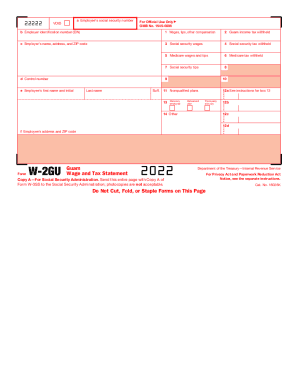

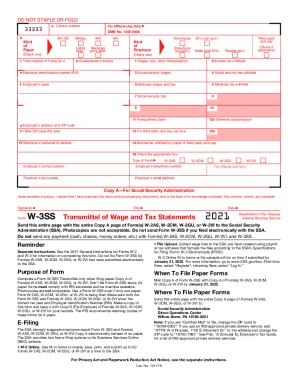

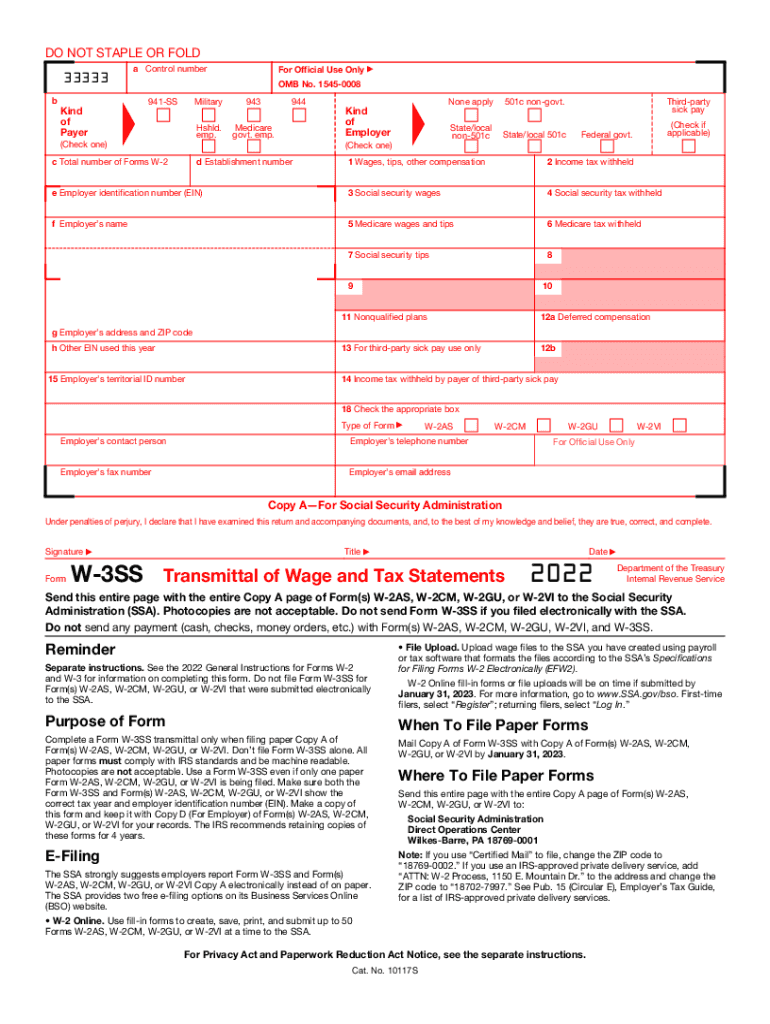

IRS W-3SS 2022 free printable template

Instructions and Help about IRS W-3SS

How to edit IRS W-3SS

How to fill out IRS W-3SS

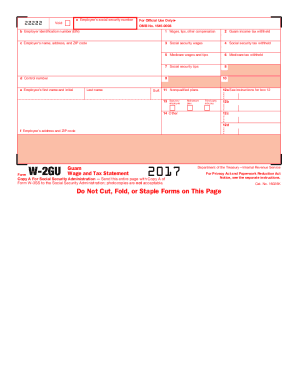

About IRS W-3SS 2022 previous version

What is IRS W-3SS?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3SS

What should I do if I make a mistake on my form 3 after submission?

If you realize you've made a mistake after submitting your form 3, you can submit an amended form 3 to correct the error. Make sure to clearly indicate that it is an amendment and include any relevant details that showcase the changes made. This will ensure that your record is updated accurately.

How can I verify if my form 3 has been received and processed?

To verify receipt of your form 3, check the confirmation email or notification received after submission. If you filed electronically, you can track its status using the online portal of the relevant agency. For issues like rejection codes, refer to the guidelines provided during the submission process.

What are the legal considerations for using an e-signature on form 3?

When using an e-signature on form 3, ensure the platform you are using complies with electronic signature laws. This includes having adequate security measures in place to protect your data. It's important to maintain records of consent and signature verification for your documentation.

What should I know about filing form 3 for nonresidents or foreign payees?

Filing form 3 for nonresidents or foreign payees may involve additional considerations such as withholding tax obligations. Ensure that you have the proper documentation and understand the specific requirements for foreign entities or individuals to comply with local regulations.

What common errors should I avoid when submitting form 3?

Common errors on form 3 can include incorrect personal information and failure to include necessary signatures or documentation. Double-check all entries and review the submission guidelines to avoid these pitfalls, ensuring your form is complete and accurate before submission.

See what our users say