Get the free Managing General Agent/Underwriter Supplemental Application

Show details

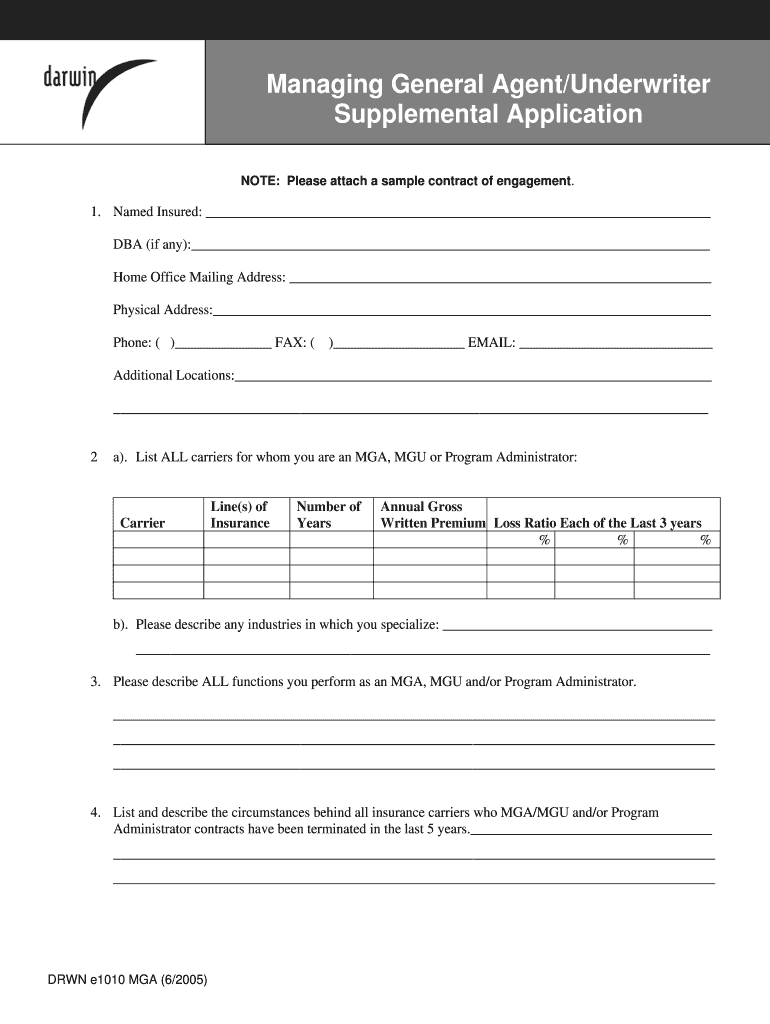

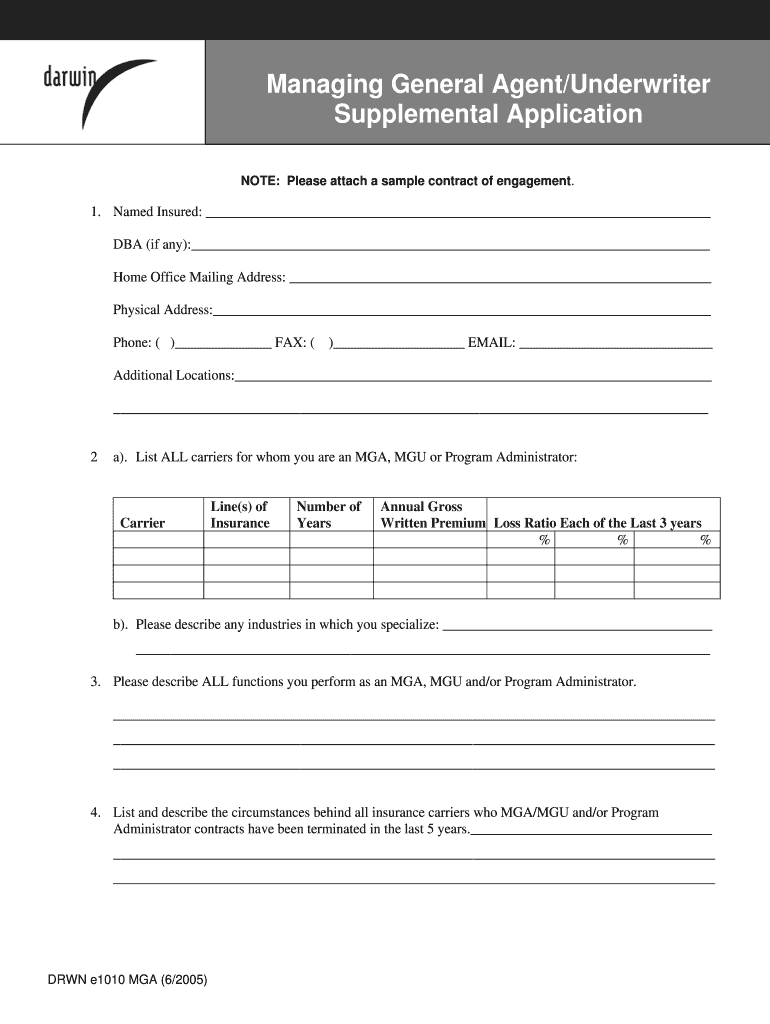

This application collects detailed information about a Managing General Agent/Underwriter, including their experience, functions, and the insurance carriers they represent.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign managing general agentunderwriter supplemental

