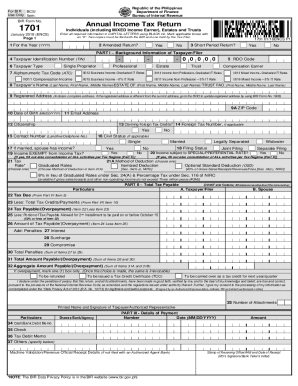

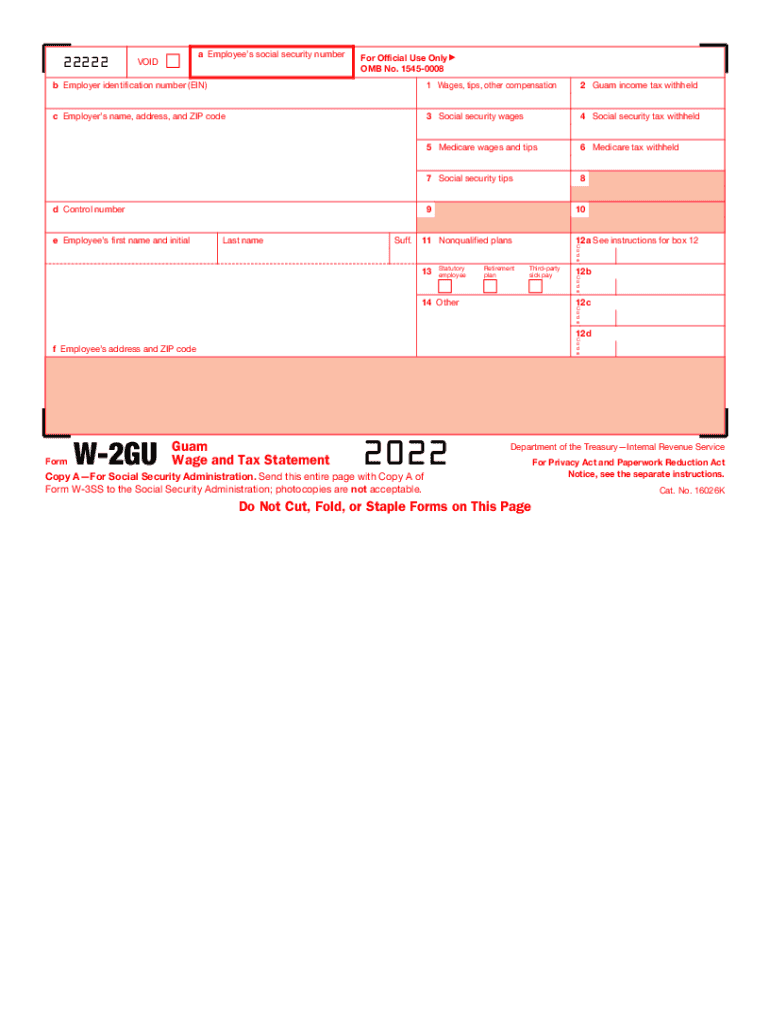

IRS W-2GU 2022 free printable template

Instructions and Help about IRS W-2GU

How to edit IRS W-2GU

How to fill out IRS W-2GU

About IRS W-2GU 2022 previous version

What is IRS W-2GU?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2GU

How can I correct mistakes made on a previously filed 2gu you?

If you need to correct mistakes on your 2gu you form after filing, you can submit an amended form. This is typically done by filing a new 2gu you with the correct information and noting it as an amendment. Make sure to keep a record of the changes for your files, as corrections may be reviewed during audits.

What should I do if my e-filed 2gu you is rejected?

In case your e-filed 2gu you is rejected, you should carefully review the rejection notification for specific error codes and guidelines provided. Once you've identified the problem, rectify the issues and resubmit the form. Keeping track of these details helps in preventing future rejections.

How long should I retain records related to my 2gu you filings?

It's advisable to retain records related to your 2gu you filings for at least three years from the date of submission. This period allows for any necessary audits or inquiries that may arise concerning the information you reported.

Can I use electronic signatures on my 2gu you forms?

Yes, electronic signatures are generally acceptable for 2gu you forms, provided they comply with relevant signing regulations. Ensure that your e-signature method is secure and verifiable, as this will help maintain the integrity of your filing.

What steps should I take if I receive an audit notice regarding my 2gu you?

If you receive an audit notice concerning your 2gu you, promptly gather all relevant documentation to support your filings. Review the details in the notice and prepare your response carefully. It may also be beneficial to consult a tax professional for guidance during the audit process.

See what our users say