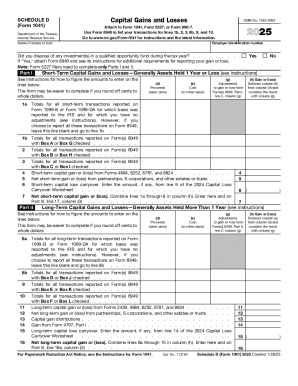

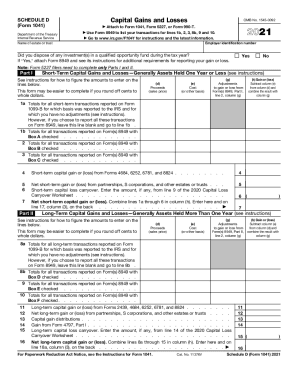

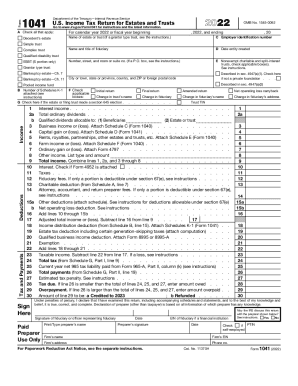

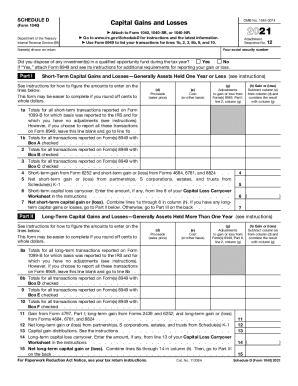

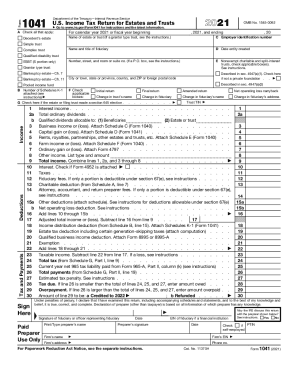

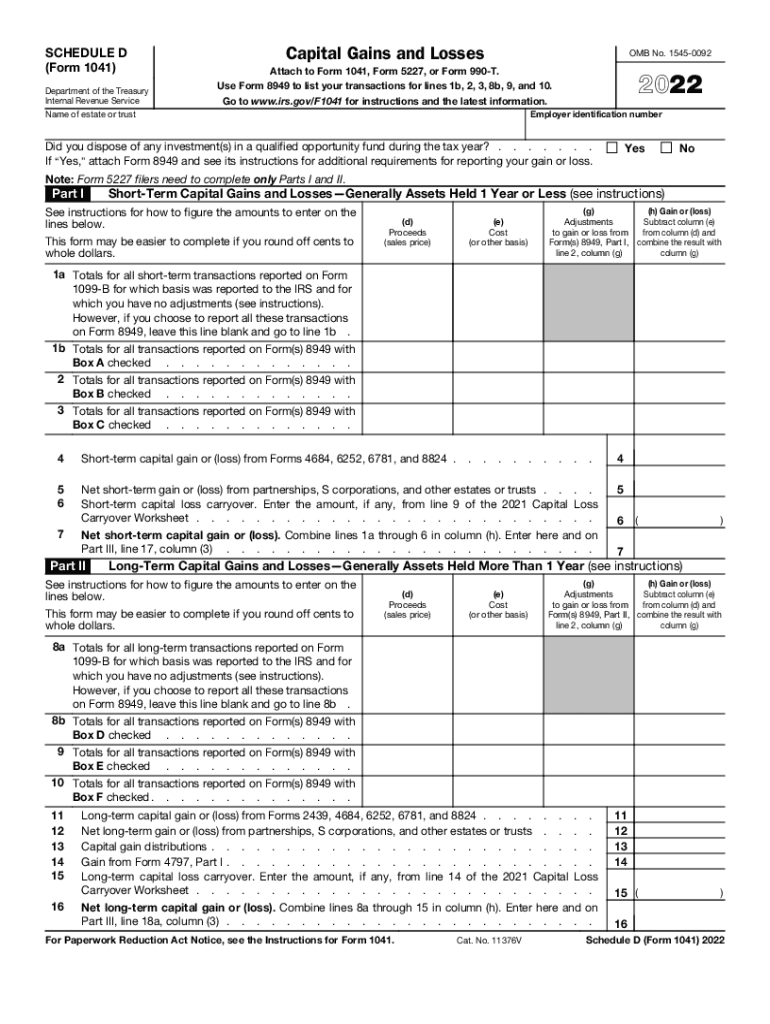

IRS 1041 - Schedule D 2022 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2022 previous version

What is IRS 1041 - Schedule D?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041 - Schedule D

What should I do if I realize I've made a mistake after filing the IRS 1041 - Schedule D?

If you find an error after submitting IRS 1041 - Schedule D, you can file an amended return using Form 1041-X. Ensure that you clearly indicate the changes and attach any necessary documentation to support your corrections. It's crucial to keep a copy of your amended return and any correspondence with the IRS for your records.

How can I check the status of my IRS 1041 - Schedule D filing?

To verify the status of your IRS 1041 - Schedule D, you can use the IRS 'Where's My Refund?' tool if you e-filed, or call the IRS directly for updates on paper submissions. Be sure to have your tax identification number and details from the form handy for reference during your inquiry.

What should I do if my IRS 1041 - Schedule D e-file is rejected?

If your IRS 1041 - Schedule D e-file is rejected, review the rejection codes provided by the IRS and correct the indicated issues. After making the necessary changes, resubmit the form electronically. You can also seek assistance from tax software support if the errors persist.

Are there specific security measures I should consider when e-filing IRS 1041 - Schedule D?

When e-filing IRS 1041 - Schedule D, ensure you use a reputable tax software with strong data encryption and secure servers. Additionally, maintain the confidentiality of your sensitive information and be cautious of phishing scams targeting taxpayer details.

How can I avoid common errors when submitting IRS 1041 - Schedule D?

To avoid common mistakes on IRS 1041 - Schedule D, double-check all entries for accuracy, ensure you have included all necessary supporting documents, and follow the IRS guidelines closely. Using reliable tax software often helps minimize errors by guiding you through the filing process.

See what our users say