Edit your managing general agentunderwriter supplemental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your managing general agentunderwriter supplemental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing managing general agentunderwriter supplemental online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit managing general agentunderwriter supplemental. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out managing general agentunderwriter supplemental

How to fill out Managing General Agent/Underwriter Supplemental Application

01

Begin with the applicant's basic information: name, address, and contact details.

02

Provide details regarding the agency or company, including its history, ownership structure, and organizational chart.

03

Outline the types of insurance products the agency offers and specify the coverage limits.

04

Include information about the agency's experience: years in operation and any specialty areas.

05

Fill in details about the agency's financials, such as annual revenues and loss ratios for prior years.

06

Disclose any regulatory actions or complaints against the agency or its agents.

07

Provide information on the agency's claims handling procedures and policies.

08

Include any additional documentation that supports the application, such as resumes of key personnel.

Who needs Managing General Agent/Underwriter Supplemental Application?

01

Insurance agencies seeking to act as Managing General Agents or Underwriters.

02

Companies looking to increase their underwriting capacity through MGA agreements.

03

Regulatory authorities requiring detailed information on underwriting practices.

04

Insurers wanting to evaluate the risk and capabilities of their managing agents.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between managing general agent and managing general underwriter?

The primary distinction between MGAs and MGUs lies in their scope of authority. MGAs are generally granted broader powers, encompassing: Underwriting: Assessing risks and setting premiums for insurance policies. Marketing and Sales: Promoting and selling insurance products to brokers and agents.

What is the purpose of a managing general agent?

A managing general agent (MGA) is a type of insurance agent who has the authority to underwrite insurance policies. Underwriting means an MGA can assess a customer's risk and offer them insurance. Traditional insurance agents sell insurance policies to customers.

What's the difference between an MGA and an MGU?

What Is the Main Difference Between an MGA and an MGU? Unlike an MGA, an MGU isn't required to be licensed. But MGAs have more control over their operations.

What is the difference between MGA and AGA?

An MGA is defined in the paper as "an individual, partnership or corporation that holds at least one direct brokerage contract with a life insurance company registered to do business in Canada." An AGA, meanwhile, consists of an arrangement "where groups of representatives contract together with an MGA, or have banded

What is the difference between an agent and an underwriter?

Agents: They sell financial protection services to their clients – protecting their assets from various property and casualty exposures. Underwriters: Responsible for evaluating and managing the risk that is associated with offering financial protection.

How does a managing general agent make money?

Compensation - MGAs usually earn a commission based on the amount of business they generate. Some companies pay commissions at different levels depending on the type of policy sold.

Is an MGA an underwriter?

A managing general agent (MGA) is a specialized type of insurance agent/broker that, unlike traditional agents/brokers, is vested with underwriting authority from an insurer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Managing General Agent/Underwriter Supplemental Application?

The Managing General Agent/Underwriter Supplemental Application is a document used to gather additional information from managing general agents or underwriters to assess risk, underwriting eligibility, and compliance for insurance policies.

Who is required to file Managing General Agent/Underwriter Supplemental Application?

Managing general agents and underwriters who are seeking to obtain or renew insurance coverage are required to file the Managing General Agent/Underwriter Supplemental Application.

How to fill out Managing General Agent/Underwriter Supplemental Application?

To fill out the Managing General Agent/Underwriter Supplemental Application, applicants should provide accurate, complete information regarding their agency's operations, financials, compliance history, and any relevant risk factors as requested within the application form.

What is the purpose of Managing General Agent/Underwriter Supplemental Application?

The purpose of the Managing General Agent/Underwriter Supplemental Application is to facilitate thorough risk assessment and underwriting decisions by providing detailed insights into the operations and risk characteristics of the managing general agent or underwriter.

What information must be reported on Managing General Agent/Underwriter Supplemental Application?

The information that must be reported on the Managing General Agent/Underwriter Supplemental Application may include agency name, address, insurance types handled, financial statements, claims history, risk management practices, and licensing details.

Fill out your managing general agentunderwriter supplemental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Managing General Agentunderwriter Supplemental is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.